Diaspora Capital & Ethiopian Crowdfunding: Meseret Warner's Vision | GECA Podcast

Diaspora Capital & Ethiopian Crowdfunding: Meseret Warner's Vision | GECA Podcast

Most diaspora send money home as gifts. What if those billions became investments instead?

Over $100 billion flows into Africa annually as remittances – consumed, gifted, never invested. Meanwhile, 95% of Ethiopian businesses can’t access traditional finance due to lack of collateral. What if redirecting even a fraction of diaspora capital could change entire economies?

Join Andy Field in conversation with Meseret Warner, founder of Ignite Investment (Ethiopia’s first equity crowdfunding platform) and GECA Steering Committee member, as she reveals how to bridge the gap between diaspora capital and African entrepreneurship. From IT developer in Canada to pioneering fintech in Ethiopia, Meseret shares the trust-building journey required to convert remittance senders into equity investors.

From proving the concept through digital marketing alone (raising millions before building a platform) to navigating Ethiopia’s regulatory sandbox, Meseret breaks down why trust matters more than technology, how to make companies “crowdfund ready,” and why women entrepreneurs actually repay debt at higher rates than men.

Key insights:

- Why diaspora communities are emotionally invested – not just financially

- How to convert one-way remittance flows into two-way equity investments

- The critical role of regulatory sandboxes in emerging markets

- Why 65% of Ignite’s funded companies are women-led enterprises

- How partnerships with GIZ and African Development Bank enable scaling

- The coordination gap: why retail investors face barriers high net worth individuals don’t

- What incremental progress in the UK, US, and Ethiopia signals for global crowdfunding

Remittances fund consumption. Investment builds economies.

Share this article

Andy Field (Host): Hello everyone, and welcome back to the GECA Podcast — the voice of global equity crowdfunding. I’m Andy Field, Steering Committee Lead of the Global Equity Crowdfunding Alliance, where we speak with the leading voices shaping the future of capital raising across borders.

As crowdfunding continues to evolve, we’re exploring what it takes to run successful campaigns on a global basis — and what founders, platforms, and investors need to know to thrive in this ever-expanding ecosystem.

Today’s episode is a particularly special one because I’m joined by someone whose work genuinely challenges how we think about capital, borders, and opportunity.

I’m delighted to be speaking with Meseret Warner, Founder and Managing Director of Ignite Investment — Ethiopia’s first equity crowdfunding platform — and also a recent addition to the GECA Steering Committee.

Meseret brings a truly global perspective to this conversation. Over the course of her career, she’s worked across international institutions, including the United Nations and national statistical agencies, before going on to become one of Africa’s most influential fintech pioneers.

What really sets her work apart is her focus on diaspora capital — and her belief that the billions of dollars sent home every year as remittances can, and should, be transformed into productive long-term investment.

Through Ignite Investment, Meseret has helped design a borderless equity crowdfunding model — carefully navigating U.S. regulatory requirements and Ethiopian laws — facilitating millions in investment and supporting a remarkable number of women-led enterprises, all while building that all-important trust infrastructure and regulatory alignment in a complex, evolving market.

The evolving Ethiopian capital market and the growth of regulatory sandboxes have opened doors for financial innovations like Ignite.

At GECA, we talk a lot about breaking down borders in equity crowdfunding — and Meseret’s work shows what that looks like in practice. Not as a theoretical ideal, but as something that can materially change lives, businesses, and economies.

In this conversation, we’re going to explore Meseret’s journey, the power of diaspora-led investment, the realities of building crowdfunding in emerging markets, and what her experience can teach us about the future of truly global equity crowdfunding.

So, welcome Meseret. It’s great to have you here.

Meseret Warner (Guest): Great to be here. Thank you, Andy.

Andy Field (Host): And for those who may not know you yet — and I can’t believe there are many, because I’ve seen you in lots of webinars recently, right across the globe — how do you usually describe what you do, in plain, simple terms?

Meseret Warner (Guest): Yeah — I guess, in very simple terms, I always work on expanding access to finance for those who have traditionally been excluded. Whether it’s borrowing money to run businesses or for personal needs — having good access to finance really does open opportunities.

So my work has always been that. It could be crowdfunding, it could be something else — but at the end of the day, that’s the core of what I do.

Andy Field (Host): Yeah. And I mentioned very briefly in my introduction that your career path is vast — there’s a lot in there.

From working with the UN and national statistical agencies to founding Ethiopia’s first equity crowdfunding platform — what was the moment where you said, “This is what I need to build. This is what’s needed”?

Meseret Warner (Guest): You know what it’s like — like anything else, it wasn’t really like I woke up one day and said, “Oh great, this is what I’m going to do.” I wish it was that easy.

Andy Field (Host): It would be easier.

Meseret Warner (Guest): Exactly — then you’d know what you were getting into right up front.

No — it’s really a path. It’s a process.

I’m diaspora myself. I came back from Canada — that’s where I lived most of my life. I was doing other things, but then I got involved in a project in Ethiopia, and they asked me to help them raise funds.

And I immediately started thinking: where is capital? Where can we access finance? Especially in Ethiopia, where companies can only borrow money if they have an immovable asset — collateralised debt financing — and 95% of businesses are small businesses and startups, where they don’t have collateral and they can’t borrow.

So working on those projects, I could see everyone was struggling to access finance.

And then on the other side, you see billions coming in. That was easy for me to see because I’m diaspora. I used to send money to my mum and my family when I was there — when someone says they need money for something, you send it.

So I started putting those pieces together.

At the beginning, I was thinking we need diversified sources of finance — angel investors, venture capital, private equity.

But I quickly learned it’s not that easy. There are many factors. Those markets aren’t mature in Ethiopia, and you don’t see those flows very easily.

So I thought: okay — here is capital that is flowing very easily: remittances. It’s mostly consumption. There’s even a high cost to send money as remittances. But it’s a clear flow.

So I started looking at the problem and saying: here is a huge need, and here is a huge pool of capital — how do you bridge those two?

Before the platform, we tried to prove the concept. Even in a well-known project where the promoters were trusted, it was easier to mobilise capital — even without a platform. I was doing digital marketing and other things — things I knew from my career. I was an IT person; I was a developer in Canada for years.

And I was surprised to see we were able to raise millions from diaspora all over the world — completely off-platform.

That proved something important: if you give people access to structured, trustworthy, and transparent opportunities, there is openness to invest.

That was the evolution — and that’s how I got here.

Andy Field (Host): That answers what was going to be my next question — how your personal journey has shaped your thinking.

So, what changes when diaspora communities move from sending money to actually owning part of businesses they believe in?

[00:09:00]

Meseret Warner (Guest): It’s definitely a process.

When diaspora are sending money — like I said, I used to send money to my family — it’s easy. One, you send it to someone you know. You hope you know what they’re going to use it for.

Andy Field (Host): What they’ve told you they’re going to use it for.

Meseret Warner (Guest): Exactly. Sometimes you find out later it was used for something else — but from the sender’s perspective, you’re sending it to family. You’re not expecting anything back. It’s gone. It’s a donation, a gift — consumption. It’s a one-way street.

There’s no due diligence. Nothing.

But when you introduce the idea: “Instead of sending money repeatedly, what if you invest so the person or business becomes self-sustaining?” — that changes everything.

It’s the old saying: don’t give someone fish every day — teach them how to fish. That changes economies. It may not be your exact family — but it can help your country and your community.

And because I came back and I’m on the ground, I can see the Ethiopian diaspora are actually among the biggest investors. People like me gave up jobs, came back, put in money, built businesses.

So it’s not foreign to them — they do invest. But equity crowdfunding adds structure and accessibility.

The first thing I learned is: trust, trust, trust.

If I give it to my mum, I know it gets to her. But if I invest through a platform: how do I know you invested it properly? How do I know the company won’t take the money and disappear? How do I see the impact I’m looking for?

So having that conversation takes time. It’s worth it — and each time we have it, more people convert than I expect. But you need patience.

And also — equity crowdfunding isn’t just the fancy technology. In Ethiopia, it’s about building the entire ecosystem.

The companies raising funds often aren’t “platform-ready.” They aren’t prepared to share diligence materials the way someone in Washington DC would expect.

So we had to work on both sides: educate and build trust with investors — and support fundraisers to become investment-ready.

That’s partly why we partnered with GIZ (a German development agency implementing partner). They focus on private sector development. We said: these companies want to raise funds, but they need support to become investable — to become “crowdfunding-ready.”

In the U.S., you can hire marketing agencies — but it’s expensive. People talk about spending up to $50,000 USD to be ready to raise. But if an African company is raising half a million, they can’t put $50,000 — close to 10% — into preparation.

Andy Field (Host): That’s interesting — because the “crowdfunding-ready” challenge is global: marketing, getting a crowd behind you, preparing to list — and trust is absolutely universal.

So what surprised you most once Ignite Investment went live?

[00:16:00]

Meseret Warner (Guest): I was pleasantly surprised. A lot of people were already looking for something like this.

The diaspora are emotionally invested. They’re passionate about seeing progress. It’s not like investing in Apple stock — that’s purely numbers. With diaspora, there’s also identity and impact.

So as soon as they saw a pathway to invest, it was surprising. In the first week we launched in 2022, we had about 30 sign-ups — and half were investors — from five different countries, mostly the U.S. and the UK, asking: “How can I invest?”

They didn’t know me, they didn’t know Ignite — but they read, they reached out, they signed up. It proved we were filling a gap.

Andy Field (Host): And a lot of the enterprises you’ve supported are women-led. Was that intentional?

[00:18:00]

Meseret Warner (Guest): Yes — very intentional.

I’ve been working on women’s economic empowerment for years. I was President of the African Women Entrepreneurs Program — we had 42 chapters across Africa.

When you look at access to finance, it’s already difficult for SMEs — but for women, it’s even worse. Only a tiny fraction of funding goes to women-led ventures.

Even me — I’m well-spoken, I’ve worked globally — and I still don’t have access in the same way many of my male peers do. That’s just how the world works, and it’s even harder in Ethiopia.

I’m also a numbers person — computer science and mathematics — and when I look at the data, it’s shocking.

So we deliberately reach out to women-led ventures, because they’re less likely to reach out the same way others do, due to social norms, networks, and other disadvantages.

And you’d be surprised — many have amazing ventures. And they often repay debt at better rates than men-led ventures.

Andy Field (Host): I wouldn’t be surprised at all.

Let’s talk about regulation. Ignite operates within Ethiopia’s regulatory realities. What has that experience taught you about working constructively with regulators?

[00:21:00]

Meseret Warner (Guest): It’s essential. Especially where there isn’t a clear crowdfunding framework.

Most African countries don’t have dedicated crowdfunding regulations. Some platforms operate through existing financial regulations — but crowdfunding is different. It needs its own framework.

So you must bring regulators with you.

In Ethiopia, the Capital Market Proclamation came out in 2021 — and I was engaged from day one. When the regulatory sandbox opened for innovative financial systems, we applied like anyone else, and we’re still working with them.

We also worked hard to stay compliant by design. We registered the company in the U.S. and comply with U.S. regulatory requirements, and we also operate within the open rules available in Ethiopia — for example, foreign indirect investment pathways.

If you’re not compliant, you can be shut down overnight — and cross-border investment is already complex. Without regulatory support, it becomes impractical and unscalable.

We genuinely believe in the opportunity. Over $100 billion comes into Africa as remittances each year — and diaspora already invest, just not always through structured channels.

That’s why partnerships matter — like GIZ, and we’re also partnering with the African Development Bank. If we prove the concept and scale it, we can expand into other African countries.

And there’s progress: the Ethiopian approach is increasingly to say, “Tell us what you’re doing — and let’s see how it can become a regulated solution,” rather than simply saying no.

That openness matters — and you get there by engaging them consistently.

Andy Field (Host): That makes sense. And I imagine that’s part of why GECA resonated with you, and why you joined the Steering Committee — access to people and insights across the globe that can help the work in Ethiopia.

[00:26:00]

Meseret Warner (Guest): Absolutely. When I heard about GECA, I thought: “It’s about time.”

We need standards.

High-net-worth individuals and accredited investors can invest anywhere — Dubai, China, South America, the U.S. — no one stops them. But for crowdfunding, regulations are so restrictive and fragmented.

So if you’re a retail investor and you want to invest $100 into your home country legally and transparently, it becomes extremely difficult.

That’s why coordination matters. Even a little harmonisation would make a huge difference — like how global systems such as SWIFT enable coordination.

We’re not asking for identical regulation everywhere — but some baseline alignment could unlock opportunity and democratise access to investment.

That’s what crowdfunding was meant to do: give startups and SMEs access to capital when they can’t access venture capital — and allow communities to back them.

Andy Field (Host): Exactly. So what gives you the most optimism right now about the future of global crowdfunding?

[00:30:00]

Meseret Warner (Guest): We’re making progress — real progress.

Look at the UK: crowdfunding has raised billions. Those success stories open doors and push policymakers to catch up.

And it’s been incremental — but meaningful. In the U.S., under the JOBS Act, it started with under $1 million and low individual limits. Now it’s up to $5 million. Those improvements happen because impact is visible.

SMEs and startups create the majority of jobs — over 60% in most economies. If you give them access to finance, they lift the economy and everyone benefits.

So yes: incremental progress gives me hope.

Andy Field (Host): I couldn’t agree more. Meseret, this has been fascinating. Before we finish — where can people follow you and learn more about Ignite Investment?

[00:32:00]

Meseret Warner (Guest): Absolutely. Our platform is igniteinvestment.com. People can visit and see companies raising, and we have a video showing how it works.

I’m also very active on LinkedIn — that’s the best place to find me and follow our work. We have an office in Ethiopia, and a registered company in the U.S.

And of course, through GECA as well.

Andy Field (Host): Brilliant. Thank you.

Meseret, thanks so much for sharing your story and insights today. Your work is a huge reminder that equity crowdfunding isn’t just about technology or regulation — it’s about unlocking opportunity, building ownership, and creating pathways for capital to flow more efficiently to the people and ideas that need it most.

Conversations like this are exactly why GECA exists: to bring together diverse global perspectives, challenge fragmented thinking, and help shape a more connected and inclusive equity crowdfunding ecosystem.

Thank you, Meseret — and we’ll speak again soon.

And to our listeners: thanks for tuning in. Stay with us for future episodes as we continue to explore the people, the policies, and the platforms unlocking crowdfunding without borders.

Don’t forget to follow GECA for more conversations with the people shaping the future of global equity crowdfunding.

And visit thegeca.org to learn more about our mission, our growing global supporter base, and how you can get involved.

Thanks, Meseret — and thanks everyone for listening. We’ll see you next time.

[End of Transcript]

Unlocking Cap Table Value: Post-Raise Investor Activation with Joey Hayes | GECA Podcast

Unlocking Cap Table Value: Post-Raise Investor Activation with Joey Hayes | GECA Podcast

Most founders celebrate when they hit their funding goal. Then communication drops off a cliff. What if the biggest asset you gained wasn’t the capital – but the community of 500+ investors sitting in a spreadsheet you’ve never opened?

Join Andy Field in conversation with Joey Hayes, founder of THRU and investor in 65+ startups, as he reveals why post-raise investor activation is crowdfunding’s most overlooked opportunity. Joey shares how he discovered that roughly 10% of any cap table can significantly impact business growth – if founders know how to ask.

From his failed first business Mac Shack to building a platform that transforms passive backers into active growth partners, Joey breaks down why founders struggle post-raise, how to identify high-opportunity investors, and the one thing every founder should do tomorrow if they haven’t communicated with investors in 30 days.

Key insights:

- Why engaged investors are 3x more likely to reinvest

- How 20-25% of investors will actively help – if asked properly

- The difference between broadcasting to 500 people and activating the right 50

- What platforms should do differently to support post-raise engagement

- How AI will transform founder-investor relationships in the next 2-3 years

Capital raises companies. Activated communities build them.

Share this article

[00:00:00] Welcome to the GECA Podcast, powered by the Global Equity Crowdfunding Alliance. Dive into the realm of borderless equity crowdfunding, where we bring the world’s top experts and industry leaders directly to you – discussing innovations that are redrawing the boundaries of finance. Ready to expand your horizons?

Here’s your host, Andy Field.

Andy Field (Host): Hello everybody, and welcome to the GECA Podcast. Today we’re diving into a part of the equity crowdfunding and startup journey that’s often overlooked—and it’s actually quite important—and that’s what happens after the raise.

So my guest today is Joey Hayes. Joey’s an entrepreneur, investor, and the founder of THRU—that’s T-H-R-U—a company focused on helping founders unlock the real value hidden in their cap tables.

Joey’s career began in global commercial roles at companies like IHG, Hyatt, Hilton, and Booking.com before he made the leap into entrepreneurship and investing. In 2021, he launched the first of his bootstrap businesses, Mac Shack. This was a journey that sparked one of the most important insights of his career.

He’s spoken about that many times—and that is: for many founders, isolation and underutilized investor support can be just as dangerous as a lack of capital.

Looking across his portfolio of more than 65 startup investments, Joey noticed a recurring pattern: founders raising money successfully, but then struggling to engage and leverage their investors once the campaign ended.

And what followed was the creation of THRU. THRU is a platform—and a philosophy—built around turning passive backers into active contributors to growth.

Now at GECA, we often focus on how to raise capital more efficiently across borders. And Joey is going to remind us that raising capital is just the beginning—and what founders and platforms do next may matter even more.

Today we’re going to explore how investor engagement really works, why so much value remains untapped, and how activating those communities could reshape the future of equity crowdfunding.

Joey, it’s great to have you with us. Welcome.

[00:02:00]

Joey Hayes (Guest): Beautifully said, Andy. Thank you so much.

Andy Field (Host): No problem. And Joey’s actually based in Amsterdam today. I’ve got a big woolly jumper on here—it’s pretty cold. Hopefully it’s not too bad for you where you are.

Joey Hayes (Guest): I find if I wear summer gear, I feel warmer. So that’s my strategy.

Andy Field (Host): No, that’s a good one. That’s a good one.

Joey Hayes (Guest): Right there with you.

Andy Field (Host): Fantastic, Joey. Let’s get right in. You’ve worked across global hospitality and tech giants. What first pulled you into startups and investing?

[00:03:00]

Joey Hayes (Guest): Yeah, so my interest in crowdfunding actually started when I was in grad school. I was at NYU, studying sustainable real estate development, and I was able to do a project on the first crowdfunded skyscraper in Bogotá.

It was a project that I really dove into, and I loved it. I became really interested in crowdfunding then.

Then later, when I moved to Amsterdam during COVID, I got really into crowdfunding again—it became my little obsession, my COVID obsession. While people were buying on Amazon, I was investing small-ticket amounts in companies, for better or for worse.

But I really got into the crowdfunding space and investing in startups. Then I started my own business—my first business—Mac Shack, my restaurant.

After that, I started joining a lot of founder communities, both online and in person. That’s really when I started to love what these communities were about—how helpful they were—and how interesting it was to understand the whole entrepreneurial journey.

And that’s what kind of got me obsessed with trying to help founders make it easier for them.

Andy Field (Host): Yeah. Okay—so going from corporate to becoming the founder, and investor at the same time—how did that shape how you see the ecosystem today?

[00:04:00]

Joey Hayes (Guest): Yeah, it was—like you said in the intro—starting a business was quite a lonely journey, but it didn’t really have to be.

It was fun and fulfilling, but what I found was that there was all this support around me. For example, I would get out of work, then go to my restaurant and start working on all the problems that a restaurant has.

I was in charge of the business side. My partner was involved in the operations and the cooking. And I would sit there and bake in my problems, for lack of a better word, and just try to determine who in my support network was there to help me.

And I realized there was a lot of—not conflict—but friction between knowing I needed help, and actually getting that help from the people around me.

That got me into: one, getting better at entrepreneurship and realizing that asking for help is actually a huge part of being a successful entrepreneur.

And two, it’s a skill a lot of people don’t have in general—but a lot of entrepreneurs don’t have it because we just want to do it all ourselves.

So that made me a bit obsessed with trying to help myself get better help from the people around me—and then help others do that too.

And when I was determining what kind of company I wanted to start, I struggled with it for a while. Then one day I was like: crowdfunding.

I looked at my portfolio and thought: none of these founders—none of these startups—have ever really asked me for help.

Andy Field (Host): Even someone who’s got an active interest in the business.

[00:06:00]

Joey Hayes (Guest): Yeah—someone with an active interest.

Actually, I have an interesting story for you, Andy. I was at a hospitality tech conference in Paris, and one of the founders I invested in was there—one of the best startups I invested in. I was really excited to meet him. His name was Luca.

I went up to him after his talk and said, “Hey Luca, I was an investor in your Wefunder campaign a little over a year ago.”

And he was like, “Oh man, that’s so great.” Then he said, “What the hell are you doing here in Paris at this hospitality tech conference?”

And I said, “I work for Booking.com.”

His eyes lit up and he was like, “You work for Booking? I’ve been looking for a Booking.com contact for months now.”

And I’m like, “Luca—I’ve been on your cap table for over a year. My bio says that, my LinkedIn says that.” And he’s a super dialed-in founder—very dialed in.

So I thought: if he’s missing it, everyone’s probably missing it.

And the more founders I spoke to, the more I noticed this wasn’t something they really planned for. After the raise, cap tables collect all this money—but post-raise, it becomes a void.

So that’s when I decided this is something I could really help with in the crowdfunding ecosystem, but also just with startups and founders in general.

Andy Field (Host): So it’s about your experience with Mac Shack. I know you’ve spoken about that not really working out so well. Can you give a bit more insight into what that period taught you about being a founder? You’ve already mentioned isolation, and the fear of asking for help. Did you recognize absolutely that you needed help?

[00:07:00]

Joey Hayes (Guest): Oh, absolutely. I recognized that. I think everyone needs help. It was a matter of determining how to ask for help, when to ask for help, and who the best person was to help.

That’s what I really struggled with—cutting through all the noise.

A lot of times, by the time I asked for help, I was in the red zone. I’d already tried everything else, and then you’re asking in a sea of panic—and that’s never nice for either person.

So I learned to be more proactive: understand what you need help with, why, and when. Then go to that person and say, “Hey, I really need help with this.”

And try not to do it in panic mode—where you put pressure on them.

One thing I learned is: when you’re asking someone for help, you have to make it as easy on that person as possible.

Also—this was a mindset shift—someone told me (and I forget who), but: when you don’t ask for help, you don’t give someone the opportunity to help you.

So when you don’t ask, you’re actually taking something away from them. That changed everything for me.

Andy Field (Host): Yeah, that’s a great way of looking at it. And I think entrepreneurs by their very nature are probably not the best people in the world to automatically ask for help. They like to think they understand their own business and nobody knows it better—and of course they don’t.

But there’s no harm and no shame. It can only be an advantage—getting the right people to help with the right problem.

How different do you think your journey with Mac Shack might have been if you’d had stronger engagement from people helping you?

[00:09:00]

Joey Hayes (Guest): It would’ve been a lot different. Honestly though, I don’t think it would’ve succeeded either way.

Andy Field (Host): Oh, okay.

Joey Hayes (Guest): Because it wasn’t the right business for me. It was a really great first business, but in the end it wasn’t. Even if it did succeed, I think I would’ve been pretty miserable, to be honest with you.

But I think my takeaways from that are exactly what was supposed to happen—and it was supposed to lead me onto this.

There are a lot of people out there in similar situations, where they have businesses that are struggling—or they’re struggling—and they don’t know how to capitalize on the networks they have, whether it’s investors, friends, or family.

Where I think this is most beneficial is crowdfunding, because you have hundreds or thousands of people who are literally invested in your business—and they’ve already given you the money, Andy. That’s the hard part, right?

Andy Field (Host): That’s right—they bought into you.

[00:10:00]

Joey Hayes (Guest): Exactly. Asking them to share a referral code or intro somebody—that’s probably the easy part.

And a big part of it is riding the momentum of the raise. You come off the raise and everyone’s excited—especially if you hit your target—and then communication drops off a cliff.

Momentum is so important in business, in everything. If you can continue that momentum after the raise and capitalize on the knowledge and skills of your investors, you’ll be more successful, keep them engaged, and overall build a better business.

Andy Field (Host): That makes perfect sense. So moving on to what you’re doing with THRU now—why do you think founders struggle so much with activating their investors after the raise? Is it that crowdfunding is seen as finished once the capital has been raised?

[00:11:00]

Joey Hayes (Guest): A couple things.

One is: they’re exhausted. The raise is exhausting—often more work than they expected. By the time it’s over, they’re relieved and want to get back to building their business, which is fair.

Another part is: they don’t plan for the post-raise. There’s so much planning for the raise itself, and post-raise gets kicked down the road.

Also, they often don’t have the people for it. The founder or CEO ends up doing it, and after the raise they want to do something else. If they don’t have a community manager (which I think is so important), it’s hard.

It’s mostly lack of planning, exhaustion, and lack of strategy. There aren’t many people focused on post-raise. Most firms and consultancies focus on the raise itself.

So it’s a lack of support—and those things combined make the transition difficult.

Andy Field (Host): And what sets crowdfunding companies apart—in a positive way—is they’ve got this marketing asset: a community of people who’ve already bought into the business. They’ve actively invested, so they believe in the story.

Approaching them and activating them can only be beneficial—they’re ready-made ambassadors.

[00:13:00]

Joey Hayes (Guest): Exactly. If you go up to any company and say, “I’ll give you 1,000 people who want to help your business grow—who are truly invested in you succeeding,” they’d say, “Oh my God—give me the names, give me the emails.”

And you already have them.

Another interesting part is: founders don’t realize that often the people investing in them are in the industry themselves. It resonates with them because they understand it.

Like, I tend to invest in hospitality companies and hospitality tech because that’s my field. A lot of founders will find, when they look through their cap table, that many investors are in the same industry—and are in a great position to help.

Andy Field (Host): So their main driver may not be a set return within a certain timeframe—it could be genuine interest and expertise, which makes them well-placed to help.

You mentioned patterns across 65+ investments. What kept repeating?

[00:15:00]

Joey Hayes (Guest): Some founders were good at the engagement piece—maybe about half. They kept investors informed by adding them to marketing emails or posting monthly updates on Wefunder, StartEngine, etc.

But hardly any were meeting the activation piece—and many didn’t have the mindset that investors are a growth channel. They see them as a source of capital, then it’s a hard stop.

I was talking to a founder the other day with 3,000 investors. He said, “Joey, I don’t know why we didn’t think of this. Why don’t we do more with these evangelists who can amplify our marketing? Refer customers? Intro partnerships?”

It’s never seen through a commercial lens—only through a capital-raise lens.

Also: engaged investors are about three times more likely to reinvest.

A lot of founders put too much emphasis on what to say. They overthink it. Sometimes they say they have nothing to say.

But people just want to know what’s going on. The worst thing is silence.

There’s a lot of underthinking and overthinking—not much middle-ground thinking.

Andy Field (Host): And you’ve answered my next question: the biggest misconception about the cap table is that it’s “just investors,” when actually it’s a whole group of ambassadors with aligned incentives.

[00:18:00]

Joey Hayes (Guest): Exactly. Even on the capital front—you should look at your investor base as a way to get more investors, even institutional investors.

When we go through cap tables, we see retail and accredited investors who work for investment firms and literally say, “Reach out if you’re looking for more capital.”

Wefunder does a good job collecting bios and asking investors during checkout what they can do to help—but it’s mostly ignored.

Because it’s intimidating: you download a spreadsheet with 500 investors and think, “I’m not sifting through this.” So it goes in a drawer.

What we do is sift through it for you. We determine who’s best suited to help and who’s willing.

We use platform data and our own co-created survey with the founder. The survey also helps identify who’s extra motivated—because they actually fill it out.

We’re seeing around 20–25% of investors take that step, and about 10% become high-opportunity investors who could do something significant for the business.

Andy Field (Host): That’s interesting. So how does THRU do things differently from typical investor relations tools?

[00:20:00]

Joey Hayes (Guest): We don’t have our own platform. The last thing anyone needs is another platform.

We ask for access to the backend of whatever tool they use so we can download reports. We co-create the survey using whatever tool the startup prefers—Google Forms, Jotform, etc.

We take the data, use AI plus manual lookup, and cross-reference it with the founder’s goals.

Then we produce a simple report—usually a Google Doc—with recommendations and insights, and we go through it together to decide next steps.

We also segment investors by industry, by engagement level, and by preference: “Do you want to be supportive, active, or silent?” We don’t want to bother people who don’t want to engage.

A useful insight we often uncover: who in the investor base is already a customer. Many founders have no idea. If 30% of your investors aren’t customers, you can run a targeted campaign to convert them—often with good success.

We also help with outreach strategy. A lot of times you don’t lead with “Can you help me?” You start with advice: “Based on your background, how would we break into this industry?” People love giving that advice—and then you build a relationship.

Ultimately, it’s about nurturing high-value opportunities in your cap table.

Our next phase is productizing this: understanding the founder’s tech stack, detecting opportunities and challenges in real time, ranking which investors can help, and reducing friction from “I need help” to “I’ve asked for help,” even drafting communications to support the process.

Andy Field (Host): That’s pragmatic. But even when founders want to do this, they can be limited by resources, money, and energy. Where do you get stuck when engaging investors?

[00:24:00]

Joey Hayes (Guest): Sometimes people say a lot and then don’t respond—and that’s okay. We usually give it three attempts, and then we move on.

Long-term, it’s valuable to understand who really is founder-focused—who wants to help versus who just says they will.

Also, don’t email-blast your whole cap table. Take the top 20 and do dedicated, personalized outreach. Call them out respectfully: “On the survey you said you were willing to help with this—I’m reaching out.”

And have a specific ask. Don’t say, “I need intros to the luxury hospitality market.” You’ll get crickets. Find the right people and ask specific questions.

If you get them on the phone, have an agenda—don’t waste their time or yours.

One founder told me, “Joey, this is great, but it’s overwhelming.” So we prioritized: for example, start with someone who invested 25,000 rather than 500. That’s not always right, but we learn as we go.

We also enrich the data with manual LinkedIn research to make it more robust and increase chances of success.

Andy Field (Host): If I was an investor and the founder approached me that way, I’d see it as proactive—trying to make my investment work.

So how should platforms support post-raise activation? Is it more platforms collecting the right data—or is there more they can do?

[00:28:00]

Joey Hayes (Guest): More platforms should do it, yes—offer templates for monthly investor updates, reminders to send updates.

KingsCrowd just launched a free investor relations tool—things like that help.

But the key is education: move investor engagement from a chore or compliance issue into something profitable. Founders need that mindset shift: “You will lose money if you don’t do this.”

Crowdsourcing support is one of the biggest reasons founders choose crowdfunding—so not capitalizing on it is a waste.

As an industry, we haven’t done well enough at that. We need stewardship—everyone pushing the same narrative.

We’ve spent the last 10 years building access—more investors, more founders. Now we need the next phase of professionalization: post-raise retention and investor experience, so investors come back. We’ve lost a decent amount of people along the way.

Andy Field (Host): And we always come back to education in these conversations: the work doesn’t end when the raise ends.

Looking ahead—how do you see founder–investor relationships evolving over the next five years?

[00:30:00]

Joey Hayes (Guest): I’m hoping AI and automation play a bigger role—that’s what we’re banking on at THRU.

Detect opportunities and challenges, match them to the cap table, and identify who can help.

Also, AI can help with the “chore” work: meeting notes, monthly summaries, drafting updates—so it’s less daunting.

I’m very clear: you need engagement before activation. And you can’t ignore the rest of the cap table. It’s the 80/20 rule: focus on the top 20%, but still communicate broadly.

I think platforms will do more—we’re already seeing it. There may be legislation in the US increasing the amount companies can raise.

But overall, the experience of both investor and founder needs to improve. I hope it only gets better from here: crowdfunding grows, people have better experiences, they come back, and they tell friends and family.

Andy Field (Host): Perfect. So to sum up: if founders listening today could change one thing tomorrow about how they operate post-raise, what would it be?

[00:33:00]

Joey Hayes (Guest): I’d ask: when’s the last time you reached out to your investors? And what do you know about your investors—your cap table?

If someone asked you, “How do I get an X, Y, Z introduction?” would you know who to go to on your cap table? Do you know who’s on there?

So: one, look at your investor insights. Two, look at when you last communicated.

If you haven’t communicated in more than 30 days—do it. There’s really no bad communication. Even saying, “We’re building a communication strategy, and here’s what you can expect,” is fine.

Just say something.

Andy Field (Host): Great. To finish—where can people learn more about THRU and your work? And do you work globally?

[00:34:00]

Joey Hayes (Guest): Yeah—we’ll work with anybody.

We’ve focused mainly in the US because we just started, and I’ve been focusing on my investments, but we’re scaling. Anyone around the world—we’re happy to help.

LinkedIn is the best way to reach me—maybe you could put the link in the show notes. And also our company page.

Our website is: https://www.comethru.co/

There’s a “Request early access” button that goes straight to me. We’ll determine if it’s the right fit.

And like I said—we’re consulting, and it’s just me right now, so there is some bandwidth limitation. But we’re trying to help as many people as possible.

Reach out, and we’ll determine the best way to help.

[00:35:00]

Andy Field (Host): Fantastic, Joey. Thanks so much. It’s a really powerful—and practical—conversation.

What really stands out is the reminder that capital alone doesn’t build great companies. It’s the people who do that.

And when founders learn how to truly activate their investor communities, they unlock not just funding, but momentum, insight, and advocacy.

And for GECA, this is a crucial part of the puzzle. Building better cross-border markets isn’t only about regulation and platforms—it’s also about what happens inside each cap table once the raise is complete.

Thanks again, Joey. That was a fantastic conversation. We’ll be sure to connect people with you who like what you’re doing.

Joey Hayes (Guest): Thank you, Andy—and thank you for everything you do for the industry and with GECA. I’m excited to work with you moving forward, and I really appreciate you giving me the opportunity today.

Andy Field (Host): No problem at all. And to our listeners—thanks for tuning in. Stay with us for future episodes as we continue to explore the people, the policies, and the platforms that are unlocking crowdfunding without borders.

Don’t forget to follow GECA for more conversations with the people shaping the future of global equity crowdfunding. And visit thegeca.org to learn more about our mission, our growing global supporter base, and how you can get involved.

Thanks everyone, and we’ll see you next time.

[End of Transcript]

GECA 2025 Year-End Update: From Belief to Global Movement

Building the Future of Borderless Equity Crowdfunding

A message from Andy Field, GECA Steering Committee Executive Lead

What began as a shared belief that “collaboration is key” has grown into a genuinely global movement. 2025 was our foundation year and what a foundation we’ve built together.

By the Numbers: 2025

Think Tank Roundtables: 5 (Architects of Change series)

Steering Committee: 7 → 15 members (+114%)

Global Reach: 4 continents (2 more in discussions)

Supporter Base: 40 → 80+ organizations (+100%)

Podcast Episodes: 12 released (GECA WorldView)

Major Events: 2 USA conferences + 2 global panels

Key Milestone: Manifesto published

From a core group to a truly global think tank- in just 12 months.

What We Accomplished in 2025

- Grew the Alliance

Our Steering Committee expanded from 7 to 15 members, now spanning four continents — with conversations already underway to bring representatives from two more regions into the fold.

Our supporter base more than doubled: from 40 to 80+ organizations and individuals who share our belief that equity crowdfunding works best when we address regulatory, technological, and cultural borders together — not in isolation.

- Launched Architects of Change Think Tank Series ⭐

Our flagship initiative for 2025: a series of five high-level roundtable discussions bringing together the brightest minds in global equity crowdfunding.

The Series:

- “Breaking Down Borders: How Platforms Can Enable Global Deal Access and Visibility”

- “Beyond Borders: Learning from EU ECSPR to Build Global Crowdfunding Passports”

- “Regulation as Rocket Fuel: How Smart Compliance Drives Platform Growth”

- “The $1 Trillion Opportunity: Building Liquidity Through Innovation”

- “The Conversion Code: What Actually Moves Global Investors from Interest to Investment”

What made it transformational:

These conversations were strategic deep-dives that shaped GECA’s policy framework. We convened platform CEOs, innovators and thought leaders from across the globe to tackle the hardest questions facing cross-border equity crowdfunding.

The impact:

- Formed the foundation for our 2026 Whitepaper (releasing Q1)

- Created working groups on key challenges identified in the series

- Generated McKinsey-style strategic analysis articles

- Established GECA as the authoritative voice on borderless crowdfunding

This series proved that collaboration produces solutions — and positioned GECA as the think tank driving the future of our industry.

- Built Industry Relationships & Representation

We forged strong partnerships with professional and industry bodies including EDFA and CfPA, amplifying GECA’s voice in critical regulatory discussions.

We represented GECA across multiple platforms:

- Two USA conferences (Supercrowd LA — Los Angeles and the CfPA Summit — Washington DC)

- Appeared on major global online panels

- Took part in numerous industry discussions worldwide

These engagements validated GECA’s mission and built the relationships that will enable real progress in 2026.

- Established Thought Leadership

Published our Manifesto — articulating GECA’s vision for collaborative, compliant, global equity crowdfunding.

Launched 12 podcast episodes — the GECA WorldView podcast featuring voices from across the ecosystem, exploring challenges and solutions.

Delivered Architects of Change series — our most ambitious initiative, from which we learned enormously and were honored to host so many influential voices.

Looking Ahead: 2026

We’re heading into 2026 with real momentum.

The Architects of Change Think Tank Series generated incredibly valuable insights, helping us to create a roadmap and sparking global collaborations that will transform our industry.

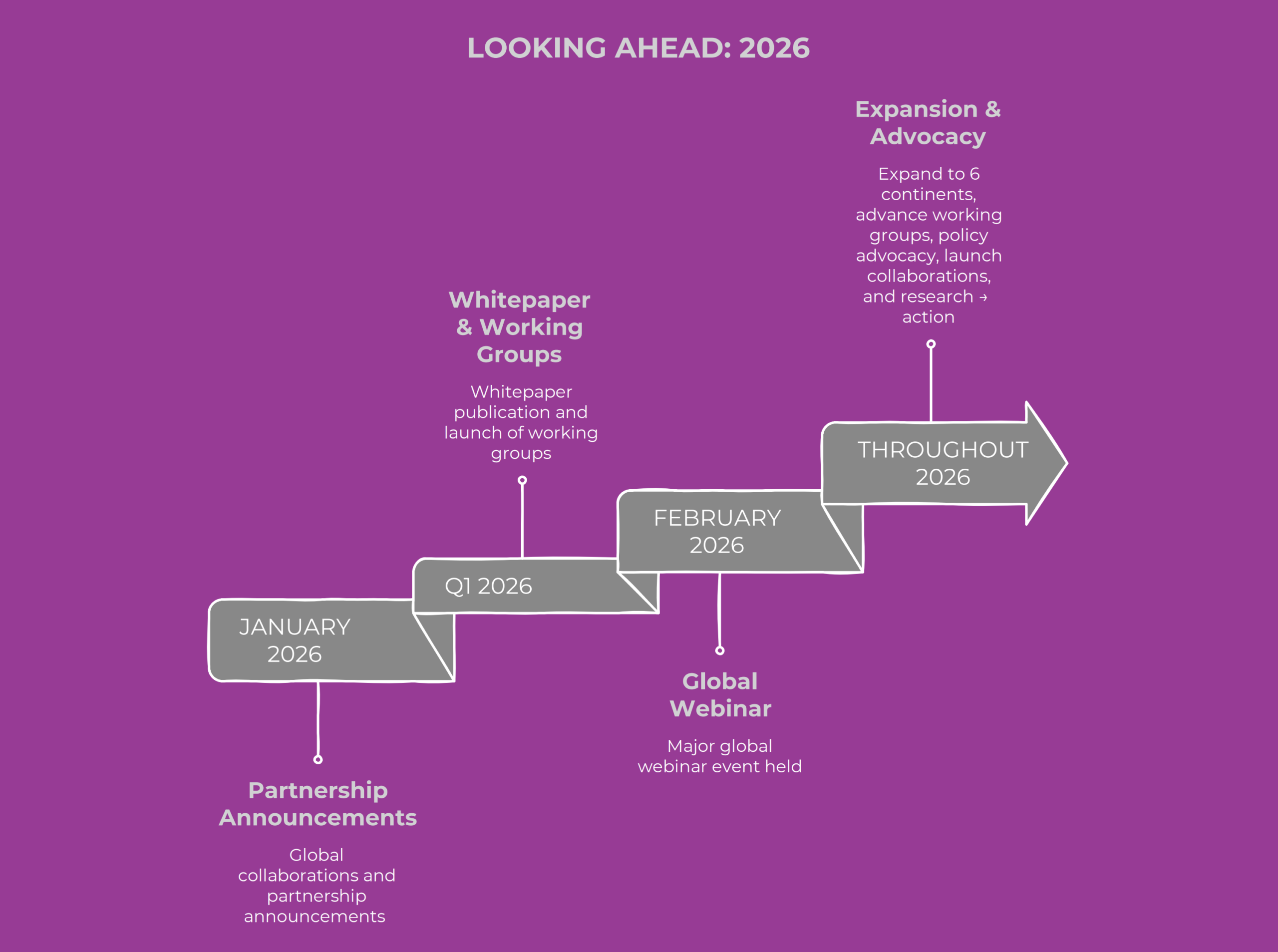

January 2026:

→ Partnership announcements — exciting global collaborations that will advance GECA’s mission (stay tuned!)

Q1 2026:

→ Whitepaper publication — distilling learnings from Architects of Change into a comprehensive framework for global equity crowdfunding infrastructure

→ Working groups launch — tackling specific challenges identified in the Think Tank series

February 2026:

→ Major global webinar — bringing together platforms, regulators, and innovators to chart the path forward (details coming soon)

Aims Throughout 2026:

→ Expand Steering Committee to 6 continents

→ Advance infrastructure working groups

→ Strengthen policy advocacy based on Think Tank findings

→ Launch collaborative initiatives with global partners

→ Turn 2025’s research into 2026’s action

2025 was about understanding the challenges.

2026 is about building the solutions — together.

The announcements coming in January will show just how serious we are about making borderless equity crowdfunding a reality.

To every platform operator, regulator, innovator, and supporter who joined us this year: thank you. Your support is really helping to build a movement.

What we’ve achieved together in 2025 is remarkable. What we’ll accomplish in 2026 -with the collaborations we’re announcing in January — will be transformational.

I hope you have a peaceful and happy festive break.

The announcements are coming. The work continues. The future is borderless.

Here’s to 2026.

Andy Field

GECA Steering Committee Executive Lead

Join the Global Crowdfunding Movement:

- Learn more about GECA: thegeca.org

- Become a member: thegeca.org/membership-app-form

- Follow GECA: LinkedIn | Twitter | Medium

The Global Equity Crowdfunding Alliance (GECA) works toward creating a truly borderless global equity crowdfunding ecosystem through industry collaboration, regulatory alignment, and international knowledge sharing.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Frequently Asked Questions

What is GECA?

GECA (Global Equity Crowdfunding Alliance) is a global think tank and industry

alliance uniting equity crowdfunding platforms, regulators, and innovators to

enable compliant cross-border investment. Founded in 2024, GECA now spans 4

continents with 80+ member organizations.

What did GECA accomplish in 2025?

GECA's 2025 achievements include:

- 5 Think Tank roundtables (Architects of Change series)

- Steering Committee growth from 7 to 15 members (+114%)

- Membership doubled from 40 to 80+ organizations (+100%)

- Expansion to 4 continents (Europe, North America, Africa, Asia)

- 12 podcast episodes released (GECA WorldView)

- Published industry Manifesto

- Engaged at CfPA Summit and major global events

What is the Architects of Change Think Tank series?

The Architects of Change series is GECA's flagship initiative: 5 intensive

roundtable discussions bringing together platform CEOs, regulators, and

innovators to tackle cross-border crowdfunding challenges. The insights from

this series form the foundation of GECA's 2026 Whitepaper and working groups.

How many countries does GECA operate in?

GECA has active representation across 4 continents with 15 Steering Committee

members and 80+ member organizations spanning Europe, North America, South America, Africa,

and Asia.

What is GECA's mission?

GECA's mission is to unite platforms, regulators and innovators globally to

enable compliant cross-border equity crowdfunding through collaboration,

standards, and policy advocacy.

What is GECA announcing in 2026?

In January 2026, GECA will announce major global partnerships. Q1 2026 brings

the Whitepaper publication and working groups launch. February 2026 features

a major global webinar bringing together platforms, regulators, and innovators.

Who can join GECA?

GECA membership is open to equity crowdfunding platforms, regulators,

technology providers, service providers and industry leaders committed to

collaborative, compliant, borderless crowdfunding.

How do I join GECA?

Apply for GECA membership at: https://thegeca.org/membership-app-form/

What is borderless equity crowdfunding?

Borderless equity crowdfunding enables investors to access investment

opportunities across jurisdictions and allows companies to raise capital

globally within compliant regulatory frameworks. GECA convenes stakeholders, is developing frameworks,

and advocates for policies that enable borderless equity crowdfunding

Who leads GECA?

GECA is led by a 15-member Steering Committee spanning 4 continents, including

platform CEOs, regulators, and industry innovators. Andy Field serves as

Steering Committee Executive Lead.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

From Financial Crisis to Crowdfunding Champion: Paul Lovejoy's 366-Day Journey to Democratize Investment

How a $12,000 experiment across 400+ investments is proving that everyday people can build wealth outside Wall Street - and why the future of finance depends on it

By the Global Equity Crowdfunding Alliance

The Investor Who Put His Money Where His Mouth Is

Paul Lovejoy didn't set out to become a crowdfunding revolutionary. In 2008, he was a real estate investor who, along with his family, lost nearly a million dollars when a fraudulent investment scheme collapsed during the financial crisis. The money was devastating to lose. The shame was even worse.

"I didn't just lose my money, it was also my family's money," Lovejoy recalls in a recent episode of the GECA Podcast. "It was a horrible event and it took years for me to recover from just the trauma and get over the shame part of it. I didn't publicly admit that for 10 years."

But what emerged from that darkness was something extraordinary: a mission to democratize access to investment opportunities and build an alternative financial system where regular people, not concentrated wealth, determine what gets funded.

Today, as Principal Investment Advisor at Stakeholder Enterprise - the United States' first investment advisory firm specializing in regulated crowd investing - and 2024 recipient of the Crowdfunding Professional Association's prestigious 'Pay It Forward' Award, Lovejoy has become one of the industry's most prolific advocates. His weapon of choice? A year-long experiment that would change how he - and potentially millions of others - think about building wealth.

The 366-Day Challenge: Investing Every Single Day

In 2024, Lovejoy embarked on what he calls his "Leap Year Portfolio"- investing in crowdfunding opportunities every single day for 366 consecutive days. Yes, even on vacation. ("My wife hated me," he admits with a laugh.)

The parameters were simple but ambitious:

- Total invested: $12,000 over 366 days

- Average per investment: $31.52

- Portfolio allocation: 50% debt, 30% equity, 20% real estate

- Minimum investment: As low as $10

The results? Remarkable.

By the numbers:

- 432 real estate developer loans (only 3 defaults, zero actual losses due to collateral)

- 70+ small businesses supported

- 20+ family farms funded

- 33% cash flow return in just 20 months

- $4,000 returned and reinvested from the initial $12,000

"I wanted to show that you can have a legitimate financial plan without using our public stock markets," Lovejoy explains. "But more than that, I needed to put my money where my mouth is. I needed to really understand what people go through when they make these investment decisions."

The Hidden Power of Extreme Diversification

What Lovejoy discovered through his daily investment practice was transformative: diversification at scale is the ultimate risk mitigation strategy.

Unlike traditional public markets, where three institutional investors control retirement accounts and algorithmic trading concentrates wealth in just seven stocks (the "Magnificent Seven"), crowdfunding enabled Lovejoy to spread tiny investments across hundreds of opportunities.

"Some of these short-term real estate loans, I can do a $10 minimum and they would split that $10 into a dollar into different loans," he explains. "The diversification of that - you can't beat that in our public markets."

This extreme diversification proved remarkably resilient. Out of 432 real estate loans, only three defaulted - and because the loans were backed by actual property, Lovejoy didn't lose any money. The platforms were able to take control of the houses and recover the investments.

"This is investor protection right here," Lovejoy emphasizes. "Diversification, not restrictive regulations, mitigates risk."

Technology as the Great Equalizer

One of Lovejoy's most surprising discoveries was how accessible due diligence has become for everyday investors - thanks to technology.

Yelp for Due Diligence: "I discovered Yelp is a fantastic place to do due diligence," Lovejoy reveals. "You can see right away if a business just put up their Yelp page - huh, suspicious. Or if they had this Yelp page for five years with five-star reviews. There's a lot that you could see as just a regular person very easily."

AI as a Reading Assistant: "With AI coming into play, it can read these large documents very easily. You can copy text and put it into an AI and have it read for you. That is a huge help because that's really what AI is best at - reading through documents. It's either in the document or it's not. There's no opportunity to make stuff up."

This democratization of information challenges the fundamental premise behind accredited investor restrictions—that only wealthy individuals have the sophistication to evaluate private market investments.

"You don't have to be sophisticated to do this," Lovejoy insists.

The Problem with SAFEs (And Why Crowdfunding Needs Its Own Instruments)

Through his extensive experience, Lovejoy identified a critical flaw in how the crowdfunding industry has developed: we're using investment instruments designed for a completely different ecosystem.

The SAFE (Simple Agreement for Future Equity), invented by Y Combinator for their Silicon Valley incubator, has become the default instrument for equity crowdfunding. But there's a problem.

"It was perfect for their ecosystem because they're the ones doing the valuation in the next round," Lovejoy explains. "The SAFE protects the founders and it doesn't really protect investors all that much, but it didn't matter to Y Combinator because they're the ones that were gonna set the terms the next round."

But in crowdfunding? "Nobody knew what they were doing in our industry. What are we gonna use? Let's use Y Combinator's SAFE. No one thought, 'Hey, what works best for a crowdfunding industry?'"

Lovejoy's solution: We need investment vehicles specifically designed for investment crowdfunding, not borrowed from incubators. He also advocates for alternative exit strategies beyond IPOs and mergers - like dividends and stock buybacks - that provide more predictable returns for retail investors building long-term wealth.

The Real Impact: Beyond Returns

While the financial returns are compelling, what struck Lovejoy most was the real-world impact his investments were making.

One company he invested in three times, Ovanova, dropped everything when a hurricane devastated a small mountain town in North Carolina. They arrived with chainsaws, cleared roads, and set up a solar microgrid that powered the general store for 47 days - becoming a literal lifeline for the community.

"I'm seeing my small investments go to this company and now they're literally sending a lifeline to these people devastated by this disaster," Lovejoy reflects. "That was like real impact."

He invested in family farms building micro solar grids, earning 10% returns while supporting renewable energy. He funded clean energy projects and climate tech startups. He backed local small businesses creating jobs in their communities.

"It's this awesome situation where I'm helping this family farm build a micro solar grid on it, and I'm getting a 10% return," he says. "To me, it's really hard to beat."

Paying It Forward: A Philosophy of Enlightened Self-Interest

Lovejoy's recognition with the CfPA's 'Pay It Forward' Award reflects a philosophy that drives all his work: accepting responsibility for problems you didn't create because it's in your enlightened self-interest.

Drawing from his competitive water polo background, he explains: "My coach said, 'While you guys were being reactive, they were being proactive.' They're not thinking, 'We need to stop them from scoring.' They're thinking, 'When we get the ball, I'm gonna be swimming down, beating my guy to score.'"

This proactive mindset extends to systemic change.

"When inequality deepens, social cohesion collapses," Lovejoy observes. "People turn on each other instead of questioning the systems exploiting them. Furthermore, when people are stripped of opportunity and dignity, that's when crime and violence rise."

His conclusion: "Yes, it is in your self-interest, but you almost have to think of it as enlightened self-interest that it benefits me to have an economy that looks out for the wellbeing of others and our planet."

Building Alternative Financial Infrastructure

For Lovejoy, the crowdfunding movement represents something far more significant than a new investment class - it's the creation of entirely new financial infrastructure.

"The people who are involved, we are literally creating a brand new infrastructure for an alternative financial system," he emphasizes. "It's not one where large institutions or concentrations of wealth determine what gets built, what gets funded. It's people."

This infrastructure is being built through:

- Platform innovation enabling $10 minimum investments

- Regulatory frameworks like Regulation Crowdfunding creating legal pathways

- Technology democratizing due diligence and access

- Community connecting investors who care about impact with founders building solutions

"We get to build that infrastructure where no one is too big to fail, essentially," Lovejoy says. "I just wouldn't wanna be in any other space. It's such a huge opportunity. Generational."

Designing Out Fraud: A Circular Economy Approach to Regulation

When asked about the path to true cross-border crowdfunding, Lovejoy offered an innovative perspective borrowed from environmental design: the circular economy.

"The circular economy concept is you wanna design out waste and pollution in products," he explains. "I think we can apply that in other areas. Why not create systems where we design out fraud and exploitation?"

Rather than simply creating laws to police bad actors after the fact, Lovejoy advocates for designing systems that make fraud unprofitable from the start.

"I think just saying, 'Okay, we need to make laws to kind of police people,' I think that may be a little bit of an outdated perspective," he argues. "We need to take a step back and say, 'If we design this system in the first place, let's make fraud unprofitable. How do we do that?'"

This systems-thinking approach aligns perfectly with GECA's mission to create regulatory frameworks that facilitate cross-border investment while maintaining investor protection - not through restriction, but through intelligent design.

Advice for New Investors: Start Small, Start Now

For anyone new to crowdfunding, Lovejoy's advice is refreshingly simple:

"Start small. Find a $10 or $25 investment if you can. That's the place to start."

He learned more from making his first investment than from weeks of preparation. "It's just practicing. Doing it is gonna teach you. And start small and go through the due diligence. Even if it's a $25 investment, treat it like a $25,000 investment."

His second piece of advice: Start with debt instead of equity.

"You're gonna get returns happening to you a lot quicker. A lot of my investments were in loans, not equity -these were more debt-based. And I gotta tell you, after 20 months since I first started, I've already had a 33% cash flow return."

This cash flow can then be reinvested, creating a compounding effect that builds momentum rapidly.

Advice for Founders: Community First, Always

For entrepreneurs considering crowdfunding, Lovejoy's guidance is equally direct:

"You can't just show up and expect people to invest in you."

The most successful campaigns he observed shared common characteristics:

- Community building before launch (not expecting platforms to do marketing)

- Clear communication about use of funds and exit strategy

- Modeling successful campaigns in similar industries

- Marketing budget planning as part of the raise strategy

- Authentic engagement with potential investors

"You have to plan ahead, get your community involved, plan for a marketing budget, and look at how other people have done it before just jumping in," he advises.

The Crowdfunding Revolution Is Just Beginning

Six months into his daily investment streak, Lovejoy had a humbling realization: "I look back and I was like, 'I wasn't as good as I thought I was.' It's like when you do something every day, there are things that you just see that you didn't before."

By the end of the year, his perspective had transformed entirely. "Now I don't think I'm some great investor. I know that there's a lot more to learn out there, but I am so much better than I was before I started that."

This continuous learning - this willingness to question assumptions and remain humble in the face of complexity - exemplifies the spirit GECA champions in building a truly borderless crowdfunding ecosystem.

The Path Forward: Education, Collaboration, Global Integration

Lovejoy's work intersects perfectly with GECA's mission on multiple fronts:

Education: "The entire ethos of GECA is education," Lovejoy observes. "And it's kick-ass." Whether educating founders about realistic exit strategies, investors about due diligence tools, or regulators about the power of designed systems over restrictive rules - education remains the foundation.

Democratization: Making sophisticated investment strategies accessible to everyone, regardless of wealth, geography, or "accredited" status.

Infrastructure Building: Creating the platforms, regulations, and tools that enable borderless capital flows while maintaining investor protection through design, not restriction.

Impact Alignment: Connecting capital with projects that generate both financial returns and positive social and environmental outcomes.

"I love the fact that you're trying to eliminate borders for crowdfunding," Lovejoy told GECA's Andy Field. "I think that's such a wonderful mission and I'm thrilled to be a part of it."

Conclusion: The Alternative Financial System Is Here

Paul Lovejoy's 366-day journey proves what many in the crowdfunding community have long believed: everyday people can build diversified, resilient, impactful investment portfolios outside traditional Wall Street structures.

His experiment demonstrates that:

- Extreme diversification through small investments works

- Technology has democratized due diligence

- Debt crowdfunding provides reliable income streams

- Impact and returns are not mutually exclusive

- The barriers to private market investing are arbitrary, not necessary

As Lovejoy continues his work through Stakeholder Enterprise and his Crowd Capital Blueprint program, he's not just helping individuals invest - he's helping build the infrastructure for an entirely new financial system.

"This is such a huge opportunity," he concludes. "Generational. It's an amazing opportunity that we all have in this industry."

The question is no longer whether crowdfunding can compete with Wall Street. Paul Lovejoy's 366 days proved it can. The question now is: Will regulators, platforms, and investors seize this generational opportunity to democratize wealth creation globally?

GECA believes the answer is yes. And with advocates like Paul Lovejoy putting their money - and their daily commitment - where their mouth is, the future of borderless, democratized, impact-driven investing has never looked brighter.

Connect with Paul Lovejoy:

- 🌐 Website: stakeholderenterprise.com

- 💼 LinkedIn: Paul Lovejoy

- 📧 Direct message: "Hey, I saw you on the GECA podcast"

Watch the Full GECA Podcast Episode: 🎧 Paul Lovejoy: From Financial Devastation to Daily Investment

Join the Global Crowdfunding Movement:

- Learn more about GECA: thegeca.org

- Become a member: thegeca.org/membership-app-form

- Follow GECA: LinkedIn | Twitter | Medium

The Global Equity Crowdfunding Alliance (GECA) works toward creating a truly borderless global equity crowdfunding ecosystem through industry collaboration, regulatory alignment, and international knowledge sharing.

From Defrauded Investor to Crowdfunding Champion: Paul Lovejoy's 366-Day Investment Journey | GECA Podcast

From Defrauded Investor to Crowdfunding Champion: Paul Lovejoy's 366 Days | GECA Podcast

Join Andy Field for an inspiring conversation with Paul Lovejoy, Principal Investment Advisor at Stakeholder Enterprise and 2024 recipient of the Crowdfunding Professional Association’s prestigious ‘Pay It Forward’ Award. From experiencing devastating financial fraud in 2008 that affected his entire family, to discovering crowdfunding’s transformative potential during COVID, Paul shares his remarkable journey of recovery, learning, and advocacy that led him to become one of the industry’s most prolific retail investors.

In this episode, Paul reveals the insights gained from his unprecedented 366-day daily investment streak – a commitment that saw him invest in over 400 small businesses, family farms, clean energy projects, and community development initiatives, achieving a 33% cash flow return in just 20 months while starting with investments as small as $10. He breaks down his strategic portfolio allocation of 50% debt, 30% equity, and 20% real estate across 432 real estate developer loans, 70+ small businesses, and 20+ family farms, demonstrating how extreme diversification creates built-in risk mitigation that traditional public markets cannot match.

Beyond the numbers, Paul discusses the philosophical framework that drives his work – the concept of “paying it forward” through accepting responsibility for systemic problems you didn’t create because it’s in your enlightened self-interest. Drawing from his competitive water polo background, he explains how proactive thinking and designing systems that eliminate fraud (rather than just policing it) can reshape the entire crowdfunding ecosystem. He offers candid insights into the challenges facing the industry, including why SAFEs (Simple Agreement for Future Equity) borrowed from Y Combinator’s incubator model don’t serve crowdfunding communities well, and why we need investment instruments specifically designed for platform-mediated retail investment.

Paul shares practical advice for new investors – start small with $10-25 in debt instruments, use AI and Yelp for accessible due diligence, and treat every investment seriously regardless of size – and offers crucial guidance for founders on building community before launching campaigns. He discusses how technology is democratizing due diligence, why exit strategies beyond IPOs and mergers (like dividends and stock buybacks) deserve more attention, and how crowdfunding platforms are literally building the infrastructure for an alternative financial system where regular people, not concentrated wealth, determine what gets funded.

Whether you’re interested in impact investing that delivers both financial returns and community transformation, learning how to build a diversified portfolio outside traditional public markets, or understanding how crowdfunding can address inequality while serving your own long-term interests, Paul offers invaluable perspectives from someone who has put his money where his mouth is – 366 days in a row. His commitment to education, transparency, and systemic change exemplifies GECA’s mission of creating a borderless crowdfunding ecosystem that democratizes access to capital and investment opportunities worldwide.

Share this article

GECA Podcast Transcript: Paul Lovejoy Interview

[Intro – GECA Announcer]: Welcome to the GECA Podcast, powered by the Global Equity Crowdfunding Alliance. Dive into the realm of borderless equity crowdfunding, where we bring the world’s top experts and industry leaders directly to you, discussing innovations that are redrawing the boundaries of finance. Ready to expand your horizons? Here’s your host, Andy Field.

Andy Field: Hello everyone. Welcome back to the GECA Podcast, the voice of Global Equity Crowdfunding. I’m Andy Field, Steering Committee lead of the Global Equity Crowdfunding Alliance, where we speak with the leading voices who shape the future of capital raising across borders. As crowdfunding continues to evolve, we’re exploring what it takes to run successful campaigns globally, what founders, platforms, and investors need to know to thrive in this ever-expanding ecosystem.

And today I’m really thrilled to be joined by Paul Lovejoy. Paul is Principal Investment Advisor at Stakeholder Enterprise. He’s based in Hawaii—lucky for some. He’s a longtime advocate for crowdfunding, a prolific investor himself, and he’s also this year’s recipient of the Crowdfunding Professional Association’s ‘Pay It Forward’ Award, recognizing his incredible contribution to the crowdfunding community.

Paul, congratulations again on that award and thanks so much for joining us.

Paul Lovejoy: Oh, I’m thrilled to be here. I love the fact that you’re trying to eliminate borders for crowdfunding. I think that’s such a wonderful mission and I’m thrilled to be a part of it.

Andy Field: Oh, thank you. Thanks again for joining us. For listeners who may not know your story, can you just give us a very quick overview—just a couple of minutes—of how you first got involved in crowdfunding and what’s made you so passionate about it?

Paul Lovejoy: Yeah, back in 2008, I was a defrauded investor, financially devastated by the system collapse. And it caused me to spiral down into this shame and sleepless nights. I was in denial about it. And it was awful, really, because it wasn’t just my money I lost—it was also my family’s money. It was a horrible event and it took years for me to recover from just the trauma and get over the shame part of it. I didn’t publicly admit that for 10 years.

Anyways, I did finally get myself together and I forgave myself. I let go of the past and it allowed me to ask the question: what the heck just happened? What is going on? So it led me in a direction where I went from real estate to wealth management.

And when I got into wealth management, I saw that there was all this gatekeeping happening with the private market. In the United States you have to be something called an accredited investor and meet certain wealth thresholds. And so I saw that entire populations—large populations, something like 90% of the US—couldn’t invest in these private markets. Just this whole financial gatekeeping. Working in wealth management, I really lost my motivation to work there.

One thing I did see while I was there was peer-to-peer lending and I was like, “That’s interesting. It’s not the public market. It’s not a private market. What is this?” But I didn’t really think about it too much longer. I ended up losing my motivation to work in wealth management because of this financial gatekeeping and telling people, “You can’t have services with us.” I hated telling people that.

And that’s right when COVID hit. And another thing I got interested in was something called impact investing. And I was wondering what’s the difference between ESG and impact investing? And what I saw with all my research is that the only way you can make an impact investment was in the private market. And the only way you can be in the private market is if you were an accredited investor.

But then I remembered—I was like, what about that peer-to-peer lending stuff? And so I did this Google search: “retail access to private markets.” And that’s when crowdfunding popped up, regulation crowdfunding. And I was like, “Oh my gosh!” It was like all the dots connected for me. I was like, “Oh, this is how people can actually fund businesses they care about.”

And it allowed regular people access to really great investment opportunities that were reserved for the wealthy. So it had multiple layers: a financial layer where regular people can prosper on some really great investment opportunities, and the fact where you can fund a business that you care about in your community and that delivers real impact, shaping the future. So that’s how I got into crowdfunding. I opened up my own firm. I was just all in when I saw it.

Andy Field: Yeah, I can see how that struck a chord. Actually, you and I met for the first time—we’d obviously connected on social media previously—but a couple of weeks ago, I was over in Washington DC, as were you, at the CfPA Summit. And you were telling me some of these stories then, and I find it fascinating how that resonated with you at that time and you went straight away all in. That shows a real act of faith if you like. And you’ve built a really strong reputation in this space now.

And I know one of the things that we were talking about over in DC, and one of the things that really stands out, is your daily investment streak. So can you tell us a bit about how that started and what inspired you to commit to essentially investing every single day for—and you’ll tell me how long that was?

Paul Lovejoy: Yeah, it was for 366 days in a row because I wanted to do it for a year straight and the year I happened to choose was a leap year.

Andy Field: Yeah, great!

Paul Lovejoy: So why not one extra day? So really what I was seeing is that there were tremendous financial opportunities within this space. And I didn’t like what I was seeing in our public markets anymore, here in the US—and I know it’s similar around the world—where you have institutional investors that manage retirement accounts and they basically control the entire public markets. And it’s just three of them. And they’re using algorithmic trading to optimize to get the best stocks.