How a Marketing Visionary Transformed Aptera’s $140M Campaign Into a Masterclass for Borderless Equity Crowdfunding

In an era where traditional investment barriers are crumbling and capital flows are becoming increasingly democratized, few individuals embody the transformative potential of global equity crowdfunding quite like Sarah Hardwick. As CEO of The Crowd and the strategic architect behind one of history’s most successful equity crowdfunding campaigns, Sarah’s recent appearance on the GECA Podcast with host Andy Field offered profound insights into the future of borderless investment – insights that perfectly align with the Global Equity Crowdfunding Alliance’s vision of a truly connected, global ecosystem.

The Architect of Movement-Based Investment

Sarah’s journey to becoming a crowdfunding luminary began long before equity crowdfunding became mainstream. With over two decades of experience in brand storytelling and values-based marketing, she built her foundation at Zenzi, her values marketing company, where she developed emotionally resonant campaigns for global brands including Nestle and Chiquita. This background in psychology-driven marketing would prove instrumental in revolutionizing how founders connect with investors on a deeper, more meaningful level.

The culmination of her expertise came during her tenure as Chief Marketing Officer at Aptera Motors, where she orchestrated what can only be described as a paradigm-shifting campaign. The numbers alone tell a remarkable story: $140 million raised from more than 20,000 investors, generating approximately $1.6 billion in orders. But behind these impressive figures lies a sophisticated understanding of how to build genuine community around shared values – a approach that transcends geographical boundaries and speaks directly to GECA’s mission of borderless equity crowdfunding.

Beyond Transactions: Building Global Movements

What sets Sarah apart in the crowdfunding landscape is her fundamental rejection of the transactional approach that has long dominated the industry. “I started The Crowd to move away from this transactional view of crowdfunding and move towards relationship and building these deep and longstanding relationships and building a movement,” she explained during her conversation with Andy.

This philosophy directly addresses one of the core challenges facing the equity crowdfunding industry today. According to recent industry data, while global equity crowdfunding is projected to reach between $30-60 billion by 2030 – with moderate growth scenarios suggesting $28.8 billion and high-growth projections reaching $65.1 billion – success rates remain frustratingly low, with many campaigns failing to achieve their funding goals due to an inability to create meaningful connections with their audience.

Sarah’s approach offers a compelling solution. By focusing on values alignment rather than demographic targeting, her methodology creates what she terms “hardcore fans” who become natural ambassadors for campaigns. This organic advocacy is particularly powerful in a global context, where traditional marketing channels may be less effective across different cultures and regulatory environments.

The Global-First Philosophy: Lessons from Aptera’s Success

Perhaps most relevant to GECA’s mission is Sarah’s revolutionary stance on global market engagement. While many founders treat international expansion as a “phase two” consideration, Sarah advocates for global thinking from day one – a strategy that proved instrumental in Aptera’s success.

“The most successful campaigns, Aptera for example, it was always an important part of our phase one,” Sarah noted. “Having that and inspiring that community and recognizing and speaking to the global audience initially I think is very critical. And I think that’s often pushed off as a nice to have when in actuality, I think it’s something that’s really pivotal from the beginning.”

This insight challenges conventional wisdom and directly supports GECA’s advocacy for borderless equity crowdfunding. Recent data from the Cambridge Centre for Alternative Finance and regulatory reports reveals that equity crowdfunding markets have faced significant challenges since their 2021-2022 peak, with the UK market declining 58% from 2021 to 2024, US Regulation Crowdfunding falling roughly 30% in 2023-24, and the EU equity crowdfunding market totaling just €60 million in 2023. These market contractions make Sarah’s proven approach to building passionate, values-aligned investor communities even more critical, as traditional broad-based marketing strategies become less effective in a more competitive environment.

Sarah’s global-first approach recognizes a fundamental truth about modern investment behavior: values and mission alignment matter more than geographic proximity. “We’re not trying to market to people based on demographics,” she emphasized. “Where they live is less important than what they care about.”

The Science of Values-Based Targeting

Central to Sarah’s success is her sophisticated understanding of how to identify and attract values-aligned investors. Her famous quote, “You stand for everything, you stand for nothing,” encapsulates a crucial insight about modern investment psychology. Rather than trying to appeal to everyone, successful campaigns must be willing to polarize their audience, attracting passionate supporters while accepting that others may not resonate with their message.

This approach is particularly relevant in the global context that GECA champions. Cultural nuances and regulatory differences across borders can make broad-based marketing approaches ineffective. However, values-based messaging transcends these barriers, creating universal appeal among like-minded individuals regardless of their geographic location.

The Aptera campaign exemplified this principle. The three-wheeled solar vehicle didn’t appeal to everyone – “you either loved it or you hated it,” as Sarah noted – but those who connected with its environmental mission became deeply committed advocates. This passionate base not only invested but actively recruited others who shared their values, creating a self-sustaining movement that expanded organically across global markets.

Technology as an Enabler of Global Connection

Looking toward the future, Sarah envisions artificial intelligence and advanced analytics playing increasingly important roles in optimizing the investor journey and enabling more sophisticated global campaigns. Her prediction that “we’ll have agents executing crowdfunding campaigns and components of crowdfunding campaigns” within the next year reflects the rapid technological evolution occurring in the industry.

These technological advances hold particular promise for addressing the challenges of global equity crowdfunding that GECA seeks to solve. Language barriers, time zone differences, and cultural nuances – traditional obstacles to international expansion – can be effectively managed through AI-powered tools that provide localized, culturally appropriate communication at scale.

Sarah’s current work involves developing comprehensive training programs and tools that package the systematic approach used in the Aptera campaign into accessible formats for other founders. This democratization of proven methodologies aligns perfectly with GECA’s educational mission and could significantly accelerate the adoption of global-first strategies across the industry.

The Platform Evolution: Community Over Transaction

Sarah’s observations about platform development offer important insights for the global equity crowdfunding ecosystem. She advocates for platforms to move beyond simple transaction facilitation toward community building, noting that “some platforms are really moving towards that and making strides and embracing community as the core part of this.”

This evolution is particularly important for global platforms seeking to create cohesive communities across diverse markets. Successful international platforms must facilitate not just financial transactions but meaningful connections between investors who share common values and interests, regardless of their physical location.

The most successful global platforms, according to Sarah’s analysis, are those that create “insiders” and “ambassadors” – engaged community members who actively promote both the platform and the companies raising capital on it. This network effect becomes exponentially more powerful when it spans multiple countries and cultures, creating truly global movements around shared values and missions.

Collaboration as Catalyst: The GECA Connection

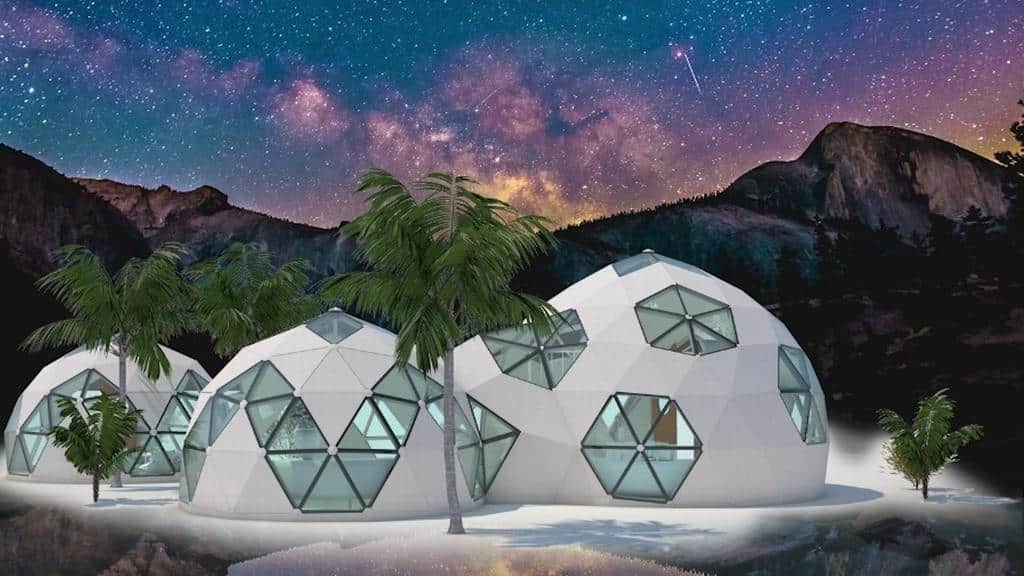

Sarah’s enthusiasm for collaborating with GECA reflects a growing recognition that the future of equity crowdfunding lies in coordinated, global approaches. Her work with clients like GeoShip – a company that offers innovative bioceramic domes designed for sustainable, regenerative, and eco-friendly living, with resilient, affordable homes that integrate nature and have strong international demand – exemplifies the potential for values-driven companies to build global communities around their missions.

“I have a client called GeoShip and they have a huge international presence and a huge demand. They’re working on regenerative lifestyle with innovative bioceramic domes designed for sustainable, eco-friendly living,” Sarah explained. “For them, there is a huge opportunity to bring in investors and there are communities all over the world that would love to have this type of community and this type of technology. I would love to work with GECA to be able to create that community and help to bring some of these investors, these like-minded investors who share these values into some of the campaigns that I’m working on.”

This collaborative vision reflects the growing recognition that the future of equity crowdfunding lies in coordinated, global approaches that address one of the key challenges identified in GECA’s manifesto: the need for the industry to “collaborate to compete.” Rather than competing against each other, equity crowdfunding stakeholders must work together to compete against traditional investment channels and to capture the enormous potential of global capital markets.

The Transparency Imperative: Building Trust Across Borders

One of Sarah’s most compelling insights relates to the importance of transparency and authenticity in building investor relationships. Her emphasis on founders being “real and transparent” becomes even more critical in global contexts, where investors may have limited ability to conduct traditional due diligence.

“When things go great, that’s amazing, and you have all these people to celebrate with you,” she explained. “And when things are challenging, you can really build a movement that will rise with you and that will help to challenge the norms and really be a part of this change that you’re trying to enact.”

This transparency creates the trust necessary for cross-border investment relationships and helps build the kind of loyal, engaged investor base that can sustain companies through various growth phases. In global markets where regulatory protections may vary, this trust becomes even more valuable as a form of investor protection.

Future Horizons: Scaling Values-Driven Investment Globally

As the equity crowdfunding industry continues to evolve, Sarah’s approach offers a roadmap for how platforms, founders, and investors can work together to create a truly global ecosystem. Her success with Aptera demonstrates that when properly executed, values-driven campaigns can transcend traditional boundaries and create worldwide movements around shared missions.

The implications for GECA’s mission are profound. By focusing on values alignment rather than geographic proximity, the equity crowdfunding industry can move toward the borderless investment ecosystem that GECA envisions. This requires not just technological solutions but a fundamental shift in how campaigns are conceived and executed – a shift that Sarah has successfully demonstrated and is now working to scale through education and training.

Conclusion: The Sarah Blueprint for Global Impact

Sarah’s insights on the GECA Podcast illuminate a path forward for the global equity crowdfunding industry – one that prioritizes authentic relationships over transactions, values alignment over demographics, and global thinking over local limitations. Her proven track record with Aptera and her ongoing work through The Crowd provide concrete evidence that this approach can deliver extraordinary results.

As GECA continues to advocate for borderless equity crowdfunding, leaders like Sarah demonstrate that the future is not just theoretical but achievable. Her emphasis on going “all in,” building authentic communities, and thinking globally from day one offers a blueprint that other industry participants can follow to unlock the enormous potential of global equity crowdfunding.

The conversation between Sarah and Andy represents more than just an interview – it’s a roadmap for transformation. As the equity crowdfunding industry stands on the brink of global expansion, insights like these will prove invaluable in shaping a more connected, values-driven, and ultimately more successful ecosystem for founders and investors worldwide.

In an industry often focused on short-term gains and transactional relationships, Sarah stands as a beacon for what’s possible when we prioritize authentic connection, global thinking, and values-driven community building. Her success with Aptera wasn’t just a crowdfunding campaign – it was a proof of concept for the borderless investment future that GECA seeks to create.

To join GECA’s mission, visit here. To learn more about Sarah’s work, visit jointhecrowd.co. The full GECA Podcast interview with Sarah is available here: