The Capital Revolution: Building a Borderless Future for Crowdfunding

How Jenny Kassan and the global crowdfunding movement are dismantling the barriers that keep innovation capital locked away from the businesses that need it most

In a recent episode of Crowdfunding Chronicles, the GECA Podcast, host Andy Field sat down with Jenny Kassan, President of the Crowdfunding Professional Association, for a wide-ranging discussion about the future of borderless crowdfunding. Their conversation revealed both the enormous progress made in democratizing capital access and the significant barriers that still constrain the industry's transformative potential.

In the gleaming towers of Wall Street, $400 trillion circulates through global financial markets daily. Yet according to Jenny, only 15% of that staggering sum ever reaches the productive businesses that form the backbone of local economies. The rest, she argues, "is just money flying around this global financial casino, not actually doing anything productive."

This stark reality has fueled Jenny's two-decade crusade to democratize capital access - a mission that began in the vibrant commercial streets of Oakland, California, and now finds powerful alignment with the Global Equity Crowdfunding Alliance (GECA) through the CfPA's recent decision to become GECA supporters.

From Legal Theory to Street-Level Reality

Jenny's journey into crowdfunding wasn't paved with Wall Street ambitions. After earning her law degree from Yale, she found herself working with immigrant entrepreneurs in Oakland's low-income neighborhoods - brilliant business owners with compelling stories who couldn't access the capital needed to scale their ventures.

"There was so much money in our global financial ecosystem," she recalls, "and yet so little of that money reaches these businesses. How much better would the world be if these businesses had access to some financial resources?"

That question sparked what would become the legal framework for modern crowdfunding. As co-founder of the Sustainable Economies Law Center, Jenny helped draft the petition that ultimately became the JOBS Act of 2012 - landmark legislation that opened private investment opportunities to everyday Americans for the first time in decades.

The Numbers Tell a Compelling Story

The impact has been substantial. Since Regulation Crowdfunding went live in 2016, over $2 billion has flowed to startups and small businesses through this single exemption alone. Combined with the expanded Regulation A+ framework, the JOBS Act has facilitated more than $10 billion in capital formation for smaller issuers - a testament to the pent-up demand for alternative financing channels.

But these figures represent just the beginning. Recent data from KingsCrowd shows that equity crowdfunding was the only segment of private capital that grew in 2022 (+16% by deal count) while venture capital declined sharply. This resilience during market turbulence suggests crowdfunding has evolved from experimental financing tool to essential infrastructure.

The European Union's 2024 market report reveals similar momentum, with €1 billion raised across 5,782 projects in the first year under the harmonized European Crowdfunding Service Providers Regulation (ECSPR). Notably, 17% of EU crowdfunding funding now crosses borders - early evidence that regulatory harmonization can unlock international capital flows.

Breaking Down the Borders

Yet for all this progress, Jenny sees fundamental limitations in the current patchwork of national regulations. While institutional capital moves freely across borders with a click, individual investors face significant barriers when attempting to invest in businesses they care about internationally.

"If you're a money manager who manages billions of dollars, you don't have to worry about that stuff," she observes. "But those of us who want to invest in smaller businesses... we're totally left out of it."

This asymmetry has profound implications. Consider the estimated 280 million people living outside their countries of birth - diaspora communities with deep knowledge of opportunities in their home markets, yet largely unable to deploy investment capital there due to regulatory fragmentation.

The solution, according to both Jenny and GECA's vision, lies in creating what Andy Field, GECA's Steering Committee lead, calls "borderless crowdfunding" - a system where passionate investors can back meaningful ventures regardless of geographic boundaries. In a recent appearance on the GECA Podcast, Jenny articulated this shared vision with compelling clarity.

The Technology Catalyst

The tools to enable this transformation are already emerging. Blockchain technology promises to standardize compliance through programmable smart contracts that can enforce investor caps and disclosure requirements across jurisdictions automatically. Recent analysis shows the real-world asset tokenization market grew 85% year-over-year in 2023, suggesting institutional appetite for digitized securities.

Artificial intelligence is streamlining the compliance burden that has historically constrained smaller offerings. DealMaker's AI-driven compliance process reduced regulatory timelines by 65% in 2024, while achieving 99% onboarding success rates. Such innovations address one of crowdfunding's persistent challenges: the fixed costs of compliance that can consume 5-12% of funds raised, particularly burdensome for smaller campaigns.

Local Roots, Global Reach

Perhaps counterintuitively, Jenny believes the path to global crowdfunding runs through intensely local initiatives. Her current project, Baltimore Community Commons, aims to create a place-based ecosystem where residents become comfortable investing in their own community first.

"My theory of change is that things really do change when we can be face-to-face with each other," she explains. "It's overwhelming when you think about global change, but I believe it has to be a global movement of local activism."

This philosophy aligns with emerging investment patterns. During the pandemic, crowdfunding campaigns with strong community connections consistently outperformed those targeting purely financial returns. Investors, research shows, are motivated by both potential profits and personal passion for the ventures they support.

Regulatory Evolution and International Cooperation

The regulatory landscape is evolving to accommodate these realities. The EU's ECSPR represents the most ambitious harmonization effort to date, allowing companies to raise up to €5 million across all member states under a single authorization. Early results suggest success: platforms report reduced compliance costs and increased cross-border participation.

Similar momentum is building globally. Canada unified its provincial crowdfunding rules in 2021, Australia has maintained steady growth with A$289 million raised to date, and emerging markets from Malaysia to Nigeria are implementing frameworks designed to channel both domestic and diaspora capital to local entrepreneurs.

In the United States, discussions around "JOBS Act 4.0" could raise Regulation Crowdfunding caps beyond the current $5 million limit and create limited secondary trading exemptions - changes that would enhance liquidity and attract larger check writers.

The Platform Evolution: From Scale to Ecosystem

The platform landscape is evolving rapidly, with major players like Wefunder, StartEngine, and Republic collectively accounting for roughly 80% of US Regulation Crowdfunding volume. These leading platforms have made remarkable strides, transforming from simple marketplace hosts into comprehensive service providers offering integrated legal, marketing, and compliance support. Many have pioneered innovations in secondary trading, tokenization, and investor education that benefit the entire industry.

However, their very success highlights an emerging opportunity. If crowdfunding is truly meant to serve the 99.9% of companies that don't access venture capital, the industry may benefit from a more distributed approach that combines the strengths of established platforms with specialized local expertise.

The fundamental opportunity lies in scalability with specialization. While major platforms excel at standardized processes, regulatory compliance, and investor acquisition, the diverse needs of global entrepreneurs may be best served through complementary ecosystem models. Local and specialized platforms can provide deep domain expertise, community relationships, and cultural understanding that enhance campaign success rates.

Rather than viewing this as competition, the future likely favors collaborative networks where established platforms and emerging specialized providers work together. Major platforms could provide infrastructure, compliance frameworks, and investor pools, while local partners contribute market knowledge, due diligence capabilities, and community engagement.

This distributed model could unlock the true potential Jenny envisions: leveraging the scale and expertise of successful platforms while enabling local specialization and cross-border connectivity. The current market structure exists partly due to regulatory complexity and operational barriers - as these inefficiencies are addressed, we may see new collaborative models that benefit all participants.

The goal isn't to replace successful platforms but to expand the ecosystem in ways that serve more entrepreneurs effectively while creating new opportunities for platform innovation and growth.

Measuring Real-World Impact

Beyond capital formation statistics, early data suggests crowdfunding is delivering on its promise of economic democratization. The SEC's 2024 analysis found that successful Reg CF companies correlated with continued business growth and ability to secure follow-on financing. While only 0.25% have reached IPO and 2.2% have been acquired - expected given the market's youth - survival rates match or exceed those of traditionally funded startups.

More importantly, crowdfunding appears to be reaching underserved entrepreneurs. Women and minority-owned businesses show strong representation in crowdfunding campaigns, often outperforming their participation rates in venture capital. This suggests the "crowd" may be less prone to the unconscious biases that have historically limited access to growth capital.

However, as Jenny notes, significant challenges remain. In the United States, a recent study revealed that 60% of people don't have enough money to afford even basic necessities - highlighting the wealth concentration that limits who can participate as investors. "We are in a time of wealth being concentrated in fewer and fewer hands," she observes, pointing to a fundamental constraint on crowdfunding's reach.

The Road Ahead

Looking forward, industry leaders anticipate several convergent trends that could accelerate the shift toward borderless crowdfunding:

Regulatory Harmonization: Industry associations and advocacy groups are beginning to coordinate efforts across jurisdictions, potentially laying groundwork for future mutual recognition agreements that could allow qualified offerings to access international investor pools seamlessly.

Technological Integration: The convergence of traditional crowdfunding with DeFi protocols and tokenization could create programmable compliance that transcends national boundaries, while AI continues to reduce operational friction. Initiatives like Dacxi Chain are building blockchain infrastructure to connect global crowdfunding ecosystems while maintaining regulatory compliance across jurisdictions.

Demographic Shifts: Millennials and Gen Z, digital natives with strong values alignment preferences, are entering their prime investment years with expectations shaped by seamless online experiences and social impact considerations.

Institutional Participation: Early signs suggest larger investors are beginning to view crowdfunding not as competition but as complementary deal flow, potentially bringing additional validation and capital to successful campaigns.

A Vision Realized

The transformation Jenny envisions isn't merely about regulatory reform or technological advancement - it's about fundamentally realigning how capital flows through the global economy. Instead of money chasing money in increasingly abstract financial instruments, she sees a future where investment becomes "a joyful, values-driven act" connecting people to enterprises they believe in.

"Every human being is affected by a financial system that often doesn't serve them," she reflects. "This is a global issue. And it's time we start acting like it."

Through organizations like the Crowdfunding Professional Association, which recently became GECA supporters, and the Global Equity Crowdfunding Alliance itself, that vision is becoming operational reality. By sharing best practices, coordinating advocacy efforts, and demonstrating successful models, these coalitions are building the infrastructure for a more inclusive capital ecosystem.

The goal isn't to replace traditional finance but to create alternatives that serve the 99.9% of businesses that will never access venture capital or public markets. If successful, the movement could redirect even a small percentage of global financial flows toward productive investment - potentially unleashing unprecedented innovation and economic opportunity.

As Jenny puts it: "We're not looking at the money side first and foremost. There's nothing wrong with making money, but it's not the driving force in true innovation. The thing about true innovation is there's always money down the road."

For the millions of entrepreneurs worldwide with compelling visions but limited access to capital, that road may soon lead everywhere.

Listen to the full podcast conversation with Jenny Kassan: Watch here

Jenny Kassan's book "Raise Capital On Your Own Terms": Buy here

GECA manifesto: Read here

The Global Equity Crowdfunding Alliance (GECA) brings together platforms, investors, and advocates from across the globe to shape a truly borderless future for investment. Learn more about joining the movement at thegeca.org.

GECA Welcomes Crowdfunding Powerhouse Jason Fishman to Steering Committee

The Global Equity Crowdfunding Alliance (GECA) strengthens its leadership team with industry veteran who has helped raise nine figures across 500+ funding campaigns

A Strategic Addition to Drive Borderless Crowdfunding

The Global Equity Crowdfunding Alliance (GECA) is thrilled to announce the addition of Jason Fishman to its Steering Committee. This appointment comes at a pivotal time as GECA continues to advance its mission of enabling global, borderless equity crowdfunding and unlocking innovation and economic growth on an unprecedented scale.

Jason brings more than 15 years of proven expertise as a "New Media Enthusiast" to GECA, with an impressive track record of planning, activating, and managing scalable marketing strategies across diverse verticals and goals. As the co-founder and CEO of Digital Niche Agency (DNA), he has transformed the landscape of digital fundraising, having worked with over 500 crowdfunding campaigns that have collectively produced nine figures in funding.

Andrew Field, Head of the GECA Steering Committee, stated: "Jason's extensive experience in successfully marketing equity crowdfunding campaigns means he knows the industry inside out. This makes him an invaluable addition to our team. His strategic vision and proven ability to connect innovative companies with global investors perfectly aligns with GECA's mission to make equity crowdfunding truly borderless."

A Career Built on Crowdfunding Excellence

Since launching DNA in 2014, Jason has established himself as a dominant force in digital funding campaigns. His agency has worked with over 850 brands and delivered industry-leading results across eCommerce, lead generation, and digital funding initiatives. Particularly notable is his work with more than 500 Regulation CF, Regulation A+, Regulation D, and Digital Asset campaigns that have produced impressive financial outcomes for clients.

Jason's thought leadership extends beyond his agency work. He has been featured as a speaker at numerous tech and marketing conferences and has produced over 180 episodes of his "Test. Optimize. Scale." podcast. He maintains active involvement with the Forbes Agency Council and serves on the Crowdfunding Professional Association Board, further cementing his status as an industry authority.

Alignment with GECA's Vision

GECA's mission centres on advocating for what they term 'Crowd 2.0,' a revolutionary approach to equity crowdfunding that transcends borders, fosters collaboration, and removes unnecessary barriers to investment. The organization envisions a world where entrepreneurs, regardless of location, can raise capital from a global community of investors, and where investors can access opportunities worldwide, not just within their own countries.

Jason's approach to crowdfunding marketing perfectly complements this vision. His methodology, which he summarizes in three words - "test, optimize, scale"- has repeatedly demonstrated success in connecting innovative companies with investors across geographic boundaries. Jason has consistently advocated that equity crowdfunding platforms are powerful tools that companies have been waiting years to fully leverage, bringing benefits far beyond just capital, including strategic partnerships, media exposure, and B2B relationships.

Bringing Expertise That Drives Results

What sets Jason apart is his data-driven, systematic approach to crowdfunding marketing. His "Eight-Point Plan" has become a respected roadmap for successful campaigns, covering crucial elements from industry overview and competitor marketing audit to audience mapping, channel planning, creative strategy, partnerships, projections, and activation planning. This methodical approach to marketing has enabled campaigns to scale rapidly, sometimes growing from entry-level advertising budgets to six-figure monthly spends that produce seven-figure monthly returns.

Jason’s expertise in digital channels spans search engines, social media platforms, programmatic ad exchanges, influencer networks, email automation, content marketing, and strategic partnerships. His background in ad tech and deep understanding of performance metrics make him uniquely qualified to help GECA achieve its goal of making equity crowdfunding truly global.

Jason comments - "I'm honoured to join the GECA Steering Committee at this transformative moment for global equity crowdfunding. Throughout my career, I've witnessed firsthand how fragmented financial systems can affect the potential of equity crowdfunding. GECA's vision for a borderless investment ecosystem resonates deeply with my own beliefs about democratizing access to capital and investment opportunities. I look forward to contributing to this important mission and helping to build a more inclusive, efficient global crowdfunding market."

A Catalyst for Global Change

GECA believes in a world where innovation knows no borders - where entrepreneurs can raise capital from a global community of investors, and where investors can access opportunities worldwide. With the addition of Jason to the Steering Committee, GECA gains a strategic thinker with hands-on experience in turning this vision into reality.

GECA's mission addresses key challenges in the current equity crowdfunding landscape, including investors being locked out of global opportunities, entrepreneurs struggling to raise capital due to regulatory restrictions, and platforms operating in isolation, unable to scale beyond domestic markets. Jason’s expertise in navigating these challenges and finding strategic solutions will be invaluable as GECA works to transform the industry.

As GECA continues to build momentum in its mission to create a global, borderless equity crowdfunding ecosystem, The addition of Jason to the Steering Committee represents a significant step forward. His proven track record, industry connections, and innovative approach to digital marketing will help accelerate GECA's impact and bring its vision of Crowd 2.0 closer to reality.

For more information about GECA and its mission, please visit www.theGECA.org.

Netcapital Securities CEO and Compliance expert Alexandria Fisher Joins GECA Steering Committee

The Global Equity Crowdfunding Alliance strengthens its leadership with Netcapital Securities CEO who brings deep regulatory expertise and innovative approaches to cross-border fundraising.

A Strategic Addition to Advance Borderless Investment

The Global Equity Crowdfunding Alliance (GECA) is pleased to announce the appointment of Alexandria Fisher to its Steering Committee as Strategic Advisor. Alexandria brings exceptional expertise in regulatory compliance, strategic partnerships, and innovative fundraising approaches that closely align with GECA's mission of enabling global, borderless equity crowdfunding.

As CEO and CCO of Netcapital Securities Inc., Alexandria has established herself as a leading voice in expanding access to private capital markets. Her comprehensive understanding of regulatory frameworks, combined with her strategic vision for cross-border collaboration, makes her an invaluable addition to GECA's leadership team as the organization works to transform the global equity crowdfunding landscape.

Andrew Field, Head of the GECA Steering Committee, commented: "Alexandria's deep regulatory expertise and innovative approach to fundraising strategy make her a compelling strategic advisor for GECA. Her experience navigating complex compliance requirements while building bridges between different fundraising mechanisms directly supports our mission of creating a truly borderless equity crowdfunding ecosystem."

Pioneering Strategic Fundraising Solutions

Alexandria's approach to equity crowdfunding sets her apart in the industry. Rather than viewing different regulatory pathways as separate options, she champions a strategic combination of Regulation CF, Regulation A, and Regulation D offerings to maximize fundraising potential. This innovative methodology allows companies to access both non-accredited and accredited investors simultaneously, creating more comprehensive capital-raising strategies.

"Companies who look to utilize multiple offering types at the same time are being very strategic," Alexandria explains, "using the Reg CF or Reg A bucket to open the investment opportunity to their broad network, while leveraging Reg D to attract larger investments from accredited investors and venture capitalists.”

Her work at Netcapital Securities has positioned the Netcapital platform uniquely in the industry, with Netcapital Securities operating as an SEC-registered, FINRA member broker-dealer and Netcapital Funding Portal as an SEC-registered and FINRA member funding portal, both under the Netcapital Inc. umbrella. This dual status provides strategic flexibility in collaborating across platforms and regulatory frameworks – exactly the type of innovative thinking GECA champions for global equity crowdfunding.

Regulatory Expertise Meets Innovation

Alexandria's professional journey reflects a deep commitment to democratizing access to capital while maintaining the highest compliance standards. Her previous experience managing regulatory compliance programs at Fidelity Investments, combined with her current role overseeing Netcapital Securities' regulatory framework, provides her with unique insights into both traditional financial services and emerging crowdfunding models.

Her expertise spans alternative investments, private capital markets advisory for both primary offerings and secondary market transactions, broker-dealer compliance, securities regulation, digital asset securities, and regulatory roadmap development. This comprehensive background positions her to help GECA navigate the complex regulatory landscape of cross-border equity crowdfunding.

Alignment with GECA's Vision

GECA's mission centers on creating a truly global equity crowdfunding ecosystem where capital flows freely across borders, connecting entrepreneurs with investors worldwide regardless of geographic limitations. Alexandria's work directly supports this vision through her focus on strategic partnerships and her innovative approaches to regulatory compliance.

One of the most exciting aspects of Alexandria's strategic thinking is her focus on liquidity solutions for crowdfunding investments. While much of the industry focuses solely on primary fundraising, Alexandria and her team at Netcapital are exploring ways to offer investors future liquidity opportunities – a critical component for the mature, global crowdfunding ecosystem GECA envisions.

Alexandria's intellectual curiosity – what she describes as her "superpower" of "thinking deeply and critically about a number of things" – drives her to question established norms and explore new possibilities. This mindset complements GECA's mission of reimagining how equity crowdfunding can transcend traditional boundaries.

A Commitment to Democratizing Capital Access

Beyond her regulatory expertise, Alexandria's commitment to expanding access to capital markets aligns with GECA's values. She serves as an advisor to startup companies, mentors at Techstars, and is a member of Global Women in Venture Capital (VC) and the Dell Women's Entrepreneur Network (DWEN).

"I'm excited to join GECA's steering committee at this pivotal moment for global equity crowdfunding," said Alexandria. "The industry has tremendous potential to democratize access to capital, but realizing that potential requires strategic thinking about regulatory frameworks, cross-border collaboration, and innovative approaches to investor protection. GECA's mission of creating a borderless ecosystem resonates deeply with my own commitment to expanding access to private capital markets."

Bringing Cross-Platform Collaboration Expertise

Alexandria's experience with Netcapital's unique positioning offers valuable insights for GECA's mission. As she explains, "Under Reg CF, companies are limited to conducting an offering through only one intermediary at a time, whether that’s a funding portal or a broker-dealer. Regulation A and Regulation D have no such limitation. Issuers raising capital under either exemption can engage multiple broker-dealers to support and distribute their offering. This flexibility allows issuers to syndicate their deal, working with a network of broker-dealers who can each bring their own investor base to the table." This regulatory knowledge, combined with her experience in cross-platform collaboration, will be instrumental as GECA works to build bridges between different jurisdictions and regulatory frameworks.

Her focus on creating synergistic ecosystems that benefit both companies and investors directly supports GECA's vision of a more connected, efficient global crowdfunding marketplace.

Looking Forward

Alexandria's appointment as Strategic Advisor comes at a crucial time for GECA as the organization continues to build momentum around its "Crowd 2.0" vision – a revolutionary approach to equity crowdfunding that transcends borders and removes unnecessary barriers to investment.

Her combination of regulatory expertise, strategic vision, and commitment to democratizing capital access will be invaluable as GECA works to influence policy development, build cross-border frameworks, and create the infrastructure necessary for truly global equity crowdfunding.

With Alexandria's addition to the steering committee, GECA continues to assemble the expertise and leadership necessary to transform equity crowdfunding from a fragmented, locally-focused industry into the globally connected ecosystem it has the potential to become.

For more information about GECA and its mission, please visit www.theGECA.org.

The Crowdfunding Chronicles: Sarah Hardwick's Blueprint for Global Values-Driven Investment

How a Marketing Visionary Transformed Aptera's $140M Campaign Into a Masterclass for Borderless Equity Crowdfunding

In an era where traditional investment barriers are crumbling and capital flows are becoming increasingly democratized, few individuals embody the transformative potential of global equity crowdfunding quite like Sarah Hardwick. As CEO of The Crowd and the strategic architect behind one of history's most successful equity crowdfunding campaigns, Sarah's recent appearance on the GECA Podcast with host Andy Field offered profound insights into the future of borderless investment - insights that perfectly align with the Global Equity Crowdfunding Alliance's vision of a truly connected, global ecosystem.

The Architect of Movement-Based Investment

Sarah's journey to becoming a crowdfunding luminary began long before equity crowdfunding became mainstream. With over two decades of experience in brand storytelling and values-based marketing, she built her foundation at Zenzi, her values marketing company, where she developed emotionally resonant campaigns for global brands including Nestle and Chiquita. This background in psychology-driven marketing would prove instrumental in revolutionizing how founders connect with investors on a deeper, more meaningful level.

The culmination of her expertise came during her tenure as Chief Marketing Officer at Aptera Motors, where she orchestrated what can only be described as a paradigm-shifting campaign. The numbers alone tell a remarkable story: $140 million raised from more than 20,000 investors, generating approximately $1.6 billion in orders. But behind these impressive figures lies a sophisticated understanding of how to build genuine community around shared values - a approach that transcends geographical boundaries and speaks directly to GECA's mission of borderless equity crowdfunding.

Beyond Transactions: Building Global Movements

What sets Sarah apart in the crowdfunding landscape is her fundamental rejection of the transactional approach that has long dominated the industry. "I started The Crowd to move away from this transactional view of crowdfunding and move towards relationship and building these deep and longstanding relationships and building a movement," she explained during her conversation with Andy.

This philosophy directly addresses one of the core challenges facing the equity crowdfunding industry today. According to recent industry data, while global equity crowdfunding is projected to reach between $30-60 billion by 2030 - with moderate growth scenarios suggesting $28.8 billion and high-growth projections reaching $65.1 billion - success rates remain frustratingly low, with many campaigns failing to achieve their funding goals due to an inability to create meaningful connections with their audience.

Sarah's approach offers a compelling solution. By focusing on values alignment rather than demographic targeting, her methodology creates what she terms "hardcore fans" who become natural ambassadors for campaigns. This organic advocacy is particularly powerful in a global context, where traditional marketing channels may be less effective across different cultures and regulatory environments.

The Global-First Philosophy: Lessons from Aptera's Success

Perhaps most relevant to GECA's mission is Sarah's revolutionary stance on global market engagement. While many founders treat international expansion as a "phase two" consideration, Sarah advocates for global thinking from day one - a strategy that proved instrumental in Aptera's success.

"The most successful campaigns, Aptera for example, it was always an important part of our phase one," Sarah noted. "Having that and inspiring that community and recognizing and speaking to the global audience initially I think is very critical. And I think that's often pushed off as a nice to have when in actuality, I think it's something that's really pivotal from the beginning."

This insight challenges conventional wisdom and directly supports GECA's advocacy for borderless equity crowdfunding. Recent data from the Cambridge Centre for Alternative Finance and regulatory reports reveals that equity crowdfunding markets have faced significant challenges since their 2021-2022 peak, with the UK market declining 58% from 2021 to 2024, US Regulation Crowdfunding falling roughly 30% in 2023-24, and the EU equity crowdfunding market totaling just €60 million in 2023. These market contractions make Sarah's proven approach to building passionate, values-aligned investor communities even more critical, as traditional broad-based marketing strategies become less effective in a more competitive environment.

Sarah's global-first approach recognizes a fundamental truth about modern investment behavior: values and mission alignment matter more than geographic proximity. "We're not trying to market to people based on demographics," she emphasized. "Where they live is less important than what they care about."

The Science of Values-Based Targeting

Central to Sarah's success is her sophisticated understanding of how to identify and attract values-aligned investors. Her famous quote, "You stand for everything, you stand for nothing," encapsulates a crucial insight about modern investment psychology. Rather than trying to appeal to everyone, successful campaigns must be willing to polarize their audience, attracting passionate supporters while accepting that others may not resonate with their message.

This approach is particularly relevant in the global context that GECA champions. Cultural nuances and regulatory differences across borders can make broad-based marketing approaches ineffective. However, values-based messaging transcends these barriers, creating universal appeal among like-minded individuals regardless of their geographic location.

The Aptera campaign exemplified this principle. The three-wheeled solar vehicle didn't appeal to everyone - "you either loved it or you hated it," as Sarah noted - but those who connected with its environmental mission became deeply committed advocates. This passionate base not only invested but actively recruited others who shared their values, creating a self-sustaining movement that expanded organically across global markets.

Technology as an Enabler of Global Connection

Looking toward the future, Sarah envisions artificial intelligence and advanced analytics playing increasingly important roles in optimizing the investor journey and enabling more sophisticated global campaigns. Her prediction that "we'll have agents executing crowdfunding campaigns and components of crowdfunding campaigns" within the next year reflects the rapid technological evolution occurring in the industry.

These technological advances hold particular promise for addressing the challenges of global equity crowdfunding that GECA seeks to solve. Language barriers, time zone differences, and cultural nuances - traditional obstacles to international expansion - can be effectively managed through AI-powered tools that provide localized, culturally appropriate communication at scale.

Sarah's current work involves developing comprehensive training programs and tools that package the systematic approach used in the Aptera campaign into accessible formats for other founders. This democratization of proven methodologies aligns perfectly with GECA's educational mission and could significantly accelerate the adoption of global-first strategies across the industry.

The Platform Evolution: Community Over Transaction

Sarah's observations about platform development offer important insights for the global equity crowdfunding ecosystem. She advocates for platforms to move beyond simple transaction facilitation toward community building, noting that "some platforms are really moving towards that and making strides and embracing community as the core part of this."

This evolution is particularly important for global platforms seeking to create cohesive communities across diverse markets. Successful international platforms must facilitate not just financial transactions but meaningful connections between investors who share common values and interests, regardless of their physical location.

The most successful global platforms, according to Sarah's analysis, are those that create "insiders" and "ambassadors" - engaged community members who actively promote both the platform and the companies raising capital on it. This network effect becomes exponentially more powerful when it spans multiple countries and cultures, creating truly global movements around shared values and missions.

Collaboration as Catalyst: The GECA Connection

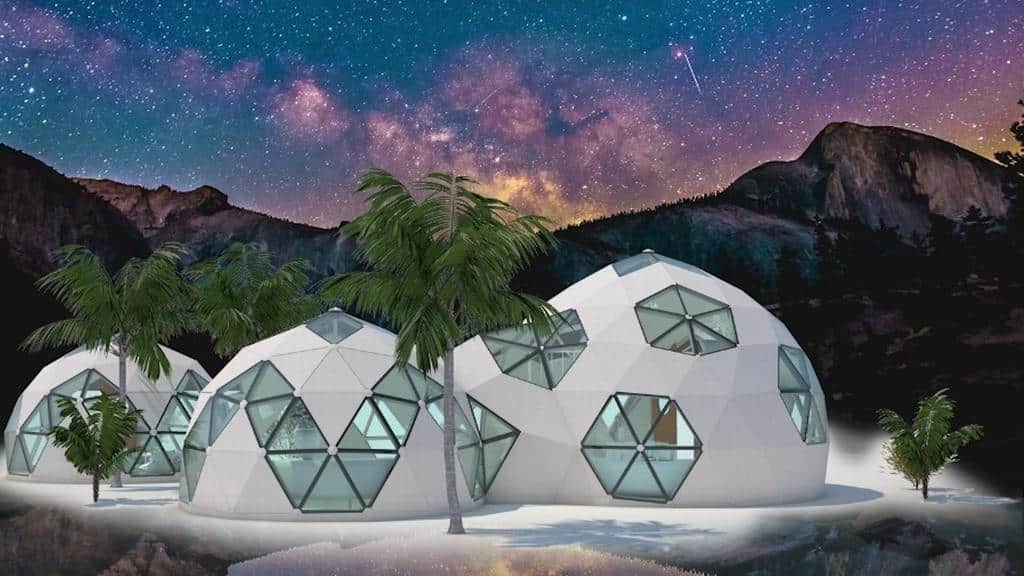

Sarah's enthusiasm for collaborating with GECA reflects a growing recognition that the future of equity crowdfunding lies in coordinated, global approaches. Her work with clients like GeoShip - a company that offers innovative bioceramic domes designed for sustainable, regenerative, and eco-friendly living, with resilient, affordable homes that integrate nature and have strong international demand - exemplifies the potential for values-driven companies to build global communities around their missions.

"I have a client called GeoShip and they have a huge international presence and a huge demand. They're working on regenerative lifestyle with innovative bioceramic domes designed for sustainable, eco-friendly living," Sarah explained. "For them, there is a huge opportunity to bring in investors and there are communities all over the world that would love to have this type of community and this type of technology. I would love to work with GECA to be able to create that community and help to bring some of these investors, these like-minded investors who share these values into some of the campaigns that I'm working on."

This collaborative vision reflects the growing recognition that the future of equity crowdfunding lies in coordinated, global approaches that address one of the key challenges identified in GECA's manifesto: the need for the industry to "collaborate to compete." Rather than competing against each other, equity crowdfunding stakeholders must work together to compete against traditional investment channels and to capture the enormous potential of global capital markets.

The Transparency Imperative: Building Trust Across Borders

One of Sarah's most compelling insights relates to the importance of transparency and authenticity in building investor relationships. Her emphasis on founders being "real and transparent" becomes even more critical in global contexts, where investors may have limited ability to conduct traditional due diligence.

"When things go great, that's amazing, and you have all these people to celebrate with you," she explained. "And when things are challenging, you can really build a movement that will rise with you and that will help to challenge the norms and really be a part of this change that you're trying to enact."

This transparency creates the trust necessary for cross-border investment relationships and helps build the kind of loyal, engaged investor base that can sustain companies through various growth phases. In global markets where regulatory protections may vary, this trust becomes even more valuable as a form of investor protection.

Future Horizons: Scaling Values-Driven Investment Globally

As the equity crowdfunding industry continues to evolve, Sarah's approach offers a roadmap for how platforms, founders, and investors can work together to create a truly global ecosystem. Her success with Aptera demonstrates that when properly executed, values-driven campaigns can transcend traditional boundaries and create worldwide movements around shared missions.

The implications for GECA's mission are profound. By focusing on values alignment rather than geographic proximity, the equity crowdfunding industry can move toward the borderless investment ecosystem that GECA envisions. This requires not just technological solutions but a fundamental shift in how campaigns are conceived and executed - a shift that Sarah has successfully demonstrated and is now working to scale through education and training.

Conclusion: The Sarah Blueprint for Global Impact

Sarah's insights on the GECA Podcast illuminate a path forward for the global equity crowdfunding industry - one that prioritizes authentic relationships over transactions, values alignment over demographics, and global thinking over local limitations. Her proven track record with Aptera and her ongoing work through The Crowd provide concrete evidence that this approach can deliver extraordinary results.

As GECA continues to advocate for borderless equity crowdfunding, leaders like Sarah demonstrate that the future is not just theoretical but achievable. Her emphasis on going "all in," building authentic communities, and thinking globally from day one offers a blueprint that other industry participants can follow to unlock the enormous potential of global equity crowdfunding.

The conversation between Sarah and Andy represents more than just an interview - it's a roadmap for transformation. As the equity crowdfunding industry stands on the brink of global expansion, insights like these will prove invaluable in shaping a more connected, values-driven, and ultimately more successful ecosystem for founders and investors worldwide.

In an industry often focused on short-term gains and transactional relationships, Sarah stands as a beacon for what's possible when we prioritize authentic connection, global thinking, and values-driven community building. Her success with Aptera wasn't just a crowdfunding campaign - it was a proof of concept for the borderless investment future that GECA seeks to create.

To join GECA's mission, visit here. To learn more about Sarah's work, visit jointhecrowd.co. The full GECA Podcast interview with Sarah is available here:

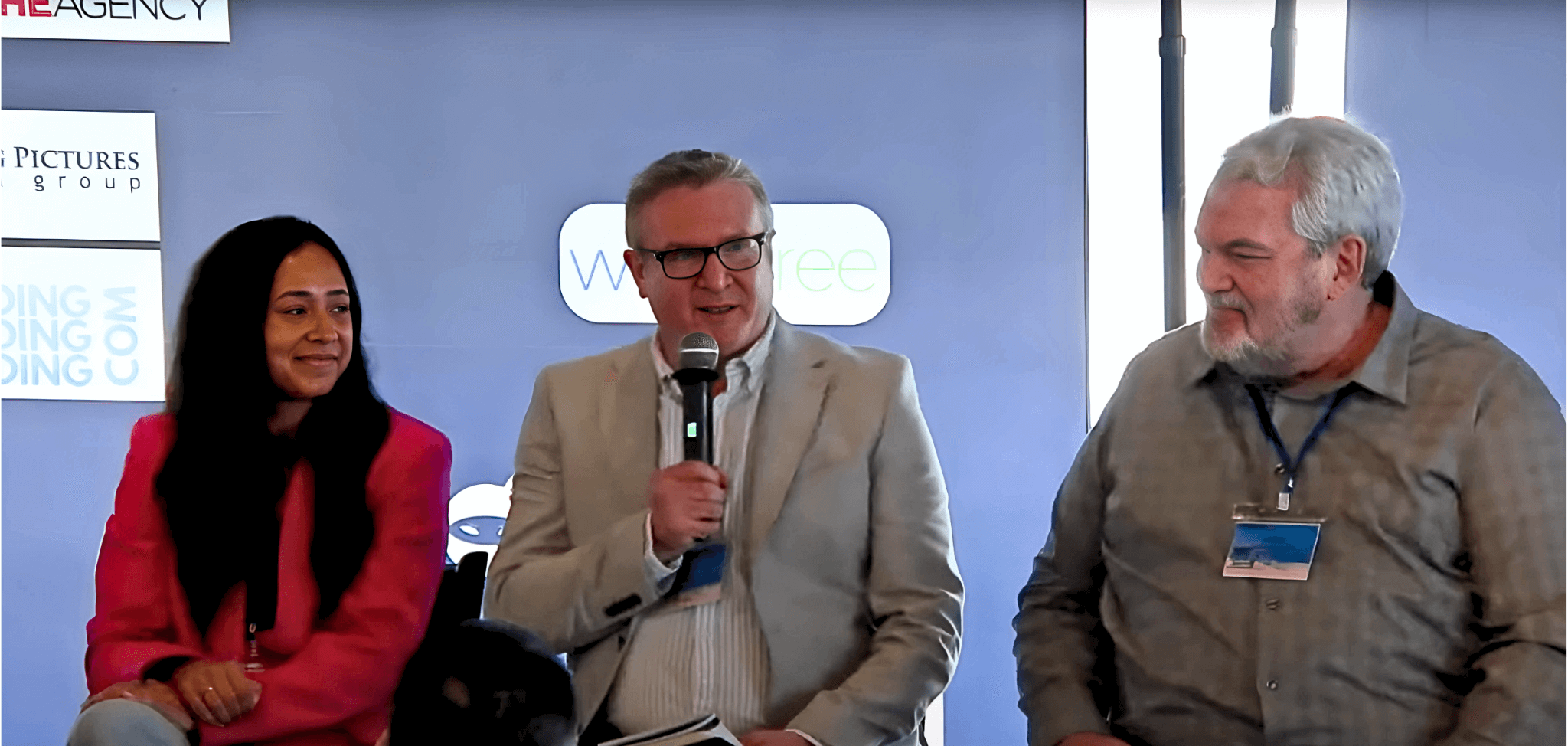

SuperCrowd LA 2025: Key Insights from Equity Crowdfunding Leaders

Last week, I had the privilege of representing the Global Equity Crowdfunding Alliance (GECA) as steering committee lead at SuperCrowd LA 2025, hosted by the ever-inspiring Devin Thorpe and the Supercrowd team. This flagship gathering brought together pioneers, operators, and advocates working at the forefront of community capital and purpose-driven finance.

A Vibrant Community Driving Transformative Change

The energy at SuperCrowd was electric – a testament to the remarkable individuals who have built this industry from the ground up. From visionary platform founders to brilliant marketing strategists, from passionate mission-driven entrepreneurs to sophisticated investors seeking both returns and impact, the event highlighted the incredible human capital that powers equity crowdfunding.

What makes this industry truly exceptional is not just its innovative financial models, but its unwavering commitment to democratizing access to capital. Time and again, I heard inspiring stories of founders who have leveraged crowdfunding to build businesses that would never have secured traditional financing, creating jobs and solving pressing social challenges along the way.

The sophistication of today's platforms and marketing agencies is extraordinary – with data-driven approaches, cutting-edge technology solutions, and deep expertise in regulatory compliance creating unprecedented opportunities for companies seeking funding and investors looking for promising opportunities.

Evolving Beyond Current Limitations

While celebrating these strengths, there was also thoughtful recognition that our industry has reached an inflection point. As one speaker aptly described it, the current landscape resembles "a Frankenstein's monster" of different sectors, geographies, stages, and instruments – creating navigational challenges that limit our collective potential.

This opportunity for greater connectivity and efficiency lies at the heart of GECA's mission: creating a truly borderless equity crowdfunding ecosystem that transcends geography and regulatory silos. The enthusiasm for this vision was palpable throughout the event, confirming we're on the right track to build upon the incredible foundation that exists today.

The Hard Numbers: Success and Failure in Crowdfunding

Jason Fishman from Digital Niche Agency shared valuable market data that gives us a clear picture of our industry's current state. His analysis of 642 live deals across major platforms revealed that while the top 10% of campaigns achieve impressive results, approximately 50% raise little to nothing. As Jason pointed out, "Success in capital raising comes from strong marketing, outreach, and realistic expectations" - not simply having a good idea or listing on a platform.

These figures highlight both the tremendous success stories and the real challenges facing our ecosystem - reinforcing that effective marketing and strategic planning remain essential components of successful fundraising.

For GECA, these metrics underscore the importance of education, setting appropriate benchmarks, and developing better frameworks for campaign success. We need to address both the successes and failures openly if we want to strengthen the entire ecosystem.

Beyond Funding: The Exit Conversation

I was honored to speak on the "Crowdfunding Exits" panel, a discussion that dug deep into one of the most critical dimensions of the crowdfunding lifecycle: what happens post-raise? We explored how we can collectively build more robust and realistic pathways for liquidity and value realization for founders, investors, and communities alike.

The panel highlighted some fascinating tensions in the exit conversation. Guy Kawasaki's advice about avoiding early exit talk contrasted with others advocating to "begin with the end in mind." There was universal agreement, however, on the importance of protecting company culture during exits - with B Corps specifically using legal "poison pills" to deter buyers misaligned with their mission.

One key insight that emerged was the risk of overvaluation traps that limit future funding and acquisitions. As we continue to develop the crowdfunding ecosystem, creating balanced, realistic valuation frameworks will be crucial for long-term sustainability.

The Trust Factor: Transparency and Education

A clear theme throughout SuperCrowd LA was the critical importance of building trust with retail investors. Platform representatives shared that conversion rates typically hover around 5-12% of registered users - indicating both the current state of investor engagement and the potential for growth. These metrics suggest that while we've built the foundations, there's meaningful opportunity to enhance investor confidence and education, potentially unlocking significant additional capital flow.

Dr. Canaan Van Williams from Proactive Real Estate Group provided a compelling case study in investor engagement. Their approach of bringing investors onsite, giving tours, answering every question, and maintaining transparent communication helped them achieve an impressive 100% rent collection even during COVID - building investor trust through demonstrable results rather than promises.

This hands-on, relationship-driven approach stands in stark contrast to the often-impersonal nature of online investment platforms, suggesting that the human element remains crucial even as we digitize and scale the investment process.

Alternative Investment Structures

Justin Renfro from WeFunder shared valuable insights about revenue-sharing models, which are gaining traction as alternatives to traditional equity. He explained that many founders default to SAFE notes without exploring potentially better options - particularly for businesses that aren't targeting hypergrowth trajectories.

Jenny Kassan emphasized that deal structures should align with business goals and values. For example, cooperatives should avoid typical investor voting rights that might undermine their member-ownership model. This customization allows for mission alignment without forcing founders to compromise their vision.

The emergence of these alternative structures represents a maturation of our industry - moving beyond simplistic one-size-fits-all approaches toward more nuanced, fit-for-purpose investment vehicles.

Impact Integration: Purpose and Profit

Perhaps the most inspiring aspect of SuperCrowd LA was witnessing how thoroughly ESG (Environmental, Social, Governance) principles have become integrated into the conversation.

Greg Brodsky session on redefining corporate purpose traced this evolution, connecting it directly to governance innovations like B Corps. He explained how these structures emerged specifically to solve problems like what happened when "Ben & Jerry's was bought by Unilever and they lost much of their original mission" because Unilever had no corporate responsibility to maintain those values.

Brian Christie tracked the paradigm shift away from Milton Friedman's 1970 NYT article that established shareholder primacy, noting how even the Business Roundtable CEOs now advocate for stakeholder approaches that serve employees, customers, and communities - not just shareholders.

This transition from a single-bottom-line focus to a more holistic view of business success represents a fundamental shift that aligns perfectly with what we're building at GECA.

Building Community, Not Just Platforms

One of the most powerful case studies presented at the event came from Sarah Hardwick, who was formerly CMO of Aptera. Their solar EV campaign leveraged an ambassador program with 800+ global volunteers to build momentum, focusing on emotional connection rather than just technical specifications.

Aptera's approach was deeply instructive. They provided ownership to their community through business cards and direct tasks, segmented ambassadors into specialized committees, and offered inside access through webinars and tours. Their ambassadors became their first line of defense against online criticism and their most powerful marketing force.

The results speak for themselves: $30M+ raised in under six months,($140M to date), driven not by massive ad spend but by authentic community engagement. This human-centered approach demonstrates that successful fundraising isn't just about technology - it's about movement building.

The Market Reality: Campaigns and Marketing

The insights about marketing requirements provided practical guidance for founders. Industry leaders noted that campaigns targeting $1M typically allocate around $15K weekly for marketing - an important planning consideration that many entrepreneurs benefit from understanding early in their journey. These benchmarks help set realistic expectations and demonstrate the professional approach required for successful campaigns in today's environment.

Jason from DNA emphasized the importance of generating sufficient traffic, noting that a 2% conversion rate is typical. This means raising $1M requires around 50,000 site visits, while a $5M raise demands approximately 250,000 visits and 15 million impressions.

These practical benchmarks provide important guidance for realistic campaign planning and expose the myth that platforms themselves will automatically deliver investors. As one panelist put it: "Platforms like StartEngine don't automatically deliver investors" – the work of building an audience remains firmly with the founder team.

Connections That Matter

Throughout the event, I had the chance to engage with so many bright minds, including Jason Fishman, whose deep expertise in campaign strategy continues to elevate what's possible in retail investing; Sarah Hardwick, whose clarity and purpose-driven approach stood out in every conversation; and one of my fellow panelists, Alexandria Fisher, CEO & CCO at Netcapital Securities Inc, whose energy and thoughtful engagement were refreshing and impactful.

It was also a pleasure to meet so many members of the CfPA (Crowdfunding Professional Association) board, whose leadership continues to shape the U.S. crowdfunding landscape in important ways. I especially appreciated the opportunity to have a meaningful conversation with CfPA president Jenny Kassan, whose legal and policy expertise is matched by her long-standing commitment to inclusive capital.

CfPA have recently become GECA supporters, and I'm excited about building a closer strategic relationship between our organizations as we align on shared objectives and explore ways to collaborate across borders and sectors.

Looking Forward: The Road Ahead

As I reflect on SuperCrowd LA, I see a movement coming of age. The event demonstrated a clear industry desire to overcome fragmentation and build more connected, interoperable ecosystems – exactly what GECA is working to create.

The data points, case studies, and expert insights shared throughout the event validate our vision of a globally connected equity crowdfunding ecosystem. We're seeing increasing recognition that the path forward requires better standardization, cross-platform collaboration, and infrastructure that reduces friction while preserving platform uniqueness.

What gives me confidence in our industry's trajectory is the combination of dedicated people and evolving technology solutions I witnessed at SuperCrowd. The founders, marketers, platform builders, and investors represent a community committed to making equity crowdfunding work better for everyone. Their expertise, when supported by improved infrastructure and collaborative frameworks like those GECA is developing, positions us well to address current challenges and build a more connected ecosystem.

What excites me most is seeing how concepts that once seemed radical – like standardized due diligence, portable investor verification, and cross-border deal flow – are now being actively discussed and demanded by industry leaders.

A heartfelt thank you to the SuperCrowd team for creating such a thoughtful and high-impact space. Events like this are where real progress begins – through connection, conversation, and a shared commitment to changing the way capital works.

If we met in LA, thank you for the insight and inspiration. And if we didn't, let's connect soon! This movement thrives when we build together.

Onward and upward!

Andy Field

GECA Steering Committee Lead

The State of Global Equity Crowdfunding in 2025: Breaking Down Barriers to Borderless Investment

In today's interconnected world, innovation knows no borders—and increasingly, neither does the capital to fund groundbreaking ideas. As the Global Equity Crowdfunding Alliance (GECA) continues its mission to enable truly borderless investments, we're witnessing significant progress in how entrepreneurs access capital and how investors participate in opportunities worldwide. This evolution is creating a more inclusive, efficient financial ecosystem that benefits stakeholders globally.

The Global Equity Crowdfunding Landscape in 2025

Equity crowdfunding has firmly established itself as a vital alternative to traditional venture capital and angel investing, democratizing access to early-stage investment opportunities while providing entrepreneurs with broader funding options. The global equity crowdfunding market stands at approximately $2.1 billion in 2025, with projections to reach $5.4 billion by 2032. This represents steady growth at a CAGR of around 13-15%, with significant potential for acceleration as cross-border solutions mature.

The market continues to evolve geographically, with North America accounting for approximately 40% of the global volume, followed by Europe at 30% and Asia-Pacific at 20%. The remaining 10% is spread across other regions, indicating substantial growth opportunities in emerging markets as regulatory frameworks develop and digital infrastructure expands.

Regulatory Progress: Toward Greater Alignment

The regulatory landscape for equity crowdfunding in 2025 shows encouraging developments toward more coherent frameworks:

European Union: The European Crowdfunding Service Provider (ECSP) Regulation, implemented in 2021, created a harmonized framework across all 27 EU member states. Platforms with ECSP authorization can operate seamlessly throughout the EU with a fundraising cap of €5 million per project over a 12-month period. The ECSP also introduced standardized investor protections, including the Key Investment Information Sheet (KIIS) and clear disclosure requirements.

United States: Regulation Crowdfunding (Reg CF) governs the U.S. market, with a maximum fundraising limit of $5 million per 12-month period. This regulatory framework requires the use of SEC-registered intermediaries and includes investor protections based on income and net worth. This structure has enabled steady growth within the U.S. market while providing a stable model that other countries can reference.

United Kingdom: Post-Brexit, the UK has maintained its own regulatory framework under the Financial Conduct Authority (FCA), distinct from the EU's ECSP. The UK model continues to emphasize investor self-certification and platform-based due diligence, with no fixed funding caps for equity offers (though prospectus requirements apply for larger raises).

Emerging Markets: Countries like Malaysia, Thailand, and New Zealand have developed their own equity crowdfunding regulations, each adapting international best practices to local market conditions. This regulatory development in emerging markets signals growing global recognition of equity crowdfunding's importance to economic growth and financial inclusion.

While this regulatory diversity creates a complex landscape to navigate, it also presents opportunities for innovation in creating compliant pathways for cross-border capital flows. Organizations like GECA are working to bridge these regulatory differences to enable truly borderless equity crowdfunding.

Opportunities for Innovation in Global Equity Crowdfunding

As the equity crowdfunding industry continues to mature, several key areas present significant opportunities for innovation. By addressing these challenges, we can unlock the full potential of a truly global equity crowdfunding ecosystem:

1. Regulatory Harmonization Opportunities

The evolving regulatory landscape presents a significant opportunity for greater alignment. While each jurisdiction maintains its own rules regarding investor eligibility, funding caps, and disclosure requirements, we're seeing promising movements toward compatibility:

- The EU's ECSP Regulation demonstrates that regional harmonization is achievable

- Bilateral agreements between major markets are creating regulatory bridges

- Industry-led standardization efforts are helping platforms navigate multiple jurisdictions

With continued collaboration between regulators, industry groups like GECA, and innovative platforms, these regulatory differences can evolve from barriers into manageable frameworks that enable rather than restrict cross-border investment.

2. Trust and Transparency Solutions

Cross-border investments naturally involve information gaps between investors and companies. This creates fertile ground for innovation in transparency and trust-building mechanisms:

- Standardized information frameworks that work across jurisdictions

- Independent verification systems for key company claims

- Cultural and market context services that bridge knowledge gaps

- AI-driven due diligence tools that supplement human expertise

The platforms that excel in building these transparency bridges are seeing higher cross-border investment flows. By making foreign opportunities as understandable as domestic ones, these innovations are gradually dismantling traditional information barriers.

3. Governance Innovation

Post-investment governance in cross-border scenarios offers exciting opportunities for technology-enabled solutions:

- Digital governance platforms with multilingual capabilities

- Standardized reporting templates that satisfy multiple jurisdictions

- Virtual AGM and voting systems that enhance investor participation regardless of location

- Investor representatives or nominees that bridge governance gaps

These innovations are transforming governance from a challenge into a strength of equity crowdfunding, allowing investors to remain connected and informed despite geographic distance.

4. Liquidity Enhancements

Creating liquidity for equity crowdfunding investments represents one of the most promising innovation areas:

- Emerging secondary markets specifically designed for crowdfunded equity

- Tokenization approaches that enable fractional ownership and potential trading

- Standardized valuation methodologies that facilitate fair pricing across borders

- Pre-arranged exit opportunities through partner networks

As these solutions mature, the historical liquidity gap in equity crowdfunding is gradually narrowing, making cross-border investments more attractive to a broader range of investors.

5. Addressing Operational Challenges

Cross-border equity crowdfunding currently faces several practical operational challenges that require attention:

- Currency conversion typically involves multiple intermediaries and significant fees

- Documentation often requires manual translation into different languages

- Financial reporting must be adapted to meet different accounting standards

- Payment processing across borders remains complex and time-consuming

While some platforms have begun implementing basic solutions like partnering with payment providers or offering template documentation, these approaches remain limited in scope. More comprehensive solutions to these operational frictions represent an important area for future development in the industry.

Emerging Solutions for Borderless Equity Crowdfunding

The global equity crowdfunding ecosystem is rapidly evolving, with innovative solutions transforming how cross-border investment works. These approaches, championed by GECA members and supporters worldwide, are creating tangible pathways toward a more integrated global market:

1. Platform Networks and Partnerships

Forward-thinking platforms are creating powerful collaborative networks that extend their reach while navigating regulatory requirements:

- Reciprocal listing agreements enable platforms to showcase opportunities across borders

- Deal syndication across partner platforms drives international capital to promising ventures

- Shared due diligence protocols enhance efficiency and consistency

- Cross-border investor introductions create valuable connections within regulatory bounds

- Innovative referral models with revenue-sharing mechanisms incentivize platforms to collaborate on cross-border opportunities

These collaborative models are allowing platforms to offer international opportunities to their investors while maintaining compliance with local regulations. The resulting networks are more than the sum of their parts, creating robust ecosystems for global investment flows.

2. Standardized Disclosure Frameworks

The industry is working toward more consistent approaches to disclosure that help bridge information gaps across borders:

- Key Investment Information Sheet (KIIS) templates from the EU ECSP providing a model for standardized disclosure

- Emerging best practices for presenting company and deal information in accessible formats

- Translation services that make disclosure documents available in multiple languages

- Efforts to align financial reporting formats to facilitate cross-border comparison

These standardization initiatives are beginning to reduce information barriers between markets, helping investors to better understand opportunities regardless of their origin. With continued development of these frameworks, we can expect further improvements in transparency and cross-border trust.

3. Blockchain and Tokenization Solutions

Blockchain technology is delivering transformative solutions to many of the traditional barriers in cross-border equity crowdfunding:

- Programmable compliance that automates jurisdiction-specific rules while enabling global participation

- Transparent ownership records with immutable audit trails that enhance trust

- Standardized tokenized equity that creates potential for seamless secondary trading

- Smart contracts that streamline investor governance and reporting across borders

Initiatives like Dacxi Chain, which is developing the intelligent infrastructure for a global equity crowdfunding ecosystem, exemplify how blockchain can connect platforms across borders while maintaining regulatory compliance. By creating a standardized protocol for cross-border investment, these solutions are reducing friction while enhancing transparency, security, and trust in the global marketplace.

4. Regulatory Collaboration and Innovation

The relationship between regulators and the equity crowdfunding industry is evolving toward greater collaboration and experimentation:

- Regulatory sandboxes provide safe spaces to test cross-border investment models under supervision

- Bilateral and multilateral agreements between national regulators create bridges between markets

- Mutual recognition frameworks identify compatible regulatory standards across jurisdictions

- Regular industry-regulator dialogues shape more effective and innovation-friendly regulations

These collaborative approaches between industry and regulators are creating pragmatic pathways to test and refine cross-border models while ensuring appropriate investor protection. Rather than seeing regulation as a barrier, innovative platforms are engaging constructively with regulators to build compliant routes to global markets.

5. Current Investor Education Approaches

Today's equity crowdfunding platforms typically provide basic educational resources to help investors understand international opportunities:

- FAQs and information pages explaining regulatory requirements

- Basic country guides highlighting local business environments

- Deal summaries translated into major languages

- Webinars and blog posts about cross-border investing considerations

While these educational tools represent important first steps, they remain relatively limited in scope and sophistication. As the industry evolves, more comprehensive educational resources will be needed to fully address the knowledge gaps that currently limit cross-border participation.

The Path Forward: GECA's Vision for Borderless Equity Crowdfunding

The Global Equity Crowdfunding Alliance (GECA) is driving the transformation toward a truly borderless ecosystem for equity crowdfunding. By uniting platforms, regulators, and stakeholders from around the world, GECA is accelerating solutions to the historical barriers that have limited cross-border investment flows.

Our vision encompasses five interconnected elements that together create a powerful framework for global equity crowdfunding:

- Regulatory Harmony: While recognizing the validity of different regulatory approaches, we champion frameworks that enable cross-border investment flows while maintaining appropriate investor protections. Through constructive engagement with regulators worldwide, we're helping to shape policies that support responsible innovation.

- Operational Standards: We're driving the development of industry standards for disclosure, due diligence, and governance that make cross-border investments more transparent, efficient, and secure. These standards allow platforms to work together seamlessly across borders.

- Technological Innovation: We embrace innovative solutions, including Dacxi Chain which is developing the intelligent infrastructure for a global equity crowdfunding ecosystem, that can overcome operational barriers and enhance trust in cross-border investments.

- Collaborative Networks: We actively foster connections between platforms, investors, and entrepreneurs across borders, creating a vibrant global community that shares best practices, co-invests in opportunities, and builds bridges between markets.

- Inclusive Growth: We're committed to ensuring that borderless equity crowdfunding democratizes access to capital for entrepreneurs worldwide while providing investors with truly global opportunities. This inclusive approach is central to our mission and values.

Through these five strategic priorities, GECA is helping to build a more integrated, efficient, and accessible global equity crowdfunding ecosystem that benefits all participants.

Conclusion: The Future is Borderless

The state of global equity crowdfunding in 2025 reflects an industry in the midst of an exciting transformation. While regulatory frameworks have matured in many markets, true cross-border investment is now entering a new phase of growth and accessibility. The innovation happening across platform networks, standardization efforts, blockchain technology, regulatory collaboration, and investor education is creating a powerful momentum toward truly borderless equity crowdfunding.

The path forward is clear and promising. As platforms develop collaborative networks, standardize information and practices, embrace technological innovation, and engage constructively with regulators, we're witnessing the emergence of a truly global ecosystem for connecting entrepreneurs with capital and investors with opportunities regardless of geography.

This evolution isn't just about technology or regulation - it's about expanding possibilities for entrepreneurs and investors worldwide. By enabling capital to flow more efficiently across borders, we're helping to fund innovation, create jobs, and build wealth in markets that have historically had limited access to growth capital. This democratization of finance represents one of the most exciting developments in global capital markets.

As the Global Equity Crowdfunding Alliance, we invite all stakeholders - platforms, investors, entrepreneurs, regulators, and technology providers - to join us in accelerating this transformation. Together, we're building a more efficient, inclusive, and dynamic global ecosystem for equity crowdfunding that will empower the next generation of innovation and growth worldwide.

This article was prepared by the Global Equity Crowdfunding Alliance (GECA) based on research and insights from our global network of members and supporters. For more information about GECA's mission and activities, please visit thegeca.org.

Breaking Down Investment Borders: A Conversation with GECA and CfPA Leadership

At SuperCrowd LA, a significant dialogue unfolded between two organizations working to transform the global investment landscape. Andy Field, Steering Committee Lead of the Global Equity Crowdfunding Alliance (GECA), and Jenny Kassan, President of the Crowdfunding Professional Association (CfPA), discussed their shared vision for democratizing finance through borderless equity crowdfunding.

The Vision: Democratizing Global Investment

The conversation centered on a powerful shared mission: making equity crowdfunding accessible to everyone, regardless of geographic location. As Field explained, GECA was created approximately eight months ago with the specific goal of "breaking down borders" in the investment space. With 50 supporters already onboard from around the world, the organization is tackling the complex challenges of enabling truly global investment flows.

Kassan expressed enthusiastic support for this vision, highlighting the fundamental disconnect in today's financial system: "There is such a need for democratization of investing right now with our global capital markets. Money is flying around our globe with really no limitations at all. But here we are trying to invest in our own communities, invest in businesses that we love and care about. And there's all these regulations that make it so hard for us to do that, not in our own country, let alone globally."

This observation cuts to the heart of the current paradox in global finance - institutional capital moves freely across borders, while individual investors face significant regulatory barriers when attempting to invest in businesses they care about, whether locally or internationally.

Regulatory Balance: Protection Without Restriction

Both leaders acknowledged the importance of appropriate regulation in protecting investors. However, they emphasized the need for proportionality in regulatory frameworks. As Field noted, "We understand the reason behind why they're there... We absolutely love the idea of regulation. It just has to be proportional perhaps."

Kassan added an important perspective on risk, pointing out that traditional public markets aren't risk-free either: "It's not like investing in the public capital of global markets isn't risky. And it's not like people don't lose money doing that." She highlighted that many public market investments simply move money around without creating productive economic activity, while crowdfunding investments flow directly to companies for productive use.

Real Economic Impact vs. Financial Circulation

One of the most compelling points raised during the conversation was the distinction between investments that create real economic value and those that merely circulate within financial markets. Kassan emphasized that crowdfunding investments go "directly to the company so they can do productive things," creating impact in the "real economy."

This perspective challenges the current imbalance where "almost everyone who has money to invest is investing in the global capital markets, not in their own communities or small businesses or non-public companies." Both leaders advocated for shifting a larger proportion of global investments toward non-public markets and community-based opportunities worldwide.

The conversation also highlighted how global crowdfunding could enable diaspora communities to invest in their countries of origin - creating powerful economic connections that current regulations often prevent.

Beyond Terminology: Investment Crowdfunding

Field and Kassan also touched on the importance of terminology and education. Field mentioned GECA's preference for the term "investment crowdfunding" rather than simply "equity crowdfunding," reflecting the broader range of investment models emerging in this space. Both organizations are committed to raising awareness about crowdfunding as a legitimate investment channel, particularly for helping startups and growth-stage companies thrive.

The Path Forward: Collaboration for Change

The conversation concluded with a commitment to continued collaboration between GECA and CfPA. This partnership represents an important step toward aligning international efforts to create more accessible, democratic investment pathways.

As these organizations work together, they face significant regulatory challenges but also unprecedented opportunities to reshape how capital flows to businesses globally. Their shared vision could help create a more inclusive financial system where individuals can invest in companies they believe in, regardless of geographic boundaries.

For more information about these organizations and how to get involved:

- Global Equity Crowdfunding Alliance (GECA): thegeca.org

- Crowdfunding Professional Association (CfPA): cfpa.org

GECA Welcomes Equitable Finance Visionary Scott McIntyre to Steering Committee

The Global Equity Crowdfunding Association (GECA) is delighted to welcome Scott McIntyre - a trailblazer in capital formation and systemic innovation - to its Steering Committee. With over a decade in leadership driving crowdfunding into the mainstream, Scott has helped shape the infrastructure supporting modern alternative finance and economic development, aligning seamlessly with GECA’s commitment to democratizing access to capital and creating a truly borderless investment ecosystem.

A Crowdfunding Champion and Industry Architect

A co-founder and 10-term Chair of the Crowdfunding Professional Association (CfPA), Scott has been a consistent voice advocating for equitable U.S. crowdfunding policy since the passage of the JOBS Act in 2012. The CfPA works directly with legislators and regulators to advance transparent, inclusive rules that fuel entrepreneurial ecosystems and protect investors.

Scott's contributions to the field have been recognized at the highest levels globally - from being invited to the White House as a "Champion of Change”, to addressing Finance Ministers of the European Union at the invitation of the U.S. State Department, to his recognition by China to deliver the keynote speech at the first Global Crowdfunding Conference. Few in the industry match his creativity and breadth of experience in both policy advocacy and grassroots innovation.

"Scott is a visionary entrepreneur and tireless advocate" says Andy Field, GECA Steering Committee Lead. "His generosity and accomplishments in recruiting and managing key experts to volunteer their valuable time to such a pressing mission makes him an invaluable addition to our steering committee as we work to build a truly global crowdfunding ecosystem."

A Systems-Level Thinker with Local and Global Impact

Scott has addressed audiences in the tens of thousands across four continents, maintaining close ties with foreign leaders in 20+ countries through a vast network of innovation hubs, alternative finance organizations, and policymakers committed to equity-centered growth.

Scott is distinguished not just by his technical skills, but his systems-level approach to economic transformation. As co-creator of the Sustainable Communities Framework (SCF) and founder of non-profit WEconomy-Us, he has pioneered replicable models that empower communities in crisis through interest-free capital and a truly free marketplace, alongside entrepreneurship and workforce development processes supporting regional production, adding resilience against global trade shifts.

From EdTech Pioneer to Alternative Finance Leader