GECA Welcomes Crowdfunding Powerhouse Jason Fishman to Steering Committee

The Global Equity Crowdfunding Alliance (GECA) strengthens its leadership team with industry veteran who has helped raise nine figures across 500+ funding campaigns

A Strategic Addition to Drive Borderless Crowdfunding

The Global Equity Crowdfunding Alliance (GECA) is thrilled to announce the addition of Jason Fishman to its Steering Committee. This appointment comes at a pivotal time as GECA continues to advance its mission of enabling global, borderless equity crowdfunding and unlocking innovation and economic growth on an unprecedented scale.

Jason brings more than 15 years of proven expertise as a "New Media Enthusiast" to GECA, with an impressive track record of planning, activating, and managing scalable marketing strategies across diverse verticals and goals. As the co-founder and CEO of Digital Niche Agency (DNA), he has transformed the landscape of digital fundraising, having worked with over 500 crowdfunding campaigns that have collectively produced nine figures in funding.

Andrew Field, Head of the GECA Steering Committee, stated: "Jason's extensive experience in successfully marketing equity crowdfunding campaigns means he knows the industry inside out. This makes him an invaluable addition to our team. His strategic vision and proven ability to connect innovative companies with global investors perfectly aligns with GECA's mission to make equity crowdfunding truly borderless."

A Career Built on Crowdfunding Excellence

Since launching DNA in 2014, Jason has established himself as a dominant force in digital funding campaigns. His agency has worked with over 850 brands and delivered industry-leading results across eCommerce, lead generation, and digital funding initiatives. Particularly notable is his work with more than 500 Regulation CF, Regulation A+, Regulation D, and Digital Asset campaigns that have produced impressive financial outcomes for clients.

Jason's thought leadership extends beyond his agency work. He has been featured as a speaker at numerous tech and marketing conferences and has produced over 180 episodes of his "Test. Optimize. Scale." podcast. He maintains active involvement with the Forbes Agency Council and serves on the Crowdfunding Professional Association Board, further cementing his status as an industry authority.

Alignment with GECA's Vision

GECA's mission centres on advocating for what they term 'Crowd 2.0,' a revolutionary approach to equity crowdfunding that transcends borders, fosters collaboration, and removes unnecessary barriers to investment. The organization envisions a world where entrepreneurs, regardless of location, can raise capital from a global community of investors, and where investors can access opportunities worldwide, not just within their own countries.

Jason's approach to crowdfunding marketing perfectly complements this vision. His methodology, which he summarizes in three words - "test, optimize, scale"- has repeatedly demonstrated success in connecting innovative companies with investors across geographic boundaries. Jason has consistently advocated that equity crowdfunding platforms are powerful tools that companies have been waiting years to fully leverage, bringing benefits far beyond just capital, including strategic partnerships, media exposure, and B2B relationships.

Bringing Expertise That Drives Results

What sets Jason apart is his data-driven, systematic approach to crowdfunding marketing. His "Eight-Point Plan" has become a respected roadmap for successful campaigns, covering crucial elements from industry overview and competitor marketing audit to audience mapping, channel planning, creative strategy, partnerships, projections, and activation planning. This methodical approach to marketing has enabled campaigns to scale rapidly, sometimes growing from entry-level advertising budgets to six-figure monthly spends that produce seven-figure monthly returns.

Jason’s expertise in digital channels spans search engines, social media platforms, programmatic ad exchanges, influencer networks, email automation, content marketing, and strategic partnerships. His background in ad tech and deep understanding of performance metrics make him uniquely qualified to help GECA achieve its goal of making equity crowdfunding truly global.

Jason comments - "I'm honoured to join the GECA Steering Committee at this transformative moment for global equity crowdfunding. Throughout my career, I've witnessed firsthand how fragmented financial systems can affect the potential of equity crowdfunding. GECA's vision for a borderless investment ecosystem resonates deeply with my own beliefs about democratizing access to capital and investment opportunities. I look forward to contributing to this important mission and helping to build a more inclusive, efficient global crowdfunding market."

A Catalyst for Global Change

GECA believes in a world where innovation knows no borders - where entrepreneurs can raise capital from a global community of investors, and where investors can access opportunities worldwide. With the addition of Jason to the Steering Committee, GECA gains a strategic thinker with hands-on experience in turning this vision into reality.

GECA's mission addresses key challenges in the current equity crowdfunding landscape, including investors being locked out of global opportunities, entrepreneurs struggling to raise capital due to regulatory restrictions, and platforms operating in isolation, unable to scale beyond domestic markets. Jason’s expertise in navigating these challenges and finding strategic solutions will be invaluable as GECA works to transform the industry.

As GECA continues to build momentum in its mission to create a global, borderless equity crowdfunding ecosystem, The addition of Jason to the Steering Committee represents a significant step forward. His proven track record, industry connections, and innovative approach to digital marketing will help accelerate GECA's impact and bring its vision of Crowd 2.0 closer to reality.

For more information about GECA and its mission, please visit www.theGECA.org.

$140M Aptera Success: Sarah Hardwick's Global Crowdfunding Strategy | GECA Podcast

$140M Aptera Success: Sarah Hardwick's Global Crowdfunding Strategy | GECA Podcast

In this inspiring episode of the GECA podcast, Andy Field sits down with Sarah Hardwick, CEO of The Crowd and the marketing mastermind behind one of equity crowdfunding’s greatest success stories. As the former Chief Marketing Officer at Aptera Motors, Sarah helped orchestrate a groundbreaking campaign that raised over $140 million from more than 20,000 investors while generating $1.6 billion in orders. Now, through The Crowd, she’s revolutionizing how purpose-driven companies approach equity crowdfunding by moving beyond transactional marketing to create deep, values-based connections with investors. With over 25 years of entrepreneurial experience and a background working with global brands like Nestlé and Chiquita, Sarah brings unique insights into the art and science of crowdfunding success. In this conversation, she reveals why founders must “go all in” on their campaigns, shares the critical importance of storytelling rooted in company purpose, and explains how values-based marketing attracts the right investors who become long-term champions. Sarah also discusses the challenges and opportunities of global crowdfunding expansion, the need for industry collaboration, and her vision for using AI and advanced analytics to enhance campaign effectiveness. This episode is essential listening for founders preparing crowdfunding raises, platforms seeking to improve investor engagement, and anyone interested in the future of purpose-driven investment.

Share this article

Andy Field: [00:00:00] Welcome to the GECA podcast, uh, the Voice of Global Equity Crowdfunding. I’m Andy, field Steering Committee lead of the Global Equity Crowdfunding Alliance, where we’re bringing together platforms, investors, and advocates from across the globe. To shape a truly borderless future for investment. And I’m thrilled today to be joined by Sarah Harwick, uh, a powerhouse in the US crowdfunding ecosystem.

Sarah’s CEO of The Crowd. The Crowd is a full service equity crowdfunding partner, de dedicated to helping purpose-driven companies raise capital and build powerful communities. And Sarah brings over two decades of experience in, in brand storytelling and, and value-based marketing. Um, she’s the former founder and CEO of Zenz and worked with major global brands like Nestle and Chiquita to help develop their campaigns, which have been rooted in psychology and emotional insight.

And after successfully exiting Zenz, Sarah became chief marketing Officer at Aptera Motors, where she helped raise over $140 million from more than 20,000 investors generating around [00:01:00] 1.6. Billion dollars in orders and creating one of the most successful and powerful equity crowdfunding campaigns in history.

And through the crowd, Sarah and her team offer end-to-end campaign management services, including strategic planning, messaging, platform integration, media outreach and investor engagement. And they have a really strong focus on values, impact and authenticity. Um, so they’re helping to transform the, the equity crowdfunding industry into a powerful tool for social environmental change.

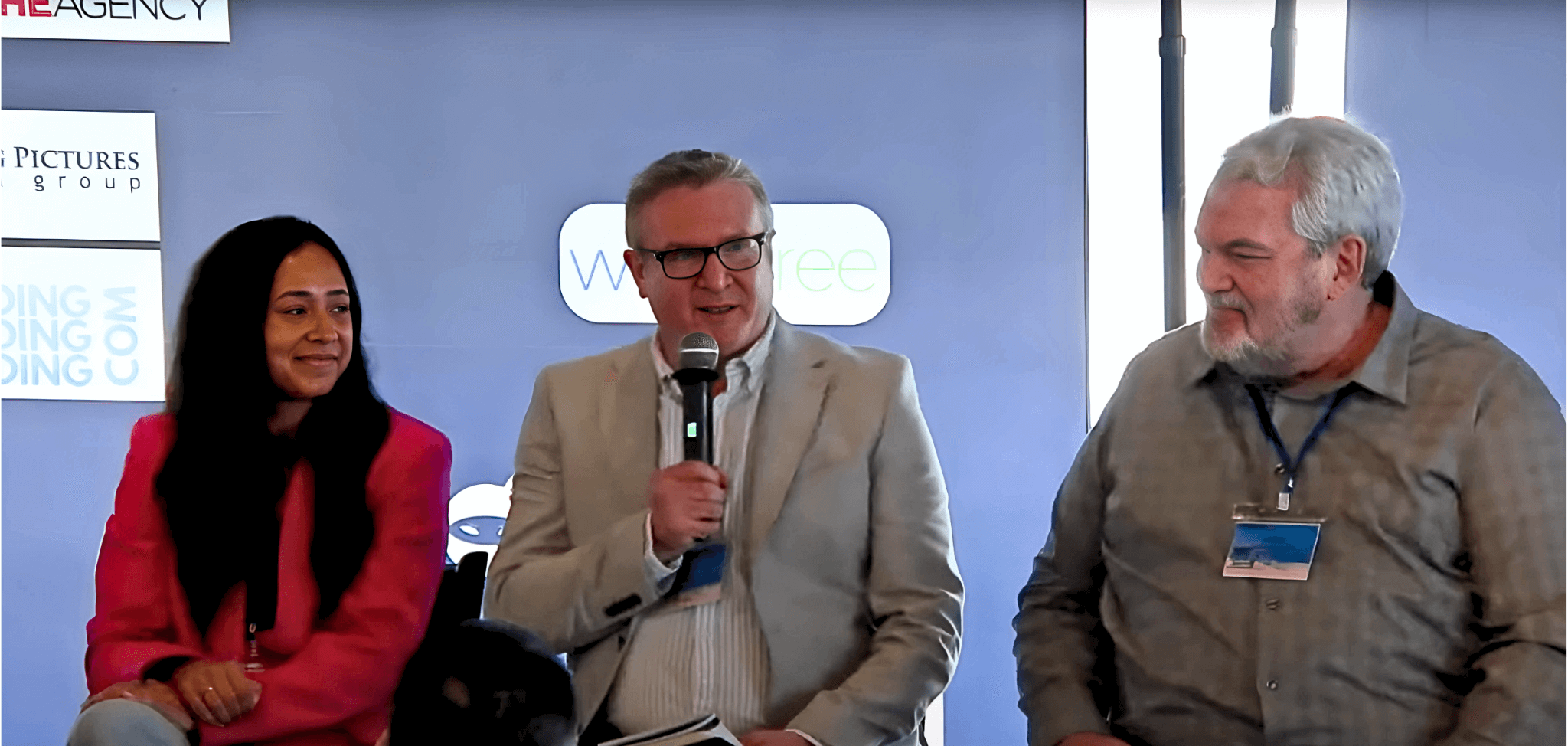

And, and quite clearly, their mission aligns very closely with, with GECA ER’s vision of a collaborative borderless investment ecosystem where capital flows towards innovation and impact. Um. I met Sarah very recently in Los Angeles at the Super Crowd LA event, and we immediately decided she’d be a perfect candidate to come and, and, uh, and talk to you, um, about her views, news and views on the, the equity crowdfunding industry.

So welcome Sarah, and thank you for coming on the podcast.

Sarah Hardwick: Thank you, Andy. It was fantastic to meet you and I’m excited to, to be here today.

Andy Field: And [00:02:00] because of the time difference, it’s very early morning for Sarah. So I really apologize for that. Sarah. It’s late in the day for me. Thank you. Um, thank you.

Sarah Hardwick: Don’t worry. I’ve got my trusty caffeine drink here.

Andy Field: Oh, brilliant. Waiting. So. Fantastic. Well, I think we can, we can dive straight in. I mean, it was quite a, that was quite a long introduction I gave you. You’ve obviously had a lot of experience in, in the industry. So can you tell us to start the, the conversation, just tell us a little bit about the, the origin story of, of the crowd and what inspired you to, to form it.

Sarah Hardwick: Sure. Well, I’ve actually been an entrepreneur for, you know, over 25 years. Um, I think, uh, the struggles for myself personally in raising capital and really, you know, having to bootstrap it was a lot of the inspiration for starting the crowd. So, you know, even though my company was very successful. I really felt, you know, I was in the shoes of founders really trying to raise capital, and so after going to Aptera and leading that campaign, I saw that gap and what really I think the gap is, [00:03:00] is around, you know, the, traditionally the transactional nature.

Um, of the way that marketing and the way that crowdfunding is approached and, you know, that’s what I saw in my first company, Zenz, my values marketing company and going to Aptera. That’s really what I saw, you know, the situation was. So in looking at that very much transactional approach, I felt like there was an opportunity to create a deeper meaning and a deeper connection with investors and customers.

Andy Field: Yeah. And that actually kind of that, I, I can’t imagine there’s, there’s many businesses that, that do it in that way. You, you know, you seem to be quite unique in the marketplace from what I’ve seen. Um, who’s, who would you say is your, your, sort of your core audience in, would it be, would it be investors? Would it be founders? Would it be both? Would it be, would it be the platforms that they work with? How, how do you sort of serve each of them uniquely?

Sarah Hardwick: Yeah, well, I work, so I’m platform agnostic. So part of the process that I do at the crowd is really guiding companies and guiding founders [00:04:00] through what the best option is from a platform standpoint.

So, starting off with, you know, should you be with a marketplace or do you want to have an integration in your own website? So I’m, I’m platform agnostic and, you know, have great relationships with a lot of the, the different, um, partners out there. Um, my core audience is really focused on founders.

Specifically founders who are doing disruptive things and really want to change the world. Yeah. And these are spaces right now, you know, the innovation that’s happening in affordable housing, in consumer products and consumer packaged goods. Um, all sorts of industries, but really focusing in on. Founders who have something amazing and are really trying to do something big and wanna create a movement.

And in the same way, what I’m really doing is bridging between these founders and investors. So for investors who want to be able to, uh, participate in, in an offering or invest in something that they believe in, I really am serving as the bridge [00:05:00] between, you know, founders and investors who both have that same passion and both wanna change the world in that same way.

Andy Field: Great. So that, yeah. So you are sort of harmonizing that side of things and I suppose essentially what you’re doing is helping them build the crowd but also build the right crowd for them. Um,

Sarah Hardwick: that’s exactly right. Yes. And I think that goes to kind of, I think a point later on, um, that I wanted to make, which was, you know, it’s really about a lot finding and uncovering and aligning, you know, the values of who those ideal investors are, and, you know, understanding that it’s okay not to go after everyone.

And so for a lot of founders, I think one of the mistakes that they make is they try to be all things to all people, and they want every different kind of investor. Yeah. And I think that’s an easy trap to fall into. But one of the most important things that we really coach founders on is to, you know, know your why and to start with that why, and that’s gonna attract the right kind of investors.

So. Not all investors are created equal. You [00:06:00] really wanna focus on those that are aligned with your values and aligned with your mission for the greatest impact.

Andy Field: Yeah. So making sure that their unique story is actually tailored and then targeted to that sort of unique demographic of people who are really gonna be interested and will buy into what they’re, that they’re doing and, and, and truly believe in what they’re doing and therefore will make the investment.

Sarah Hardwick: Yeah. I think, you know, another thing that I look for in founders that I work with is. Founders who are willing to go all in. And that’s something that I talk about a lot because I do see, you know, crowdfunding because it is, you know, something that people are excited about and is, you know, a rising trend.

And, and more and more companies are, are interested in getting into crowdfunding. Sometimes I will see them just, you know, have an, uh, an offering page or you know, in fact, yesterday I had someone who said. My start engine page is going live tomorrow. What do I do? And so really, I, that’s, that’s great. And we want these founders that are all in, but we also want founders who are really gonna make this a [00:07:00] priority and are gonna hustle.

And so if you’re just gonna throw up a page and, you know, hope for the best, those, those really aren’t the types of companies that we work with. We look for founders who want to make crowdfunding a core part of their business and create relationships that are gonna be longstanding and lasting with their customers.

Andy Field: Yeah, that makes sense. That makes sense. So I guess then that initial sort of first meeting you have with, with any sort of potential client is a really interesting one. Because, because they have to have the mindset to be able to, to work with how you are suggesting they work. And it might be quite a shift for, for quite a few people.

Sarah Hardwick: Absolutely. Yeah, absolutely. And I think, yeah, it’s getting on regular calls and getting on meetings and it’s, yeah, you know, certainly delegating some stuff to your, your team members. But I wanna see our founders on webinars. I wanna see them doing tours of their facility. I wanna see them being real and transparent and.

Sometimes that’s not easy. You know, you, I’m sure in as, as a entrepreneur and you know you’re an entrepreneur as well, things don’t always go as planned. And it’s [00:08:00] really very important, I think, to be able to be transparent with investors and to coach founders. And you know, you gotta be real. And when things go great, that’s amazing.

And you have all these people to celebrate with you. And when things are challenging. You can get, you can really build a movement that will rise with you and that will will help to, you know, cha uh, challenge the norms and, you know, really be a part of this, um, change that you’re trying to enact. So it’s not always easy and I think, um, for many founders it’s finding that kind of right crowd that will be behind them.

Andy Field: Yeah, and I love the way you term it going all in that that’s really, I mean, it sums it up perfectly, doesn’t it? You can’t, you can’t get a more, um, concise description of what they need to be doing. So yeah. That’s really interesting. Um, so, so. Your recent supporters of, of gcca, which is great because I was explaining to you what, you know, what our mission is and, and, and how we plan on, on building our community and our supporters.

And, and, uh, I know you were sort of fully behind that, which is great. I’m just [00:09:00] wondering if, so just moving on to talk a little bit about what the opportunities are, Glo you know, globally, not, not just in the States. So I wonder if you have any experience on sort of. Any regulatory or or structural barriers that you might have come across that might prevent us crowdfunding platforms, attracting global, global investors, and maybe not the platform, but maybe the founders themselves actually in your instance.

Is there anything in particular that comes to mind on that front?

Sarah Hardwick: You know, I think there is a perception with founders that it’s kind of overwhelming, and I think it’s the, you know, the compliance is part of it. The time difference is part of it, you know, the, the cultural differences part of it, I think language, things like that.

Yeah. The, yeah. And there’s, you know, I think that there’s those type of, of, you know, perceived barriers that are out there, um, that can make them feel a little bit intimidated. And so I, I think what I see sometimes is. Global being, um, positioned as a phase two. Yep. When the most [00:10:00] successful campaigns aptera for example, it was always an important phase, part of our phase one.

And I think whether even if you can’t be delivering to customers or you won’t be able to, you know, kind of service them immediately or as quickly as you can, if you’re a US based company serving, you know, US customers and investors. Having that and, and inspiring that community and recognizing and speaking to, you know, the global audience, um, initially I think is, is very critical.

And I think that’s often pushed off as a nice to have when an an actuality. I think it’s something that’s really, you know, pivotal from the beginning.

Andy Field: Yeah, I think that makes that, that makes a lot of sense. And, and so do you think that once she’s, once that opportunity, because I can imagine a lot of founders wouldn’t even consider the opportunity of going global, and I’m wondering if, do you think there’d be an appetite for that amongst the platforms and, and the issuers to, to connect with global capital markets or investors and, and if so.

What do you think needs to happen to unlock that? Is it just a question of, of [00:11:00] education? There’s obviously some regulatory, um, barriers that need to be overcome, but I just wonder what your views are on that.

Sarah Hardwick: I mean, absolutely. It feel, I feel like there’s an appetite and an interest and an excitement for that, but I, the challenge is that there’s not a playbook.

Yeah, what they’re missing and what we’re missing is a playbook for how you approach this, how you tackle, you know, investor relations and how you tackle some of these basic, you know, crowdfunding campaigns and storytelling in different regions. So that’s really what it’s, I feel like is missing, is a playbook, is is a way for them to actually tactically move forward and be effective.

The other thing I think is actually beneficial, and one thing that we look for and we try to optimize a lot is. If you have supporters and investors that are already in global markets. Yeah, because, you know, I’ve seen in my experience, you know, they will rally behind a specific region. You know, Hey, we’re here, you know, we’re, we want to, to meet up with others [00:12:00] who are the other supporters in this area.

So identifying and, and. Tapping into supporters, even if they’re few and far in between in global markets, that’s really a great way to start to help you build out your presence and to help you cross that gap and cross that bridge.

Andy Field: Yeah, that’s a really good point actually. And, and that, and that’s almost like the power of recommendation as well, isn’t it? Endorsement and it sort of adds to that value. I mean, yeah. Well, yeah. I mean, I suppose, well, hopefully gcca, that’s, that’s obviously what we are trying to assist with and, and you know, we’re. Our, our main initiative is obviously advocating for, for borderless equity crowdfunding. That’s our utopian, uh, view.

So how do you see that evolving over the next few years? Do you think that’s going to play more of a part, do you think? Do you think everybody involved in the industry will welcome that? Um, we’ve al we’ve already talked about the barriers. I just wondered from a, from a perception point of view, do you think it will be welcomed that.

Sarah Hardwick: Absolutely. Absolutely. And I think many, especially many founders who have been successful [00:13:00] crowdfunding are looking for ways to expand their reach and looking for ways to target new markets, new communities, you know, new, uh, fans who are aligned with their values. And the great thing about this is that we’re not trying to market to people based on demographics, you know, where they live.

Is less important than what they care about. And that’s exactly what, why, you know, what they want, how they wanna change the future, why they are, are part of this movement. So from my standpoint, I think it’s, I think the, the perception, I think they’re very excited and, and, and looking and seeking out ways to align with investors who share their values regardless of where they’re located geographically.

Andy Field: Yeah. And that, that absolutely is, is, is what we’re, we’re sort of, um, advocating for as well. So, yeah. That’s, that’s amazing. Okay. Well, just going back a little bit to, um, your experience, um, and maybe some advice for, for founders and for platforms, have you got any, any advice for [00:14:00] founders who are right now just.

Thinking about preparing for a crowdfunding raise right now, as in this year, especially in terms of the, we, you know, I was, um, I mentioned actually when I was speaking in LA a little bit about the importance. Some of, I think the question I was asked was what’s the, the, you know, the critical thing that, that people need to consider in their marketing.

And my advice on that as, um, I have a marketing background as well, was think about the story, the storytelling, and I think that’s crucial. Do you have any advice to, to, to businesses that are. Thinking about, um, starting a raise in terms of the marketing and the storytelling, what would be the key things that they should be considering now?

Sarah Hardwick: I mean, you are absolutely right. Storytelling is absolutely the critical part of the campaign. The question is, what stories are you telling and, and I think, and who’s telling the stories. Yeah. So taking a step back, again, it’s revisiting. Why are you here as a company? What are you trying to accomplish?

What is your [00:15:00] purpose? And getting clarity on that one statement here is why we exist. Here is what we believe in, and that why that purpose should be woven through everything, all of the stories of the campaign. And a lot of times founders, when they’re thinking about a crowdfunding campaign, jump right into, let me tell you about the product or service, or let me tell you about the market size.

And they forget about this idea of why they’re here and, and what they’re trying to do. And that’s from a storytelling standpoint, those are the most important stories that you could possibly be telling. So the first part and most important part is take a step back. Yeah, and revisit that. And we have a series of questions and an ex, some exercises that we can take founders through as part of our process that helps them recenter on that.

And then once you have that insight, then that’s where you create a messaging hierarchy and the storytelling matrix and the PR angles and all of those come from, from those insights around why.

Andy Field: So, so at the [00:16:00] core of everything needs to be that story and it’s almost helping them see the wood for the trees and reminding them that they need to do that throughout the campaign.

Sarah Hardwick: Yeah. Yeah. And I, because in that, why, when we talk about values based marketing, you’re trying to attract investors who share your values. So if you’re not putting them out there. There’s nothing to gravitate towards, and it’s very functional. And in the beginning you asked me, you know, why did I start the crowd?

And I started the crowd to move away from this transactional view of crowdfunding and move towards a relationship and building these deep and longstanding relationships and building a movement. Yeah. So moving your messaging and your stories away from the tactical and moving him into a place of values.

Is where you get the engagement and you get the longtime investors, you know, they start off with investing $500 and they come back and invest 5,000, and then maybe they become one of the lead investors. And that’s a journey. And it doesn’t happen without a deep core [00:17:00] connection to what people really, truly believe in.

Andy Field: No, that I think, yeah, that, that resonates really well with me. Um, so yeah, so once they’ve got the story at the core of everything they do, that’s a great top tip I think. Have, do you have any sort of top tip? We already mentioned that one of the key things that, um, you encourage founders to do is to not be all things to all men and, and to, to target very carefully their story to their audience.

Do you have any tips for how they would go about. Doing that sort of targeting for the, for the right investors.

Sarah Hardwick: Sure. Well, if you think about it, values are polarizing and people who are motivated by purpose and the environment and sustainability, you know, are not necessarily motivated by status and profit and achievement.

Yeah. And success. And so when you think about it, you know, you, when you are centering around that why you really, you know, you want to double down. On who you are. And I, uh, I mean, Aptera again is a great example that three-wheeled vehicle did not appeal to [00:18:00] everyone, and you either loved it or you hated it.

And you have to be okay as a founder with people hating your product or your service. And honestly. If, if there, it’s so much better to have people who are think that, you know, they hate it with a passion, then they’re ambivalent about it. So really digging into the people who absolutely love it, your hardcore fans, and it’s, and, and speaking to that and, and rallying them and playing into that and doubling down on that.

So if it’s purpose and sustainability, those are your people and you don’t compromise on those values. But you know, if it’s in another direction, then you double down on that. And it’s okay if it’s status and celebrity and maybe you’re bringing in some influencers and your campaign looks a little different and that’s okay.

The point is that you cannot be all things to all people. One of my favorite quotes is, you know, you stand for everything. You stand for nothing. Yeah. And it’s absolutely true here. So it is better to have a smaller group of really aligned and passionate [00:19:00] fans than a huge group that’s completely unengaged.

Andy Field: Yeah. Yeah. And I think. I’m right in saying at the event in LA recently you played a video about this campaign, and that was great. And I think another time maybe we’ll get you to, to, to present that video. That was a fantastic presentation you gave and I think the, the geck, a supporter base would love to see that.

So maybe we should schedule that because that will really bring it to life. Yeah. Okay. So, so as a, as a marketing and branding expert, this is a little off the wall, this question because it’s, it’s more about. Platforms. Mm-hmm. Have you got any opinions on, on what you think the platforms and maybe the industry as a whole actually could be doing better to engage retail investors?

So, so almost them supporting the, um, the issuers, uh, you know, how, how, how, how can they help? How can they help sort of with the, with the, the, you know, the engaging of those retail investors?

Sarah Hardwick: Yeah. I, I believe that, you know, some, um. That some investors are more excited and [00:20:00] inclined to be a part of a community than others.

So from a platform standpoint, building a community and you see some who have really focused on creating insiders, sending out, you know, special deals, you know, really, uh, creating kind of a movement amongst their own investors. And that is very beneficial, I think. So for the platforms to help to create those programs where there are insiders, there are ambassadors, there are people who are excited to be a part of a community.

I feel like that’s really a lot of what’s been missing and some platforms are really moving towards that and making strides and embracing community. Yeah. As you know, the, the core part of this, because it does take a community, it does take the crowd, and so I think that for, from my standpoint, platforms could probably be doing better at rallying people and making it easier for people to connect.

And to share insights and to share best practices and experience and really help each other. [00:21:00] And that’s one of the, the things that I have always felt was missing. And one of the things that I hope to do with the crowd as well is bring people together to share the struggles and share the successes and continue to improve what we’re doing with this, you know, art and the science of crowdfunding.

Andy Field: Yeah. And that actually rings true with, with, um, something that we, we’ve just published our manifesto fairly recently. And, and a big part of that is the notion of. Collaborate to compete. We need, as an industry to collaborate, we need to work together to share best practices, to share failures, to, to share experience really.

And we need to do that in order to compete not with each other, but against other sort of means. You know, there are other investment opportunities out there for investors and, and, and crowdfunding should be, should be a real consideration for them. It’s such a fantastic industry and, and one that. Can make such a difference to Yeah.

You know, to startup businesses and yeah. I think that makes, that makes perfect sense. So that’s great. What, just thinking a little bit about the [00:22:00] future mm-hmm. Where do you see the sort of the most exciting innovation happening now in, in the crowdfunding space, either in the states or globally? Do, are you seeing any springs of, you’ve talked there about, um, the potential for collaboration and, and community building with platforms.

That would be a good example, but I’m wondering what else you think you, you know, that you can see happening in the near future that’s potentially going to change the crowdfunding space.

Sarah Hardwick: Yes. Uh, certainly I think we’ve talked a lot about values driven campaigns and mission driven campaigns. I think we’ll see more and more of those really leaning into that.

That’s one trend that I think we’ll see from a technology standpoint. I think we’ll see a lot more development of analytics and tech to help us understand the investor journey more clearly. Yes, and for us as marketers and as founders and crowdfunders, having that intelligence and having those insights.

To help us to understand what’s working and what’s not is invaluable. So I envision that. We’ll [00:23:00] see, and, and we’re already starting to see platforms who are rolling out pretty sophisticated, uh, tools for issuers to help us to understand. Who’s coming through the pipeline, where they’re maybe getting stuck and how we can encourage and nurture them to get them to actually convert to become investors.

So I think we’ll see a lot of, of technology that’s evolving, that’s making it easier for marketers to really facilitate that process and to create, you know, uh, deeper connections with investors into convert more efficiently.

Andy Field: Yeah, and I guess that helps with the whole targeting piece as well, because if you, if you’re collecting the, you know, good data around investors, um, and even potential investors actually, then that will really help, um, with that sort of matchmaking between, you know, the right deal with the, with the right investor.

So, yeah, again, that makes, that’s true. Yeah.

Sarah Hardwick: You know, it’s easier than ever to spin up ads and test things. And so now with, you know, AI obviously is gonna be another huge Im impactful [00:24:00] trend that we’re gonna see in the future. I believe that we’ll have agents executing crowdfunding campaigns and components of of crowdfunding campaigns.

It within the next year where it won’t necessarily be, uh, individuals or a freelance per PR person. And all of those tools and a lot of those resources, I think will be tied together in a more automated fashion using AI to really help to increase efficiency. Where I. The AI may be working on your email funnels and distributing those emails and, uh, writing back to investor questions, and we’re already seeing things like bots and other Yeah.

You know, forms of AI being utilized. We’re obviously all using AI and, you know, running things through GPT, but I believe that we’ll see a next level of agents who are actually very sophisticated at executing on very, you know, essential tasks that are part of a crowdfunding campaign.

Andy Field: And I guess that’s going to help you. Which kind of leads me to my, the last question I have for you actually, which is, which is going to be what’s next for the crowd, but I [00:25:00] suppose part, you know, part of the, the answer you’ve just given there will be reflected in that answer. You know, what’s next for the crowd? Well, you’ve got lots of innovation, lots of exciting things that are happening in order to help you.

I wonder, I, it’s a genuine question really as to how the, the marketplace IE your, the founders that you’re working with. Will react to you using tools like that because obviously they’re very powerful and, and they need to be explained and the benefits, you know, they go, you know, they go without saying what the benefits will be.

It’d be great to see, and it’d be interesting to see how the founders react to using things like AI in their, in their marketing campaigns.

Sarah Hardwick: Yes. And I think they are already Andy. Yeah, I, I’ve had so many, even just in the past couple of weeks, here’s a video script that I asked AI to do. Yeah. Here’s, you know, the landing page suggestions. Here’s some SEO recommendations. So they’re already doing it. I think the value that we can bring is. Helping it to make it sound in the right voice and tone. Infusing those values into the language. Giving the AI a, a [00:26:00] framework Yes. For how to create a campaign that’s going to be, personalized and customized and in line with the goals of a founder.

So there’s that part of it. ’cause I think they’re already doing it, but maybe not that well. And maybe they need some help collaborating with it so we can elevate. Yes. And I think training and education, you know, that is a core. Part of what I’m gonna be doing in the next year with the crowd, we’re gonna be launching some training.

We’re gonna be launching some tools. Basically, if you can imagine the whole system that we use to raise 140 million for aptera in a playbook format where we can help to get them closer, to help to to build community, to grow your list, to get the messaging right on target, to create the right testing mechanisms for ads.

All of those core pieces to really, you get the, give them a playbook for what’s gonna be successful and how all of the things that they need, the components to be successful with a crowdfunding campaign. So that will be coming out very soon. I’m very excited to, to [00:27:00] launch that.

Andy Field: That’s interesting. And that’s one of our, I. Um, pillars actually, and that we, we put in our manifesto is that the, the need for education and training across the board actually. So for founders, for platforms, for investors. And it’s one of the things that we’d like to think that our community is going to be supporting. Um, so, so the question I was going to ask right at the end obviously was what’s next for the crowd?

You’ve kind of already answered that, but how, how could the, the GCCA community support or collaborate with what you are gonna be doing next and how you are progressing things?

Sarah Hardwick: Yes. Well, I think back to some of your questions around, you know, the ecosystem and you know, how we can be, be working more closely with global investors.

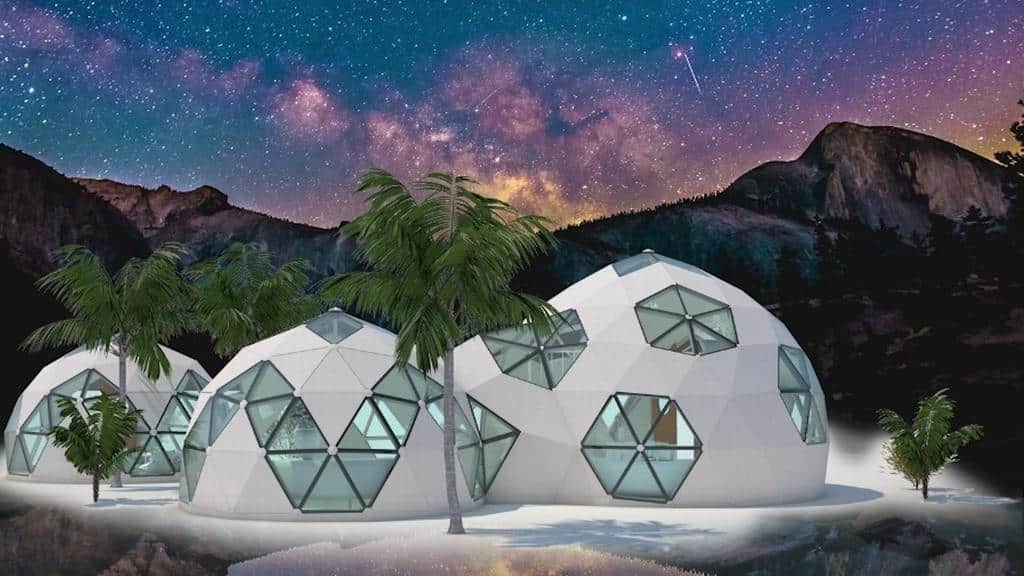

I think I would love to work closely with Gaca to bring more global investors into the campaigns that I’m running for. You know, companies, I have a client called Geo Ship, and they have a huge international presence and a huge demand. They’re working on regenerative lifestyle and, and geodesic homes. And for, for them, for [00:28:00] example, there is a huge opportunity to bring in investors.

And yeah, there are communities all over the world that would love to have this type of a, a community and this type of a technology. So, uh, I would love to work with GECA to be able to. Create that community and, and help to bring some of these investors, these like-minded investors who share these values into some of the campaigns that, that I’m working on.

So that would be be one way for sure. And I think it will, to your point, it will take some education to do that. Yeah. How can we do that? What are some of the barriers? What’s hold? What are the holdups and. Only through running these campaigns together will we figure that out. And I think it’s just a matter of diving in.

Let’s do it. Let’s get in there, go all in, let’s create it. Let’s, let’s go all in. Yeah. And let’s create strategy that we can use and let’s, let’s get rid of those, those gaps. And let’s really, you know, company by company, founder by founder, investor by investor, start to bridge that gap.

Andy Field: Well, that is a, a really poignant note to, to end on because we’ve [00:29:00] pretty much run out of time.

Um. Look a massive thank you for that. That was, that was really fascinating. I’d love to have you back on again and, and to go through an example of one of the campaigns that you’ve worked on, just because I found it so fascinating myself when I saw it and I, I’m pretty sure everyone else I. We’ll find it fascinating too.

So Sarah, thanks so much for sharing all those, those insights with us. It’s clear that, that that platforms like the crowd are, are doing some fantastic work in, in helping make investment more inclusive and aligning with our global vision for, essentially what we’re looking for is a more connected equity crowd funding ecosystem.

So thank you very much.

Sarah Hardwick: Thank you. No problem.

Andy Field: So if you enjoyed today’s episode, make sure you follow gcca on on LinkedIn and visit the gcca.org to learn more about our mission. You can download our manifesto there, um, our growing global supporter base and how you can get involved. Sarah, I did mean to ask you and just remind everybody how they can get in touch with you if they want to connect with you directly as well.

So if you [00:30:00]

Sarah Hardwick: Absolutely, yep, I would welcome any connections on LinkedIn. You’re also welcome to go to our website, join the crowd.co join the crowd.co to learn a little bit more about our offering. But I love the personal connection, so please feel free to reach out to me on LinkedIn. We’d love to connect with everyone there as well.

Andy Field: And there’s a connection to that site on the GECA website as well. If you want us to look at it via that way. It’s, it’s, it’s easy to do that. So thanks everybody again for listening. Stay tuned for more voices that are gonna help shape the future of global crowdfunding. Thank you.

Netcapital Securities CEO and Compliance expert Alexandria Fisher Joins GECA Steering Committee

The Global Equity Crowdfunding Alliance strengthens its leadership with Netcapital Securities CEO who brings deep regulatory expertise and innovative approaches to cross-border fundraising.

A Strategic Addition to Advance Borderless Investment

The Global Equity Crowdfunding Alliance (GECA) is pleased to announce the appointment of Alexandria Fisher to its Steering Committee as Strategic Advisor. Alexandria brings exceptional expertise in regulatory compliance, strategic partnerships, and innovative fundraising approaches that closely align with GECA's mission of enabling global, borderless equity crowdfunding.

As CEO and CCO of Netcapital Securities Inc., Alexandria has established herself as a leading voice in expanding access to private capital markets. Her comprehensive understanding of regulatory frameworks, combined with her strategic vision for cross-border collaboration, makes her an invaluable addition to GECA's leadership team as the organization works to transform the global equity crowdfunding landscape.

Andrew Field, Head of the GECA Steering Committee, commented: "Alexandria's deep regulatory expertise and innovative approach to fundraising strategy make her a compelling strategic advisor for GECA. Her experience navigating complex compliance requirements while building bridges between different fundraising mechanisms directly supports our mission of creating a truly borderless equity crowdfunding ecosystem."

Pioneering Strategic Fundraising Solutions

Alexandria's approach to equity crowdfunding sets her apart in the industry. Rather than viewing different regulatory pathways as separate options, she champions a strategic combination of Regulation CF, Regulation A, and Regulation D offerings to maximize fundraising potential. This innovative methodology allows companies to access both non-accredited and accredited investors simultaneously, creating more comprehensive capital-raising strategies.

"Companies who look to utilize multiple offering types at the same time are being very strategic," Alexandria explains, "using the Reg CF or Reg A bucket to open the investment opportunity to their broad network, while leveraging Reg D to attract larger investments from accredited investors and venture capitalists.”

Her work at Netcapital Securities has positioned the Netcapital platform uniquely in the industry, with Netcapital Securities operating as an SEC-registered, FINRA member broker-dealer and Netcapital Funding Portal as an SEC-registered and FINRA member funding portal, both under the Netcapital Inc. umbrella. This dual status provides strategic flexibility in collaborating across platforms and regulatory frameworks – exactly the type of innovative thinking GECA champions for global equity crowdfunding.

Regulatory Expertise Meets Innovation

Alexandria's professional journey reflects a deep commitment to democratizing access to capital while maintaining the highest compliance standards. Her previous experience managing regulatory compliance programs at Fidelity Investments, combined with her current role overseeing Netcapital Securities' regulatory framework, provides her with unique insights into both traditional financial services and emerging crowdfunding models.

Her expertise spans alternative investments, private capital markets advisory for both primary offerings and secondary market transactions, broker-dealer compliance, securities regulation, digital asset securities, and regulatory roadmap development. This comprehensive background positions her to help GECA navigate the complex regulatory landscape of cross-border equity crowdfunding.

Alignment with GECA's Vision

GECA's mission centers on creating a truly global equity crowdfunding ecosystem where capital flows freely across borders, connecting entrepreneurs with investors worldwide regardless of geographic limitations. Alexandria's work directly supports this vision through her focus on strategic partnerships and her innovative approaches to regulatory compliance.

One of the most exciting aspects of Alexandria's strategic thinking is her focus on liquidity solutions for crowdfunding investments. While much of the industry focuses solely on primary fundraising, Alexandria and her team at Netcapital are exploring ways to offer investors future liquidity opportunities – a critical component for the mature, global crowdfunding ecosystem GECA envisions.

Alexandria's intellectual curiosity – what she describes as her "superpower" of "thinking deeply and critically about a number of things" – drives her to question established norms and explore new possibilities. This mindset complements GECA's mission of reimagining how equity crowdfunding can transcend traditional boundaries.

A Commitment to Democratizing Capital Access

Beyond her regulatory expertise, Alexandria's commitment to expanding access to capital markets aligns with GECA's values. She serves as an advisor to startup companies, mentors at Techstars, and is a member of Global Women in Venture Capital (VC) and the Dell Women's Entrepreneur Network (DWEN).

"I'm excited to join GECA's steering committee at this pivotal moment for global equity crowdfunding," said Alexandria. "The industry has tremendous potential to democratize access to capital, but realizing that potential requires strategic thinking about regulatory frameworks, cross-border collaboration, and innovative approaches to investor protection. GECA's mission of creating a borderless ecosystem resonates deeply with my own commitment to expanding access to private capital markets."

Bringing Cross-Platform Collaboration Expertise

Alexandria's experience with Netcapital's unique positioning offers valuable insights for GECA's mission. As she explains, "Under Reg CF, companies are limited to conducting an offering through only one intermediary at a time, whether that’s a funding portal or a broker-dealer. Regulation A and Regulation D have no such limitation. Issuers raising capital under either exemption can engage multiple broker-dealers to support and distribute their offering. This flexibility allows issuers to syndicate their deal, working with a network of broker-dealers who can each bring their own investor base to the table." This regulatory knowledge, combined with her experience in cross-platform collaboration, will be instrumental as GECA works to build bridges between different jurisdictions and regulatory frameworks.

Her focus on creating synergistic ecosystems that benefit both companies and investors directly supports GECA's vision of a more connected, efficient global crowdfunding marketplace.

Looking Forward

Alexandria's appointment as Strategic Advisor comes at a crucial time for GECA as the organization continues to build momentum around its "Crowd 2.0" vision – a revolutionary approach to equity crowdfunding that transcends borders and removes unnecessary barriers to investment.

Her combination of regulatory expertise, strategic vision, and commitment to democratizing capital access will be invaluable as GECA works to influence policy development, build cross-border frameworks, and create the infrastructure necessary for truly global equity crowdfunding.

With Alexandria's addition to the steering committee, GECA continues to assemble the expertise and leadership necessary to transform equity crowdfunding from a fragmented, locally-focused industry into the globally connected ecosystem it has the potential to become.

For more information about GECA and its mission, please visit www.theGECA.org.

The Crowdfunding Chronicles: Sarah Hardwick's Blueprint for Global Values-Driven Investment

How a Marketing Visionary Transformed Aptera's $140M Campaign Into a Masterclass for Borderless Equity Crowdfunding

In an era where traditional investment barriers are crumbling and capital flows are becoming increasingly democratized, few individuals embody the transformative potential of global equity crowdfunding quite like Sarah Hardwick. As CEO of The Crowd and the strategic architect behind one of history's most successful equity crowdfunding campaigns, Sarah's recent appearance on the GECA Podcast with host Andy Field offered profound insights into the future of borderless investment - insights that perfectly align with the Global Equity Crowdfunding Alliance's vision of a truly connected, global ecosystem.

The Architect of Movement-Based Investment

Sarah's journey to becoming a crowdfunding luminary began long before equity crowdfunding became mainstream. With over two decades of experience in brand storytelling and values-based marketing, she built her foundation at Zenzi, her values marketing company, where she developed emotionally resonant campaigns for global brands including Nestle and Chiquita. This background in psychology-driven marketing would prove instrumental in revolutionizing how founders connect with investors on a deeper, more meaningful level.

The culmination of her expertise came during her tenure as Chief Marketing Officer at Aptera Motors, where she orchestrated what can only be described as a paradigm-shifting campaign. The numbers alone tell a remarkable story: $140 million raised from more than 20,000 investors, generating approximately $1.6 billion in orders. But behind these impressive figures lies a sophisticated understanding of how to build genuine community around shared values - a approach that transcends geographical boundaries and speaks directly to GECA's mission of borderless equity crowdfunding.

Beyond Transactions: Building Global Movements

What sets Sarah apart in the crowdfunding landscape is her fundamental rejection of the transactional approach that has long dominated the industry. "I started The Crowd to move away from this transactional view of crowdfunding and move towards relationship and building these deep and longstanding relationships and building a movement," she explained during her conversation with Andy.

This philosophy directly addresses one of the core challenges facing the equity crowdfunding industry today. According to recent industry data, while global equity crowdfunding is projected to reach between $30-60 billion by 2030 - with moderate growth scenarios suggesting $28.8 billion and high-growth projections reaching $65.1 billion - success rates remain frustratingly low, with many campaigns failing to achieve their funding goals due to an inability to create meaningful connections with their audience.

Sarah's approach offers a compelling solution. By focusing on values alignment rather than demographic targeting, her methodology creates what she terms "hardcore fans" who become natural ambassadors for campaigns. This organic advocacy is particularly powerful in a global context, where traditional marketing channels may be less effective across different cultures and regulatory environments.

The Global-First Philosophy: Lessons from Aptera's Success

Perhaps most relevant to GECA's mission is Sarah's revolutionary stance on global market engagement. While many founders treat international expansion as a "phase two" consideration, Sarah advocates for global thinking from day one - a strategy that proved instrumental in Aptera's success.

"The most successful campaigns, Aptera for example, it was always an important part of our phase one," Sarah noted. "Having that and inspiring that community and recognizing and speaking to the global audience initially I think is very critical. And I think that's often pushed off as a nice to have when in actuality, I think it's something that's really pivotal from the beginning."

This insight challenges conventional wisdom and directly supports GECA's advocacy for borderless equity crowdfunding. Recent data from the Cambridge Centre for Alternative Finance and regulatory reports reveals that equity crowdfunding markets have faced significant challenges since their 2021-2022 peak, with the UK market declining 58% from 2021 to 2024, US Regulation Crowdfunding falling roughly 30% in 2023-24, and the EU equity crowdfunding market totaling just €60 million in 2023. These market contractions make Sarah's proven approach to building passionate, values-aligned investor communities even more critical, as traditional broad-based marketing strategies become less effective in a more competitive environment.

Sarah's global-first approach recognizes a fundamental truth about modern investment behavior: values and mission alignment matter more than geographic proximity. "We're not trying to market to people based on demographics," she emphasized. "Where they live is less important than what they care about."

The Science of Values-Based Targeting

Central to Sarah's success is her sophisticated understanding of how to identify and attract values-aligned investors. Her famous quote, "You stand for everything, you stand for nothing," encapsulates a crucial insight about modern investment psychology. Rather than trying to appeal to everyone, successful campaigns must be willing to polarize their audience, attracting passionate supporters while accepting that others may not resonate with their message.

This approach is particularly relevant in the global context that GECA champions. Cultural nuances and regulatory differences across borders can make broad-based marketing approaches ineffective. However, values-based messaging transcends these barriers, creating universal appeal among like-minded individuals regardless of their geographic location.

The Aptera campaign exemplified this principle. The three-wheeled solar vehicle didn't appeal to everyone - "you either loved it or you hated it," as Sarah noted - but those who connected with its environmental mission became deeply committed advocates. This passionate base not only invested but actively recruited others who shared their values, creating a self-sustaining movement that expanded organically across global markets.

Technology as an Enabler of Global Connection

Looking toward the future, Sarah envisions artificial intelligence and advanced analytics playing increasingly important roles in optimizing the investor journey and enabling more sophisticated global campaigns. Her prediction that "we'll have agents executing crowdfunding campaigns and components of crowdfunding campaigns" within the next year reflects the rapid technological evolution occurring in the industry.

These technological advances hold particular promise for addressing the challenges of global equity crowdfunding that GECA seeks to solve. Language barriers, time zone differences, and cultural nuances - traditional obstacles to international expansion - can be effectively managed through AI-powered tools that provide localized, culturally appropriate communication at scale.

Sarah's current work involves developing comprehensive training programs and tools that package the systematic approach used in the Aptera campaign into accessible formats for other founders. This democratization of proven methodologies aligns perfectly with GECA's educational mission and could significantly accelerate the adoption of global-first strategies across the industry.

The Platform Evolution: Community Over Transaction

Sarah's observations about platform development offer important insights for the global equity crowdfunding ecosystem. She advocates for platforms to move beyond simple transaction facilitation toward community building, noting that "some platforms are really moving towards that and making strides and embracing community as the core part of this."

This evolution is particularly important for global platforms seeking to create cohesive communities across diverse markets. Successful international platforms must facilitate not just financial transactions but meaningful connections between investors who share common values and interests, regardless of their physical location.

The most successful global platforms, according to Sarah's analysis, are those that create "insiders" and "ambassadors" - engaged community members who actively promote both the platform and the companies raising capital on it. This network effect becomes exponentially more powerful when it spans multiple countries and cultures, creating truly global movements around shared values and missions.

Collaboration as Catalyst: The GECA Connection

Sarah's enthusiasm for collaborating with GECA reflects a growing recognition that the future of equity crowdfunding lies in coordinated, global approaches. Her work with clients like GeoShip - a company that offers innovative bioceramic domes designed for sustainable, regenerative, and eco-friendly living, with resilient, affordable homes that integrate nature and have strong international demand - exemplifies the potential for values-driven companies to build global communities around their missions.

"I have a client called GeoShip and they have a huge international presence and a huge demand. They're working on regenerative lifestyle with innovative bioceramic domes designed for sustainable, eco-friendly living," Sarah explained. "For them, there is a huge opportunity to bring in investors and there are communities all over the world that would love to have this type of community and this type of technology. I would love to work with GECA to be able to create that community and help to bring some of these investors, these like-minded investors who share these values into some of the campaigns that I'm working on."

This collaborative vision reflects the growing recognition that the future of equity crowdfunding lies in coordinated, global approaches that address one of the key challenges identified in GECA's manifesto: the need for the industry to "collaborate to compete." Rather than competing against each other, equity crowdfunding stakeholders must work together to compete against traditional investment channels and to capture the enormous potential of global capital markets.

The Transparency Imperative: Building Trust Across Borders

One of Sarah's most compelling insights relates to the importance of transparency and authenticity in building investor relationships. Her emphasis on founders being "real and transparent" becomes even more critical in global contexts, where investors may have limited ability to conduct traditional due diligence.

"When things go great, that's amazing, and you have all these people to celebrate with you," she explained. "And when things are challenging, you can really build a movement that will rise with you and that will help to challenge the norms and really be a part of this change that you're trying to enact."

This transparency creates the trust necessary for cross-border investment relationships and helps build the kind of loyal, engaged investor base that can sustain companies through various growth phases. In global markets where regulatory protections may vary, this trust becomes even more valuable as a form of investor protection.

Future Horizons: Scaling Values-Driven Investment Globally

As the equity crowdfunding industry continues to evolve, Sarah's approach offers a roadmap for how platforms, founders, and investors can work together to create a truly global ecosystem. Her success with Aptera demonstrates that when properly executed, values-driven campaigns can transcend traditional boundaries and create worldwide movements around shared missions.

The implications for GECA's mission are profound. By focusing on values alignment rather than geographic proximity, the equity crowdfunding industry can move toward the borderless investment ecosystem that GECA envisions. This requires not just technological solutions but a fundamental shift in how campaigns are conceived and executed - a shift that Sarah has successfully demonstrated and is now working to scale through education and training.

Conclusion: The Sarah Blueprint for Global Impact

Sarah's insights on the GECA Podcast illuminate a path forward for the global equity crowdfunding industry - one that prioritizes authentic relationships over transactions, values alignment over demographics, and global thinking over local limitations. Her proven track record with Aptera and her ongoing work through The Crowd provide concrete evidence that this approach can deliver extraordinary results.

As GECA continues to advocate for borderless equity crowdfunding, leaders like Sarah demonstrate that the future is not just theoretical but achievable. Her emphasis on going "all in," building authentic communities, and thinking globally from day one offers a blueprint that other industry participants can follow to unlock the enormous potential of global equity crowdfunding.

The conversation between Sarah and Andy represents more than just an interview - it's a roadmap for transformation. As the equity crowdfunding industry stands on the brink of global expansion, insights like these will prove invaluable in shaping a more connected, values-driven, and ultimately more successful ecosystem for founders and investors worldwide.

In an industry often focused on short-term gains and transactional relationships, Sarah stands as a beacon for what's possible when we prioritize authentic connection, global thinking, and values-driven community building. Her success with Aptera wasn't just a crowdfunding campaign - it was a proof of concept for the borderless investment future that GECA seeks to create.

To join GECA's mission, visit here. To learn more about Sarah's work, visit jointhecrowd.co. The full GECA Podcast interview with Sarah is available here:

SuperCrowd LA 2025: Key Insights from Equity Crowdfunding Leaders

Last week, I had the privilege of representing the Global Equity Crowdfunding Alliance (GECA) as steering committee lead at SuperCrowd LA 2025, hosted by the ever-inspiring Devin Thorpe and the Supercrowd team. This flagship gathering brought together pioneers, operators, and advocates working at the forefront of community capital and purpose-driven finance.

A Vibrant Community Driving Transformative Change

The energy at SuperCrowd was electric – a testament to the remarkable individuals who have built this industry from the ground up. From visionary platform founders to brilliant marketing strategists, from passionate mission-driven entrepreneurs to sophisticated investors seeking both returns and impact, the event highlighted the incredible human capital that powers equity crowdfunding.

What makes this industry truly exceptional is not just its innovative financial models, but its unwavering commitment to democratizing access to capital. Time and again, I heard inspiring stories of founders who have leveraged crowdfunding to build businesses that would never have secured traditional financing, creating jobs and solving pressing social challenges along the way.

The sophistication of today's platforms and marketing agencies is extraordinary – with data-driven approaches, cutting-edge technology solutions, and deep expertise in regulatory compliance creating unprecedented opportunities for companies seeking funding and investors looking for promising opportunities.

Evolving Beyond Current Limitations

While celebrating these strengths, there was also thoughtful recognition that our industry has reached an inflection point. As one speaker aptly described it, the current landscape resembles "a Frankenstein's monster" of different sectors, geographies, stages, and instruments – creating navigational challenges that limit our collective potential.

This opportunity for greater connectivity and efficiency lies at the heart of GECA's mission: creating a truly borderless equity crowdfunding ecosystem that transcends geography and regulatory silos. The enthusiasm for this vision was palpable throughout the event, confirming we're on the right track to build upon the incredible foundation that exists today.

The Hard Numbers: Success and Failure in Crowdfunding

Jason Fishman from Digital Niche Agency shared valuable market data that gives us a clear picture of our industry's current state. His analysis of 642 live deals across major platforms revealed that while the top 10% of campaigns achieve impressive results, approximately 50% raise little to nothing. As Jason pointed out, "Success in capital raising comes from strong marketing, outreach, and realistic expectations" - not simply having a good idea or listing on a platform.

These figures highlight both the tremendous success stories and the real challenges facing our ecosystem - reinforcing that effective marketing and strategic planning remain essential components of successful fundraising.

For GECA, these metrics underscore the importance of education, setting appropriate benchmarks, and developing better frameworks for campaign success. We need to address both the successes and failures openly if we want to strengthen the entire ecosystem.

Beyond Funding: The Exit Conversation

I was honored to speak on the "Crowdfunding Exits" panel, a discussion that dug deep into one of the most critical dimensions of the crowdfunding lifecycle: what happens post-raise? We explored how we can collectively build more robust and realistic pathways for liquidity and value realization for founders, investors, and communities alike.

The panel highlighted some fascinating tensions in the exit conversation. Guy Kawasaki's advice about avoiding early exit talk contrasted with others advocating to "begin with the end in mind." There was universal agreement, however, on the importance of protecting company culture during exits - with B Corps specifically using legal "poison pills" to deter buyers misaligned with their mission.

One key insight that emerged was the risk of overvaluation traps that limit future funding and acquisitions. As we continue to develop the crowdfunding ecosystem, creating balanced, realistic valuation frameworks will be crucial for long-term sustainability.

The Trust Factor: Transparency and Education

A clear theme throughout SuperCrowd LA was the critical importance of building trust with retail investors. Platform representatives shared that conversion rates typically hover around 5-12% of registered users - indicating both the current state of investor engagement and the potential for growth. These metrics suggest that while we've built the foundations, there's meaningful opportunity to enhance investor confidence and education, potentially unlocking significant additional capital flow.

Dr. Canaan Van Williams from Proactive Real Estate Group provided a compelling case study in investor engagement. Their approach of bringing investors onsite, giving tours, answering every question, and maintaining transparent communication helped them achieve an impressive 100% rent collection even during COVID - building investor trust through demonstrable results rather than promises.

This hands-on, relationship-driven approach stands in stark contrast to the often-impersonal nature of online investment platforms, suggesting that the human element remains crucial even as we digitize and scale the investment process.

Alternative Investment Structures

Justin Renfro from WeFunder shared valuable insights about revenue-sharing models, which are gaining traction as alternatives to traditional equity. He explained that many founders default to SAFE notes without exploring potentially better options - particularly for businesses that aren't targeting hypergrowth trajectories.

Jenny Kassan emphasized that deal structures should align with business goals and values. For example, cooperatives should avoid typical investor voting rights that might undermine their member-ownership model. This customization allows for mission alignment without forcing founders to compromise their vision.

The emergence of these alternative structures represents a maturation of our industry - moving beyond simplistic one-size-fits-all approaches toward more nuanced, fit-for-purpose investment vehicles.

Impact Integration: Purpose and Profit

Perhaps the most inspiring aspect of SuperCrowd LA was witnessing how thoroughly ESG (Environmental, Social, Governance) principles have become integrated into the conversation.

Greg Brodsky session on redefining corporate purpose traced this evolution, connecting it directly to governance innovations like B Corps. He explained how these structures emerged specifically to solve problems like what happened when "Ben & Jerry's was bought by Unilever and they lost much of their original mission" because Unilever had no corporate responsibility to maintain those values.

Brian Christie tracked the paradigm shift away from Milton Friedman's 1970 NYT article that established shareholder primacy, noting how even the Business Roundtable CEOs now advocate for stakeholder approaches that serve employees, customers, and communities - not just shareholders.

This transition from a single-bottom-line focus to a more holistic view of business success represents a fundamental shift that aligns perfectly with what we're building at GECA.

Building Community, Not Just Platforms

One of the most powerful case studies presented at the event came from Sarah Hardwick, who was formerly CMO of Aptera. Their solar EV campaign leveraged an ambassador program with 800+ global volunteers to build momentum, focusing on emotional connection rather than just technical specifications.

Aptera's approach was deeply instructive. They provided ownership to their community through business cards and direct tasks, segmented ambassadors into specialized committees, and offered inside access through webinars and tours. Their ambassadors became their first line of defense against online criticism and their most powerful marketing force.

The results speak for themselves: $30M+ raised in under six months,($140M to date), driven not by massive ad spend but by authentic community engagement. This human-centered approach demonstrates that successful fundraising isn't just about technology - it's about movement building.

The Market Reality: Campaigns and Marketing

The insights about marketing requirements provided practical guidance for founders. Industry leaders noted that campaigns targeting $1M typically allocate around $15K weekly for marketing - an important planning consideration that many entrepreneurs benefit from understanding early in their journey. These benchmarks help set realistic expectations and demonstrate the professional approach required for successful campaigns in today's environment.

Jason from DNA emphasized the importance of generating sufficient traffic, noting that a 2% conversion rate is typical. This means raising $1M requires around 50,000 site visits, while a $5M raise demands approximately 250,000 visits and 15 million impressions.

These practical benchmarks provide important guidance for realistic campaign planning and expose the myth that platforms themselves will automatically deliver investors. As one panelist put it: "Platforms like StartEngine don't automatically deliver investors" – the work of building an audience remains firmly with the founder team.

Connections That Matter

Throughout the event, I had the chance to engage with so many bright minds, including Jason Fishman, whose deep expertise in campaign strategy continues to elevate what's possible in retail investing; Sarah Hardwick, whose clarity and purpose-driven approach stood out in every conversation; and one of my fellow panelists, Alexandria Fisher, CEO & CCO at Netcapital Securities Inc, whose energy and thoughtful engagement were refreshing and impactful.

It was also a pleasure to meet so many members of the CfPA (Crowdfunding Professional Association) board, whose leadership continues to shape the U.S. crowdfunding landscape in important ways. I especially appreciated the opportunity to have a meaningful conversation with CfPA president Jenny Kassan, whose legal and policy expertise is matched by her long-standing commitment to inclusive capital.

CfPA have recently become GECA supporters, and I'm excited about building a closer strategic relationship between our organizations as we align on shared objectives and explore ways to collaborate across borders and sectors.

Looking Forward: The Road Ahead

As I reflect on SuperCrowd LA, I see a movement coming of age. The event demonstrated a clear industry desire to overcome fragmentation and build more connected, interoperable ecosystems – exactly what GECA is working to create.

The data points, case studies, and expert insights shared throughout the event validate our vision of a globally connected equity crowdfunding ecosystem. We're seeing increasing recognition that the path forward requires better standardization, cross-platform collaboration, and infrastructure that reduces friction while preserving platform uniqueness.

What gives me confidence in our industry's trajectory is the combination of dedicated people and evolving technology solutions I witnessed at SuperCrowd. The founders, marketers, platform builders, and investors represent a community committed to making equity crowdfunding work better for everyone. Their expertise, when supported by improved infrastructure and collaborative frameworks like those GECA is developing, positions us well to address current challenges and build a more connected ecosystem.

What excites me most is seeing how concepts that once seemed radical – like standardized due diligence, portable investor verification, and cross-border deal flow – are now being actively discussed and demanded by industry leaders.

A heartfelt thank you to the SuperCrowd team for creating such a thoughtful and high-impact space. Events like this are where real progress begins – through connection, conversation, and a shared commitment to changing the way capital works.

If we met in LA, thank you for the insight and inspiration. And if we didn't, let's connect soon! This movement thrives when we build together.

Onward and upward!

Andy Field

GECA Steering Committee Lead

The State of Global Equity Crowdfunding in 2025: Breaking Down Barriers to Borderless Investment

In today's interconnected world, innovation knows no borders—and increasingly, neither does the capital to fund groundbreaking ideas. As the Global Equity Crowdfunding Alliance (GECA) continues its mission to enable truly borderless investments, we're witnessing significant progress in how entrepreneurs access capital and how investors participate in opportunities worldwide. This evolution is creating a more inclusive, efficient financial ecosystem that benefits stakeholders globally.

The Global Equity Crowdfunding Landscape in 2025

Equity crowdfunding has firmly established itself as a vital alternative to traditional venture capital and angel investing, democratizing access to early-stage investment opportunities while providing entrepreneurs with broader funding options. The global equity crowdfunding market stands at approximately $2.1 billion in 2025, with projections to reach $5.4 billion by 2032. This represents steady growth at a CAGR of around 13-15%, with significant potential for acceleration as cross-border solutions mature.

The market continues to evolve geographically, with North America accounting for approximately 40% of the global volume, followed by Europe at 30% and Asia-Pacific at 20%. The remaining 10% is spread across other regions, indicating substantial growth opportunities in emerging markets as regulatory frameworks develop and digital infrastructure expands.

Regulatory Progress: Toward Greater Alignment

The regulatory landscape for equity crowdfunding in 2025 shows encouraging developments toward more coherent frameworks:

European Union: The European Crowdfunding Service Provider (ECSP) Regulation, implemented in 2021, created a harmonized framework across all 27 EU member states. Platforms with ECSP authorization can operate seamlessly throughout the EU with a fundraising cap of €5 million per project over a 12-month period. The ECSP also introduced standardized investor protections, including the Key Investment Information Sheet (KIIS) and clear disclosure requirements.

United States: Regulation Crowdfunding (Reg CF) governs the U.S. market, with a maximum fundraising limit of $5 million per 12-month period. This regulatory framework requires the use of SEC-registered intermediaries and includes investor protections based on income and net worth. This structure has enabled steady growth within the U.S. market while providing a stable model that other countries can reference.